Member Advantage

REPORT FROM THE PRESIDENT

Fourth Quarter 2016

Proven Reliability

To say that 2016 was an “interesting” year would be an understatement. Globally, nationally and locally, instability and change helped shape the year. In 2016, the United Kingdom voted to leave the European Union, a surprising decision that roiled global markets, the effects of which still reverberate today. At home, the year provided a campaign season the likes of which we had never seen, resulting in a historic election. When President-elect Donald Trump is sworn into office later this month, he will lead a new Administration that will shape our economy and U.S. policy for years to come. However, in a year in which even the Chicago Cubs bucked the trend by shaking their “Lovable Losers” mantle and winning the franchise’s first World Series in 108 years, one thing remained the same: the reliability of the Federal Home Loan Bank of New York.

To say that 2016 was an “interesting” year would be an understatement. Globally, nationally and locally, instability and change helped shape the year. In 2016, the United Kingdom voted to leave the European Union, a surprising decision that roiled global markets, the effects of which still reverberate today. At home, the year provided a campaign season the likes of which we had never seen, resulting in a historic election. When President-elect Donald Trump is sworn into office later this month, he will lead a new Administration that will shape our economy and U.S. policy for years to come. However, in a year in which even the Chicago Cubs bucked the trend by shaking their “Lovable Losers” mantle and winning the franchise’s first World Series in 108 years, one thing remained the same: the reliability of the Federal Home Loan Bank of New York.

At the FHLBNY, we take pride in being a reliable partner for our members. Just as your customers rely on you to make the loans that allow them to become homeowners, grow their business or send their children to college, so too do our members rely on us to help meet their funding needs. In the often chaotic operating environment of 2016, in which the markets frequently presented challenges, the dependability of this funding source was evident in our advances activity: advances grew steadily through the year, ultimately reaching record levels, a volume of business not seen since the height of the financial crisis eight years ago. We also added eight new members in 2016, further strengthening our cooperative and expanding our funding footprint.

Our reliability was not only evident in our advances. It was also reflected in our performance, which was strong throughout 2016, with $278.3 million in net income through the first nine months of the year – an increase of 13 percent from the same period in 2015. This reliability was also seen in the return we provided on our members’ investment in the cooperative. In each of the first three quarters of 2016, the FHLBNY declared a consistent and attractive dividend, returning nearly $200 million to our members.

Our strong performance also allowed us to remain a reliable partner for the community.

In 2016, we awarded a total of $34.4 million in Affordable Housing Program grants to help fund 42 housing initiatives. We also continued to support new homeowners through our First Home Clubsm, providing $13 million in funds to help more than 1,600 households become homeowners.

As we enter 2017, we remain focused on our housing mission and our reliability as a funding partner, and are working to be even better-positioned to support our members.

This year, our new Member Services Desk will become fully operational, streamlining processes across the Bank to more quickly respond to member liquidity needs. We will also continue to upgrade our technology and systems to improve the member experience.

And we will do so from our new and more modern New York headquarters, which will foster even more employee collaboration when we move in later this year upon the expiration of our current lease. And most of all, we will continue to work to ensure that each of you is maximizing your membership in our cooperative. Inside this newsletter, you will find more information on various funding solutions we have developed to help meet member needs.

The environment in which we operated in 2016 was challenging and often times uncertain. And yet our cooperative and our members thrived. As we enter the New Year, I am certain that our stable and trusted partnership will continue to benefit our institutions, our customers and the

communities we all support. I thank you for

your business in 2016, and look forward to

building on our momentum in 2017.

