Member Advantage

REPORT FROM THE PRESIDENT

Second Quarter 2018

Looking Back While Moving Forward

In June, the Federal Home Loan Bank of New York issued Strength in Our Cooperative, our 2017 Annual Report to members. The report captures numerous achievements the FHLBNY delivered in 2017, not only for our members, but also for the communities we serve. There truly is strength in our cooperative. We saw this strength in 2017, in which we posted record and near-record results across the board. We see it today, as the FHLBNY continues to perform at high levels. And we expect to see it going forward, as we further strengthen our partnerships with our members and support their ability to meet the needs of their communities.

In June, the Federal Home Loan Bank of New York issued Strength in Our Cooperative, our 2017 Annual Report to members. The report captures numerous achievements the FHLBNY delivered in 2017, not only for our members, but also for the communities we serve. There truly is strength in our cooperative. We saw this strength in 2017, in which we posted record and near-record results across the board. We see it today, as the FHLBNY continues to perform at high levels. And we expect to see it going forward, as we further strengthen our partnerships with our members and support their ability to meet the needs of their communities.

Advantages of FHLBNY Membership

Our strong cooperative and membership presently operate in an equally strong economy. We are currently in a historically lengthy economic expansion, marked by full employment, lower taxes, increasing deregulation and a more normalized rate environment. Our members are positioned to thrive in this environment, experiencing strong demand for loans and other financial services. But, as we move forward, we must remain aware of factors that have the potential to challenge this momentum. This is especially evident in factors that can impact your liquidity position, such as outflow of core deposits.

Traditionally, member assets have grown at a faster pace than both deposits and capital, with wholesale borrowings serving to fill in the funding gap. Following the financial crisis, there was a significant flow of deposits into depository institutions, creating an abundance of liquidity; however, as the economy has strengthened, this liquidity has been largely deployed. And with the largest banking institutions in need of deposits to meet BASEL III requirements, there is increased liquidity pressure on smaller institutions. In addition to this, heightened loan demand – driven by accelerated consumer spending, low unemployment and corporations’ expanded capital investments – and resulting asset growth can put further pressure on liquidity in an environment in which retail deposit funding is challenged.

The recent regulatory reform that will increase the Systemically Important Financial Institutions (SIFI) asset threshold to $250 billion – reducing the number of institutions subject to enhanced supervision and regulation – will likely increase competition for liquidity. For example, as institutions that are currently straddling the former $50 billion threshold may look to pursue aggressive organic balance sheet growth. Additionally, this increased threshold could spur M&A activity, driven by institutions that want to obtain scale but had previously been concerned with the regulatory burden of becoming a SIFI.

When all of these factors are combined with a rising rate environment, which could result in a substantial outflow of deposits as consumers seek higher yield elsewhere, creating both liquidity and interest rate risk challenges for community banks, it is clear that, despite the many opportunities our current operating environment provides, there remain challenges on the road ahead.

Our team at the FHLBNY is constantly monitoring the environment to ensure that we are positioned to help our members recognize and plan for these challenges as they appear. And our role as a funding partner to our members becomes even more vital in an environment in which liquidity is harder to secure. We take great pride in helping our members address challenges through the advantage of membership in the FHLBNY, and the access to our liquidity, products and programs that it provides.

Sincerely,

José R. González

President and Chief Executive Officer

WHOLESALE FUNDING CONSIDERATIONS

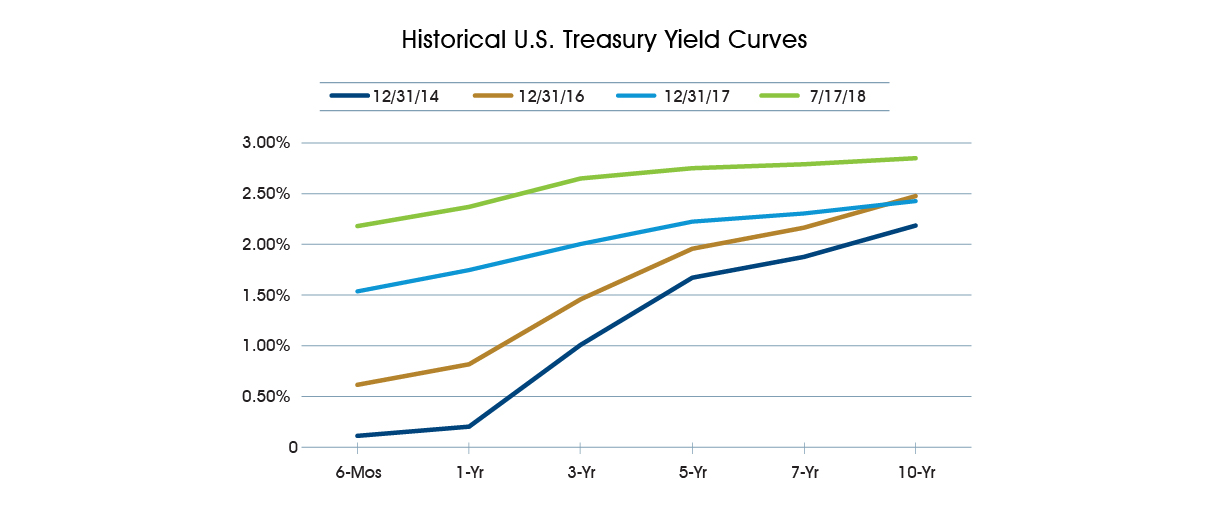

Data source: Bloomberg 2018.

