Member Advantage

MESSAGE FROM THE PRESIDENT

Fourth Quarter 2019

José R. González

President and CEO

On October 17, the iconic Delmonico’s Restaurant was the setting for the FHLBNY’s Food for Thought, an evening that brought together leaders from across both the credit union industry and our organization. The event – which drew nearly 50 people and included representatives of credit union members and both the New York Credit Union Association and the New Jersey Credit Union League – provided us with the opportunity to discuss the various means by which we support our members, including products, programs and balance sheet management strategies. This dinner follows in the same vein as our first-ever Member Symposium, held earlier this year, and the numerous educational and training sessions we have held throughout 2019 in reflecting our continued commitment to engaging with all of our members to enhance member value.

The value of membership cuts across everything we do – from our Affordable Housing Program for which we announced our 50th Round of grants in September 2019 – to our ability to remain a reliable source of liquidity in all market conditions, including most recently during the significant disruption in the short-term markets in mid-September. This commitment is expressed in the content of our quarterly Member Advantage newsletter, providing strategies for advance usage along with ways our partnership can assist with your business objectives. Lastly, in early October we launched a redesigned website to enhance your overall experience with better access to our resources. We are, in all things, focused on building member value and strengthening our partnerships.

Sincerely,

José R. González

President and Chief Executive Officer

Welcome New Members

Five new members were welcomed into our cooperative since the last edition:

- Everest Reinsurance Company

- North Franklin Federal Credit Union

- Triple-S Salud, Inc.

- Triple-S Vida, Inc.

- Twin Rivers Federal Credit Union

Five Ways to Manage Your Balance Sheet in a Volatile Rate Environment

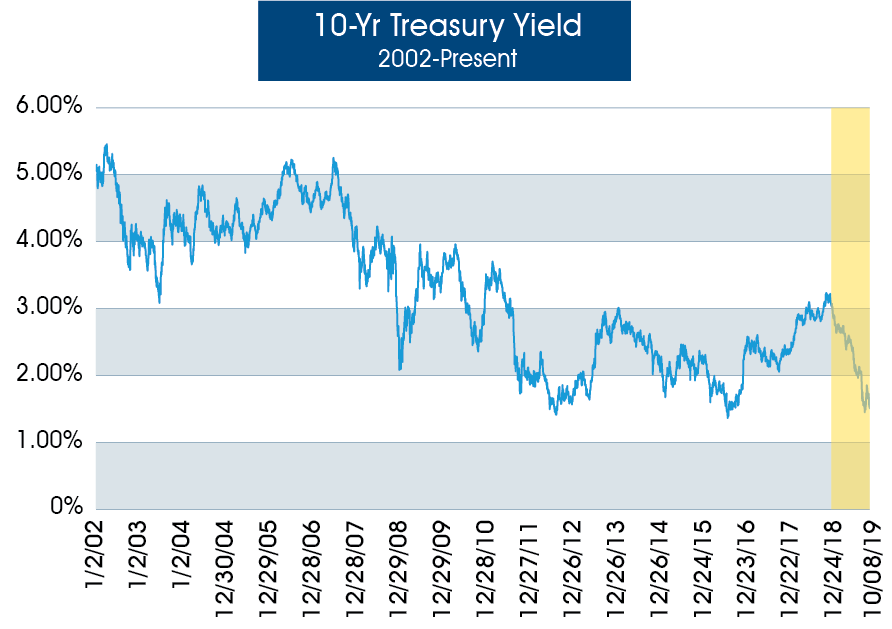

We are having a dynamic year at the FHLBNY in 2019, with a rapidly changing economic and operating landscape. Throughout 2018, all signs pointed to a rising rate environment, with the Fed conducting four 25-basis points (bps) short-term rate hikes. In September 2018, the Fed dot plot indicated that expectations factored in three 25-bps rate hikes with another in 2020, leading to a long-run Fed Funds rate of 3%. Fast forward to September 2019: the Fed has completed two 25-bps rate cuts this year with no further rate actions projected until 2021 and 2022, where the expectation is that there will be one 25-bps rate hike in each year with the long run Fed Funds rate settling at 2.50%. The benchmark 10-year U.S. Treasury yield has also plummeted this year, hovering near historic lows since September.