Sincerely,

José R. González

President and Chief Executive Officer

FHLBNY SOLUTIONS

Reflections on the Past Year and Considerations for 2017

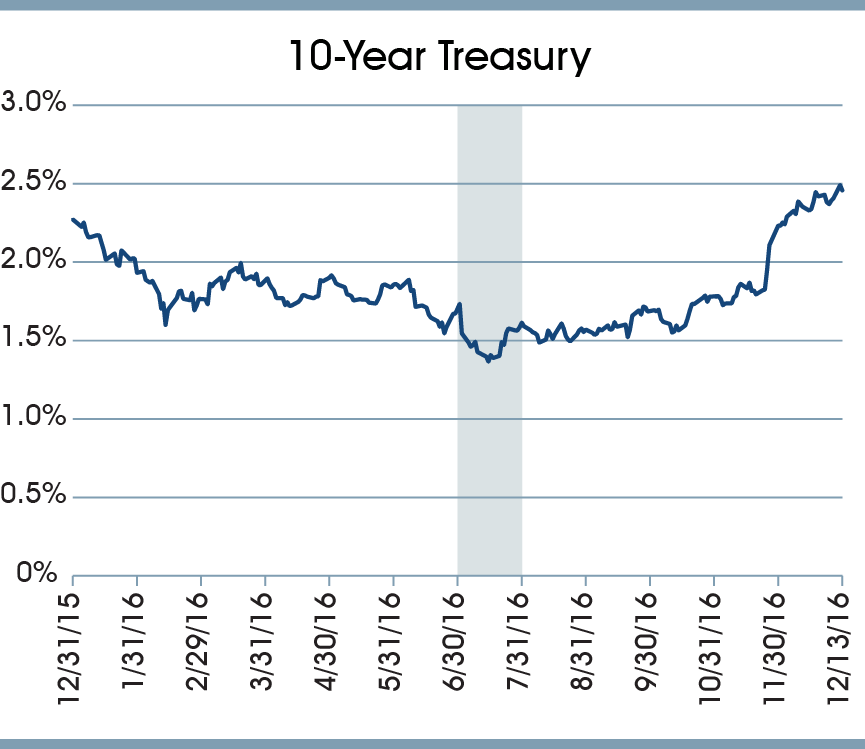

The past year was an interesting one for the FHLBNY and its members. We began 2016 emerging from the first Federal Reserve (”Fed”) rate hike in over nine years, with the 10-year Treasury yielding 2.27%. At that point, the markets predicted the Fed to end their posture of significant accommodation with several additional rate hikes predicted to take place during 2016. However, weak economic metrics and geopolitical events (e.g., the Brexit vote in June whereby the citizens of the United Kingdom voted to leave the European Union) led to uncertainty and served to flatten the long-end of the yield curve, pushing the 10-year Treasury down to its low of 1.37% in early July. A relatively flat yield curve throughout most of the year continued to pressure net interest margins (”NIMs”) and made it difficult to earn spread without reaching for yield further out on the curve.

Fast forward to the end of 2016 and the post-U.S. election period where term rates are bouncing off their recent lows and retreating to levels that surpass what we had experienced at the start of the year, with the 10-year Treasury now approaching 2.50% (see chart above). Emerging again from a December Fed rate hike – the second in the past ten years – and similar to the end of 2015, the markets are predicting that the Fed will end their accommodating position and several more short-term rate increases will occur throughout 2017.

Thoughts and Considerations for Funding in the New Year

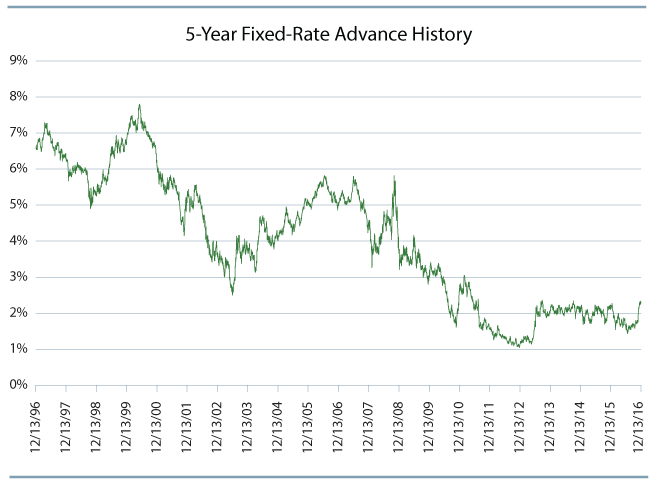

Mitigating interest rate risk (”IRR”) has been a concern for years as our members have anticipated an eventual rise in long-term interest rates. However, the recent steepening in the longer end of the yield curve was somewhat unexpected. Although we appear to have come off the bottom with regard to longer term borrowing rates, you have the potential to preserve spreads and borrow longer term at historically low levels. The chart on the right illustrates the history of the benchmark 5-year Fixed-Rate Advance. Today’s term borrowing levels remain attractive over a 20-year horizon.