The current U.S. Treasury Curve continues to flatten. In fact, the difference between the 1-year and 10-year Treasury was just 48 basis points on July 17, 2018, compared to almost 200 basis points at year-end 2014. Spread compression has become exacerbated as the U.S. Treasury continues to issue substantially more T-Bills to fund the deficit, driving up the short-end of the curve and increasing short-term wholesale funding costs. Elevated short-term wholesale funding costs coupled with heightened loan demand and greater capital levels due to tax reform is leading members to become more aggressive in retail deposit gathering with many offering extremely competitive CD rates as of late. As in past years, some members have been rolling their advances short to fend off net interest margin compression. However, we are also seeing members increasingly taking advantage of the flat yield curve by layering in term funding to stabilize funding costs as we continue to confront a “hawkish” Federal Reserve rate posture. Although some concern remains that aggressive rate hikes could potentially lead to another recession, economic indicators point to a strong economy and some feel that the probability of a recession in the near-term is relatively low.

Read further about how the FHLBNY can be your strategic partner, providing stable, low-cost funding, as well as information and funding solutions, that, when utilized, can help contribute to your solid financial performance.

FHLBNY SOLUTIONS

Five Ways to Tap Into Membership & Combat Liquidity Headwinds

Positioning your organization with the appropriate level of strategic and contingent liquidity is imperative. When was the last time your institution conducted a liquidity assessment? This exercise involves stress testing your current liquidity base and determining worst case scenarios where significant funding would be needed, or where your interest rate risk position would be substantially compromised. In this regard, obtaining the greatest possible level of borrowing potential ahead of a problem is crucial to mitigating risk and sustaining growth.

Consider the following five questions to see how you can leverage your FHLBNY membership to assist with liquidity planning to help sustain growth, maintain strong bottom-line earnings and mitigate risk.

1. Do you have sufficient collateral pledged to the FHLBNY?

Considering the intense and evolving environment we operate in, it is important to keep your “foot on the gas” and not forgo asset and income growth because of a lack of liquidity. Examine your balance sheet to see if there are opportunities to pledge additional collateral, and reach out to us if you would like assistance in this regard.

2. Are you booking loans or growing securities that can be pledged to the FHLBNY?

Take a look at your balance sheet composition to ensure your institution is positioned to sustain a trajectory growth and withstand significant liquidity pressure. You may want to grow and maintain assets that are qualified to pledge as collateral to the FHLBNY so you can have the available funding to capitalize on other opportunities should they arise. We often see members lacking liquidity and limiting their asset growth because their lending model and security portfolio strategy has too strong a focus on assets that are illiquid and cannot be pledged to the FHLBNY.

3. What is your level of on-balance sheet liquidity?

Regulators are increasingly looking for a heightened level of on-balance sheet liquidity, in the form of cash and readily marketable securities. FHLBNY funding can enable you to structure a profitable securities portfolio while mitigating risks. If you accept municipal or public unit deposits, using our Municipal Letters of Credit (MULOC) product can enable you to utilize whole loan mortgage collateral instead of encumbering security collateral when securing those deposits. The MULOC is state-approved, cost effective and widely used across our membership base.

