Member Advantage

How the Mortgage Partnership Finance® (MPF®) Program

Can Enhance Fee Income and Manage Interest Rate Risk

June 2015

As we proceed in this prolonged low-rate environment, members are keeping a close eye on the direction of both long-term and short-term interest rates. Although markets expect that rates will eventually rise, there is still much uncertainty surrounding the magnitude and timing of the next rate move. While some members have been well-served by maintaining long-term mortgage production on balance sheet over the past several years, other members have continued to offer their customers long-term mortgages, but have elected to sell that production into the secondary market.

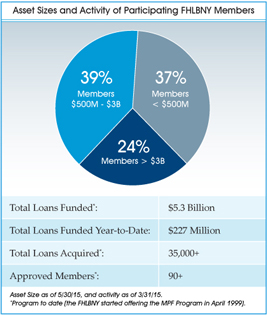

A secondary market option offered as part of your FHLBNY membership is the MPF Program. The MPF Program allows members to offer their customers long-term mortgages while selling that production to the FHLBNY for a competitive upfront price to help members mitigate interest rate risk. A key benefit of the MPF Program is its unique risk-sharing structure where the FHLBNY manages the interest rate and prepayment risks, while paying participating members fees over time for taking on a portion of the credit risk. The MPF Program also does not have the constraints from volume commitments that are often found with other secondary market outlets.

Remain Competitive in Your Marketplace

The spring/summer buying season is in full swing. April 2015 saw the highest housing starts in over seven years (according to the U.S. Census Bureau), and there has been a 9.2% increase in housing starts since April 2014. First-time homebuyers are motivated to act now, given pending rising interest rates. According to Freddie Mac’s Primary Mortgage Market Survey, published on June 11, 2015, the average 30-year mortgage rate recently jumped to its highest levels this year, topping 4% for the first time since late 2014. The refinance boom that was happening this time last year has given way to the purchase market.

The fixed-rate 30-year mortgage is the product of choice for the majority of homebuyers, as borrowers seek the stability of fixed rates and lower monthly payments. The MPF Program enables members to continue long-term lending in their communities and maintain valuable relationships with their customers, while leaving the back-end interest rate risk management to the FHLBNY. The MPF Program does not carry the standard secondary market application fees, start-up costs or annual loan volume requirements. Furthermore, there is no cost to get started, each participant receives the same pricing regardless of volume sold, and there is no penalty if members are unable to sell loans.

In addition, with a growing purchase market comes growing demand for FHA, VA and FDA Rural Housing mortgages. If a member is an approved originator of these types of mortgages, they can sell this loan production under the MPF Government product. Government loans can be sold on either a servicing retained or released basis.

Loans can be sold under the MPF Program on a flow basis or in bulk transactions. Members can choose to manage the interest rate and loan fallout risk on their own until the loan closes by taking down a three-day forward lock. Alternatively, members can lock in the interest rate for borrowers by taking down a forward lock that can provide over 60 calendar days of rate protection. Mandatory delivery is required for forward locks; however, there is latitude in providing loan substitutions.

In order for mortgage loans to be eligible for sale under the MPF Program, they must be single-family (1-4 units), conforming, fixed-rate mortgages with terms from 60 to 360 months. Acceptable property types include manufactured homes, condominiums and Planned Unit Developments. Properties must be owner-occupied and may include 1-unit second homes. Co-ops and investment properties are not eligible.

Get Rewarded for Quality Underwriting

Members that sell loans under the MPF Program share in a small portion of the credit risk rather than being charged Loan Level Price Adjustments (LLPAs) and adverse market fees by a secondary market investor. However, they are compensated for maintaining a portion of the credit risk, and could receive up to 10 basis points of fee income annualized on the outstanding balances, paid monthly.

Your credit risk obligation is determined based on loan characteristics such as FICO, LTV, debt-to-income ratios, etc. The credit risk sharing feature allocates future loan losses, if any, between the member and the FHLBNY after borrower equity and private mortgage insurance are depleted.

Participating members appreciate the additional fee income and lack of LLPAs, which affords them the additional flexibility of passing along that benefit to the borrower in the form of a lower rate.

Experience the Benefit of Dividend Potential

Selling loans into the secondary market allows you to meet consumer demand and earn fee income without substantially increasing your risk. With the MPF Program, members are required to purchase activity-based FHLBNY capital stock equal to 4.5% of their delivery commitments. Participating members view this requirement as a benefit, considering that FHLBNY stock is a historically high-yielding asset.1 When factoring in the economic benefit of the stock dividend yield, in addition to the lack of LLPAs and the competitive initial sale price, the MPF Program becomes an obvious choice for many of our members’ mortgage originators.

Whether you currently sell your loans or keep them in portfolio, the MPF Program has the potential to help you increase profitability, ensure liquidity, and earn greater fee income from the loans you originate. To learn more about participating in the MPF Program, or have us come out to discuss the program with your team, please call us at (212) 441-6701 or visit the MPF Program section.

OTHER ANNOUNCEMENTS

Already Selling Loans into the MPF Program?

Did you know you can automate the loan presentment process by uploading loan data using a ULDD file? If you have access to Desktop Underwriter (DU) or Loan Prospector (LP), you may be able to save time by automating the loan file. To learn more contact Muriel Brunken at (212) 441-6712.

Free Workshops for MPF Participants – Sign up Today for MPF University!

MPF University is the MPF Program’s free education website that offers self-paced courses conducted by AllRegs® for you and your employees. You can enroll online for MPF University in a few easy steps. Instructor guided MPF workshops are also available in the Events section.

1 Please note that there is no guarantee that the level of future dividends will match or be comparable to the level of previous dividend payouts.

“Mortgage Partnership Finance” and “MPF” are registered trademarks of the Federal Home Loan Bank of Chicago.

1LinkSK® — the FHLBNY’s New Safekeeping Platform

The new 1LinkSK® platform offers members even more than the legacy 1Link® Safekeeping Module. 1LinkSK® includes intuitive self-service features that provide your institution’s authorized users with the opportunity to:

Perform trades,

Create Pledge transactions,

View “real-time” monitoring of account activity, and

Customize reports and delivery methods.

Effective June 1 and running through December 31, 2015, an additional discount of $5 per transaction will be applied to Purchases/Sales transactions initiated by members using the 1LinkSK® Self-Service feature.

The legacy Safekeeping Module in 1Link® will be phased out by the Fall. All safekeeping transactions and reporting can be done through 1LinkSK®. For assistance transitioning to 1LinkSK®, please contact our Custody and Pledging Services team at (800) 546-5101, or by e-mail at CustodyandPledgingServices@fhlbny.com.

Feedback Welcome

Have a suggested topic for the FHLBNY Advantage? E-mail us at fhlbny@fhlbny.com.

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product