While a rising rate environment with a steeper yield curve is a welcome development for many of our members, there is concern among some of our liability-sensitive members that there could be NIM deterioration in a rapidly rising rate environment. Members who retain long-term mortgage production in portfolio may want to consider taking action now by layering in longer term advances listed below to mitigate IRR and preserve spread.

“Regular” Fixed-Rate Advances

With mortgage rates coming off a recent “bottom” and still close to historic lows, there is heightened concern that homeowners may opt to stay in their homes for an extended period of time due to their low mortgage payments. To mitigate extension risk, some members use our regular Fixed-Rate Advances and apply a “barbell” approach, using short-term advances to fund deposit shortfalls, while also using long-term advances to help preserve spread and guard against mortgage pools extending beyond their previously expected average life. Other members apply a “laddering” approach, layering in short-, medium-, and long-term advances to optimize return and mitigate IRR through the life of their long-term assets. Fixed-Rate Advances remain the most popular type of FHLBNY funding used to match-fund long-term assets and address interest rate sensitivity.

Callable Advances

The Callable Advance is a useful and flexible tool intended to help address IRR now, but which also affords you the option to make adjustments in the future based on the prevailing interest rate environment and behavior of your long-term assets. Callable Advances provide fixed-rate funding that can be extinguished by the member, in whole or in part, after a pre-determined lockout period. Members can select either the “European option” for a one-time exercise at the lockout period, or the “Bermudan option,” where members will have multiple options (quarterly) to call the advance following the initial lockout period. Therefore, you can add long-term funding now to address IRR measurements, with the flexibility of terminating funding should the interest rate environment remain static or decline, or should your balance sheet mix change (i.e., faster than expected prepays or an influx of core deposits).

For example, assume a liability-sensitive member is approaching their threshold with respect to their Net Interest Income at Risk and Economic Value of Equity at Risk. The member can address that risk now by adding a term Callable Advance. One example of how this could work would involve the selection of a Five-year Non-Call One-year Bermudan option – this structure would allow the member to extinguish their 5-year advance after a lockout period of one year, with the ability to extinguish on a quarterly basis thereafter. Should rates decline or remain static, or the member’s balance sheet composition change, they would have the ability to extinguish the advance, either entirely or in part, based on their new balance sheet structure, and book another term advance (at a lower cost) with a similar average life. The added flexibility offered by the Callable Advance can lead to significant cost savings through the life of this strategy.

CALLABLE ADVANCE FEATURES & BENEFITS

Maximum advance size: $100 million

Minimum advance size: $5 million per trade

Final maturities available: 3, 5, 7, or 10 years

Lockout periods: 1, 2, 3, or 5 years

Call options: Bermudan (quarterly) or European (one-time)

Interest payment: Quarterly based on Actual/360 day count

Required option exercise notification to the FHLBNY: 9 business days

Terms and restrictions apply.

Community Lending Program (”CLP”) Advances

Our CLP Advances are the lowest priced source of FHLBNY funding for members, offering an additional opportunity to mitigate IRR. If a member can demonstrate qualified lending activity, they can borrow at levels approximately 20-25 basis points lower than regular fixed rates, depending on maturity. CLP Advances can also be structured with most of our fixed-rate and floating-rate advance products. CLP Advances may be used for the acquisition, construction, rehabilitation and financing of housing that benefits lower income individuals or other commercial development projects located in lower income areas. Eligibility criteria and CLP Advance types are listed below.

CLP ADVANCES & ELIGIBILITY CRITERIA

Community Investment Program (”CIP”) financing can be used for originations of individual mortgage loans for families with incomes at or below 115% of the area median income. Rural Development Advances (”RDA”) and Urban Development Advances (”UDA”) are designed to finance the economic development needs of members’ communities, including commercial, small business, social service, and public facility projects and activities. While the type of activity will vary based upon the needs of the community, the individuals benefitting must have median incomes of no more than 115% (RDA) or 100% (UDA) of the area median income, or be located in neighborhoods sharing these respective income targets.