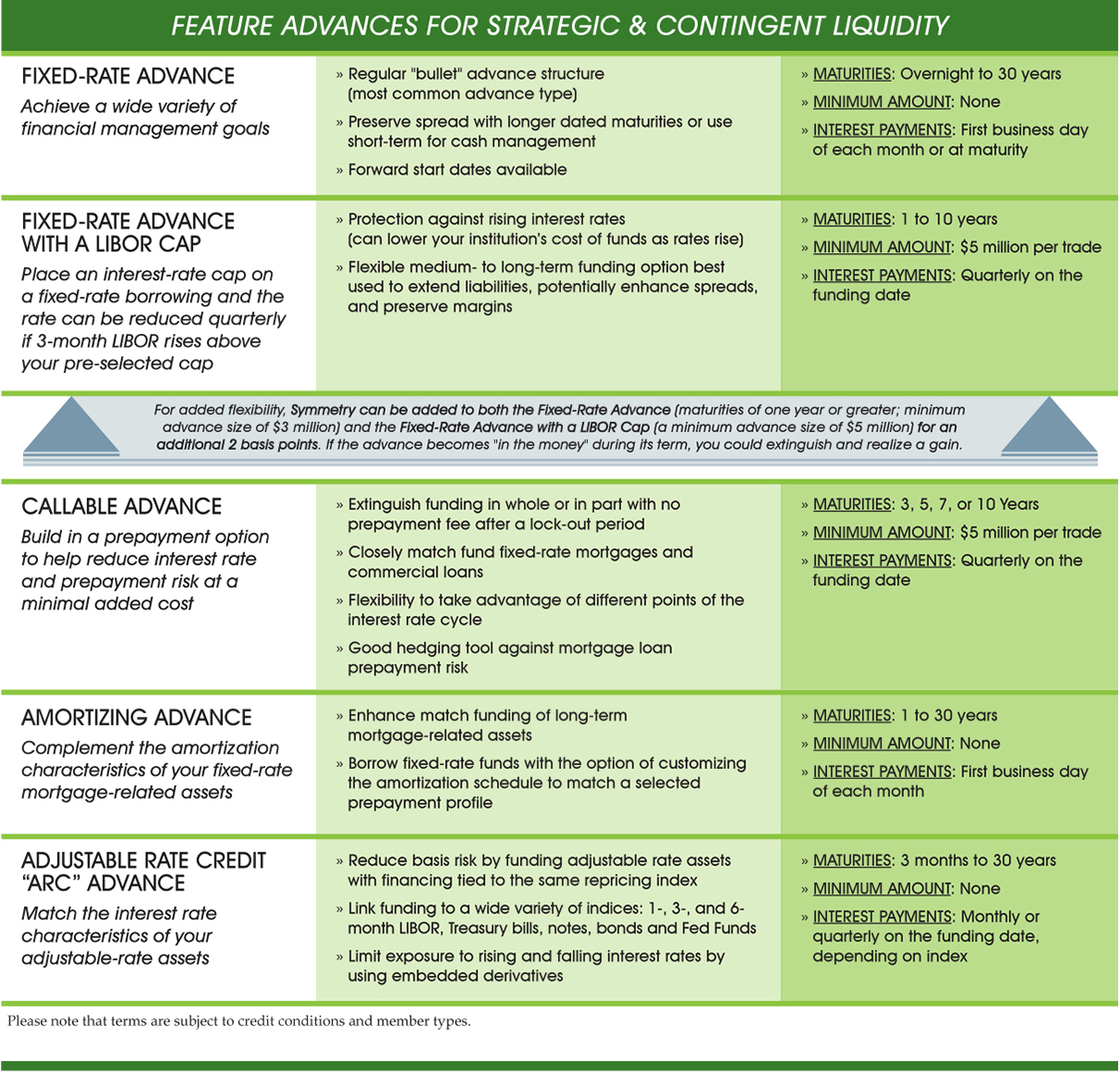

4. Do your liquidity policies include FHLBNY advance funding at all tenures?

Should your interest-rate risk position change due to core deposit outflow, it is important to be ready to execute term funding with the FHLBNY to address potential hedging needs. Not only should tenures be addressed in your liquidity policies, it is also prudent to address different advance structures so that you can use the appropriate product to address your specific needs. Further, when we review member policies we often find inaccuracies in references to FHLBNY funding terms, and we would be glad help you reconcile.

5. When is the last time you tested your borrowing potential?

If you are not a regular user of FHLBNY advances, it would be prudent from an operational perspective to conduct a test borrowing at least annually. Although borrowing is relatively simple, the process does involve multiple steps with which you should become familiar prior to experiencing a liquidity demand. Regulators also encourage periodic testing of all of your liquidity sources for process and reliability.

ONLINE GUIDES FOR MEMBERS

Did you know we accept 1st & 2nd lien home equity lines of credit and expanded lendable value on Private Label CMBS?

Learn the “ins & outs” of collateral pledging

Read more about our MULOCs as an alternate form of collateral for your municipal deposits

Interested in Learning More About Our Advance Products

Despite the robust economy, liquidity pressures may pose significant challenges for community lending institutions. However, your FHLBNY can help you prepare for your continued growth and success. Being positioned to help our members with funding to achieve growth and mitigate risk in all operating environments has been a hallmark of our franchise since its inception in 1932. We stand ready to assist you, and will gladly conduct a funding strategy session with you to discuss your growth and liquidity plans.

If you have any questions on this article or would like to set up a funding strategy session, contact your Relationship Manager at (212) 441-6700 or our Member Services Desk at (212) 441-6600.

NEWS / HIGHLIGHTS

Welcome New Members

Since our last edition, four members joined our cooperative:

Inner Lakes Federal Credit Union

Cumberland Mutual Fire Insurance Company

Security Mutual Life Insurance Co. of NY

Utica Mutual Insurance Company

CONNECT WITH US

Have suggestions for a future topic? E-mail your thoughts to fhlbny@fhlbny.com

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product