In 2018, deposit betas finally started escalating and we saw members embarking on deposit-raising efforts, much of which was focused on time-deposit gathering. With an inverted yield curve and an accommodative Fed posture, many of our members now are saddled with high-cost retail deposit funding while opportunities to invest in assets further out on the curve have diminished. Additionally, our members in asset-sensitive positions are facing challenges maintaining and growing NII in a declining-rate environment. Now more than ever, keeping your “foot on the gas” and achieving growth is critical to stay relevant and remain competitive in this rapidly changing business environment. Maintaining customer engagement with a comprehensive and competitively-priced product mix is essential to achieving growth. The FHLBNY can help provide you with liquidity to achieve growth with the proper term to help you optimize your balance sheet and achieve your Asset Liability Management (ALM) goals. The following five ALM strategies are worth considering to help you maximize your performance in this current challenging operating environment.

1. Balance Your ALM Position

In the post-crisis operating environment, many members have become asset sensitive with an expectation of rising rates while accepting substantial exposure to declining rates. In the midst of the recent declining-rate environment, those asset-sensitive members may be experiencing significant NII deterioration. Having a more neutral ALM position can assist with managing IRR and maximizing income across various interest rate environments. Taking a “bet” on the direction of interest rates is admittedly risky and can expose you to greater risks, leading to lost earnings opportunities. Depending on the area of exposure, asset-sensitive members may want to consider shortening liabilities or adding long-term assets to become better match funded, whereas liability-sensitive members may want to consider taking advantage of points on the inverted advance curve to add term funding at advantageous levels.

2. Understand Your Position Over an Expanded Horizon

Depending on the structure of the balance sheet, a financial institution may have a different ALM position in the short run that may change multiple years out in the long run. If you focus myopically on the short-run, you may be ignoring both opportunities and risks out on the horizon. For example, a member may be liability sensitive over a two-year horizon but become asset sensitive thereafter – and so, to remedy that exposure, members may want to consider borrowing for a two-year term and using short-term advances thereafter. If IRR exposure is unknown over a longer-term horizon, members could potentially pursue a course of action that is risky and have an adverse impact to profitability.

3. Recalibrate Your Deposit Assumptions

Deposit assumptions are one of the most impactful components to the IRR modeling process. Having a strong grasp of the behavior of your institution’s non-maturity deposits can lead to informed and profitable decision-making. Some members might elect to conduct internal studies while others may engage outside consulting firms to perform deposit studies. Any study should explore both quantitative and qualitative factors, be properly documented and be able to stand up to regulatory scrutiny. We recommend that you consider conducting a formal evaluation of your non-maturity deposits, as a proper deposit study could be enlightening and may lead you to conclude that your ALM position is different than your current understanding.

4. Focus on Opportunity Costs

Having the proper “what-if” scenarios are critical to a robust ALM process. There are risks to inaction, and understanding the opportunity costs of not pursuing a course of action should be part of every ALM discussion. In today’s period of rapid change, it is important to understand precisely the income impacts associated with excess capital in addition to the potential credit, liquidity and interest rate risks of adding leverage. When the IRR modeling process becomes a powerful component of decision-making, you can appropriately optimize your balance sheet, drive bottom-line income and manage risks.

5. Create a “Roadmap” to Attain Your Income Goals

The declining rate environment is pressuring bottom-line earnings across our membership. Creating a plan to maintain income growth is important to help preserve and improve scale and grow capital. A declining NII will force you to ask the following questions:

How do I make up lost income from exposure to a volatile rate environment? What will it take in non- maturity deposit growth to make up for lost spread?

What kind of asset growth do I need to create new earning opportunities?

What type of funding does my growth strategy and balance sheet require – short- or long-term advances?

How will asset growth impact liquidity? Can newly added assets be pledged to the FHLBNY?

How can I protect my current income stream from further deterioration? Should I maintain my current ALM position or move toward a more match-funded position?

Regardless of the questions that are most pertinent to your balance sheet, at a minimum, discuss them at your ALCO.

When you analyze what ALM strategies are best for your business, know that the FHLBNY is your premier provider for liquidity. The following page includes some advance strategies that may assist you when navigating through this dynamic and challenging environment.