Eligible housing and economic development projects include:

Single-/multi-family housing

Special-needs housing

Small business loans

Daycare centers

Grocery stores

Office buildings

Educational facilities

Healthcare facilities

Manufacturing facilities

Community services, such as fire stations and trucks

Infrastructure projects

Maximize Your Membership

In addition to the specific funding solutions presented above to help address IRR, members can take advantage of their FHLBNY membership as a valuable resource to assist in leveraging capital, growing assets and boosting earnings. We can provide the funding necessary to broaden your business lines or to improve your institution’s infrastructure so you can be better positioned to thrive now and in the future.

Build Borrowing Potential

Being ready to capitalize on opportunity is critical in an environment marked by intense lending competition and limited investment opportunities. When opportunity knocks, you need access to the necessary liquidity at the proper duration in order to effectively capitalize on that opportunity. We will work with you to examine your balance sheet and find opportunities to help you build your borrowing potential so you can optimize your operations and achieve a dynamic ALM process.

Leverage Capital

Some of our members maintain “lofty” capital levels while having a very low risk profile. With access to FHLBNY liquidity, members do not have to live within the limitations of their deposit base, but rather within the confines of their capital base. Maintaining excess capital levels that are not commensurate with your risk profile reduces potential earnings and stifles capital growth. We are in an extremely difficult lending environment where those without scale are having an increasingly difficult time achieving and maintaining profitability. Using all the tools available to you is increasingly important for sustainability. With access to reliable FHLBNY liquidity, you have the power to properly leverage your capital to bolster profitability so you are better positioned to provide the array of services your clients expect and need.

Manage Balance Sheet for Multiple Scenarios

Some members have been positioning themselves for an upward rate environment for years while discounting the risk present in a static or declining rate scenario. As a result, financial risk has been elevated, earnings have suffered, and capital growth has been muted. Although we are seemingly entering into a more robust point in the economic cycle, positioning your balance sheet solely for a rising rate scenario could be adding risk to your institution, and could impede your potential earnings and capital growth should rates remain static or just move within a tight range, as they have done over the past several years. Highly asset-sensitive members may consider moving toward a more matched position in the event that rates do not move up as planned. As always, the FHLBNY is here to help you mitigate risk and achieve your goals. Should you have any questions on the funding solutions discussed within this article or any other potential strategy, please contact your Calling Officer at (212) 441-6700. We look forward to partnering with you throughout the New Year.

HIGHLIGHTS / NEWS & UPDATES

Welcome New Members

Since our last edition, the FHLBNY has welcomed three members into our cooperative:

Industrial and Commercial Bank of China (USA), N.A.

Caribe Federal Credit Union

National Federation of Community Development Credit Unions, Inc.

2017 Community Lending Plan Approved

I am pleased to inform you that, in December, our Board approved the Bank’s 2017 Community Lending Plan. The Plan highlights the various community lending and affordable housing programs we offer to help our members engage in targeted community lending activity and drive growth in the communities we all serve. It is through our members’ use of these programs that we meet our housing mission. The full Community Lending Plan will be published on our website this month.

UPCOMING SYSTEM UPGRADES & CHANGES

Please Be Advised of the Following Planned System Upgrades and Changes for 2017

1Link® and 1LinkSK®

In order to continue using 1Link and 1LinkSK, system users will need to upgrade to Internet Explorer, version 11 (IE 11) to avoid any issues. More information will be provided in the coming weeks.

File Transfer Service (”FTS”)

In February the FHLBNY will be upgrading FTS to operate on HTML5 instead of a Java version of the software. The required upgrade will alleviate the need for system users to maintain Java versions in order to connect to FTS seamlessly. Instructions regarding the upgrade will be provided soon. In the interim, should you have any concerns or questions, please contact the Collateral Analysis Group at MediaPro@fhlbny.com.

Update to the 2017 Fee Schedules

The FHLBNY has reduced the fee for Repetitive Wires by $5 and has updated the fee for telephonic initiated Repetitive Wires to $12, effective January 1, 2017. Members have found it beneficial to set up and use Repetitive Wire Templates to initiate outgoing telephonic wires that contain static “repetitive” information, as they’ve resulted in increased efficiencies, reduced costs (as compared to Non-Repetitive Wires), and decreased operational risk caused by human error.

All other Credit, Collateral and Correspondent Services Fees will remain the same for 2017. If you have any questions or require assistance, please contact the Electronic Payments group at (800) 824-2426. You can access the FHLBNY’s Fee Schedules by signing on to 1Link® and clicking on the ‘Manuals and Guides’.

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product