FHLBNY Advance Strategies to Consider

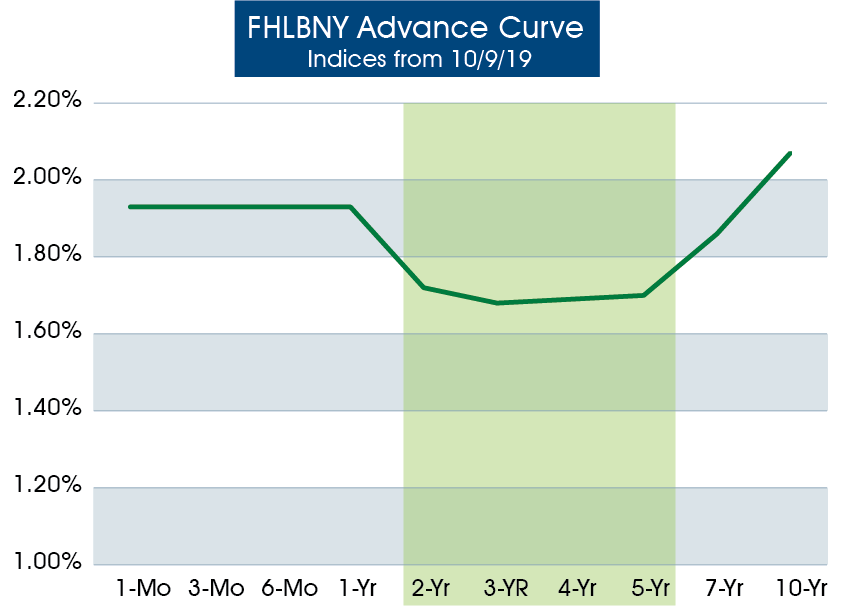

Take Advantage of Points on the FHLBNY Curve

Many of our members have become asset sensitive, and as a result have been using short-tenor advances to fund their liquidity needs. However, opportunities on the curve exist for members who need liability extension. Depending on your IRR profile, you can potentially achieve savings going out a little further on the curve. For example, if your institution is liability sensitive going out two years but becomes asset sensitive in year three, you may want to take advantage of 2-year borrowings at more advantageous levels. The advance curve is relatively flat from year two out to year five, as a 5-year advance is currently just 2 bps cheaper than a 2-year advance.

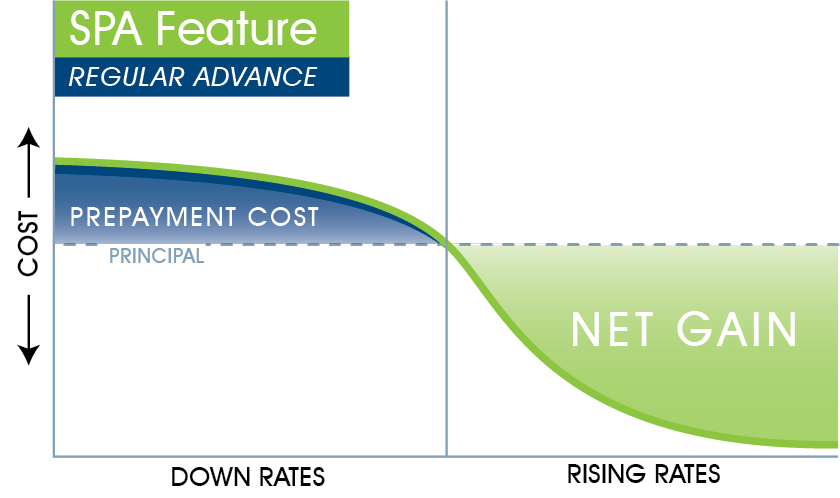

Symmetrical Prepayment Advance (SPA) Feature

The SPA feature is helpful when booking defined maturity Fixed-Rate Advances. For an additional 2 bps, you can add symmetry to an advance, meaning that if the interest rate environment changes and your advance becomes “in the money” during its term, you may potentially be able to harvest a gain on an early extinguishment (less financial indifference costs). We are approaching historic lows on the 10-year Treasury issuances which has translated into historically low-term advance rates.

Should the yield curve steepen over the life of your term advance with symmetry, you may have the benefit of an unrealized gain that can be monetized and booked to income. The unrealized gain can also serve as an offset to unrealized losses that may occur in your security portfolio. Additionally, if you believe that you may be engaging in a balance sheet restructuring in the future (becoming part of a merger, embarking on a deposit raising effort, no longer needing term funding, etc.), having a gain you can harvest may be of great assistance at that time.

AVAILABLE SPA STRUCTURES

TERMS: One year up to 30 Years (term dictated by individual product parameters)

MINIMUM TRANSACTION SIZE: $3 million

MINIMUM PARTIAL PREPAYMENT SIZE: $3 million

ADVANCE TYPES: Fixed-Rate Advances

Note: Prepayment above $1 billion per member per month will require review and approval from the FHLBNY.

Contact us to discuss the strategies mentioned in this article.

Member Services Desk: (212) 441-6600

Relationship Managers: (212) 441-6700

Have suggestions for a future topic? E-mail your thoughts to fhlbny@fhlbny.com

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product