Member Advantage

Considerations to Maximize Your Membership

January 2015

Forging ahead into 2015, although we seem to be moving toward a different point in the interest rate cycle, persistent global economic and geopolitical factors are applying significant downward pressure on the longer end of the yield curve. Members could face additional margin pressure should short-term rates rise, causing further flattening of the yield curve. However, some members view this environment as an opportunity to position their balance sheets to become less liability-sensitive.

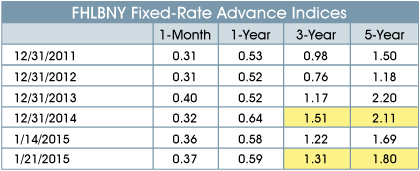

FHLBNY advance rates are still at historic lows — and down markedly since year-end 2014 (see the chart). Our long-term rates have experienced volatility, and is demonstrated by the 20 and 31 basis point decline in our 3- and 5-year advances, respectively. Members took advantage of this rate dip and executed fixed-rate term funding at advantageous levels.

Furthermore, at the time this article was being authored, New York City and the surrounding region faced a snowstorm of historic magnitude (especially historic for some Long Island members). Although we remained open for business, some members took precautionary measures and borrowed funds for several days to “shore up” their cash positions in the event of possible power outages and employees not being able to get into work. As always, we strive to be your reliable liquidity partner in any economic climate — and in any weather condition!

These post crisis years have certainly been challenging for many members, with formidable headwinds again forecasted for 2015. Consider letting the FHLBNY help you “weather the storm” by leveraging our strategic partnership and taking full advantage of membership. The following five points could potentially help broaden your liquidity, address risk, keep you informed and assist with your bottom-line profitability in 2015.

Improve Earnings and Liquidity — Use Whole Loan Collateral

The regulatory impact of the U.S. Interagency’s Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR)1 on institutions that are not required to comply with these measures is yet to be determined. Will the LCR and NSFR become the new regulatory standard? Will examiners look for substantial compliance of these measures by smaller community lenders? An important cornerstone of these two liquidity measures is keeping high-qualified liquid assets unencumbered. Here are two options to consider where members can use whole loan mortgages to strengthen their regulatory liquidity while mitigating negative impact on profitability:

Use the Municipal Letters of Credit (MULOC) program to help keep liquid securities unencumbered. MULOCs are tri-party agreements between the member institution, the FHLBNY, and a municipal depositor, where the FHLBNY guarantees performance by the member institution with its obligation to the municipal depositor. The MULOC is deemed as acceptable collateral to secure municipal deposits by the states of NY and NJ, and a member may use whole loan mortgages to collateralize the MULOC while leaving liquid securities unencumbered. The MULOC is operationally efficient and is a cost-effective alternative to purchasing low-yielding securities for the sole purpose of collateralizing municipal deposits. Regular Letters of Credit (L/Cs) are also available for other general purposes, such as facilitating residential housing finance or community lending, to assist with asset/liability management, liquidity, or other funding purposes.

Use FHLBNY advances for funding as opposed to repurchase agreements. The FHLBNY offers members the ability to pledge relatively illiquid whole loan mortgages and obtain liquidity through our advance program. Members have found that advances are a more economical and efficient way to obtain funding versus delivering securities for repurchase agreements — yet another way to keep liquid assets unencumbered.

Maximize Borrowing Potential – Have a Collateral “Check Up”

We are a big advocate for “fixing the roof while it’s sunny.” Even if you view the current operating environment as “overcast,” the same concept applies — don’t wait for an emergency to start focusing on ways to improve your liquidity. As all of us are keenly aware, things can change quickly and it’s best to be prepared. If you are pledging whole loan mortgages, there may be an opportunity to pledge additional mortgage types. There could also be opportunities to potentially enhance the valuations of the mortgages your institution already pledges by providing additional data points in your monthly loan listing. Perhaps your loan data submission contains errors that cause loans to be excluded from your pool of pledged mortgages — we can help with that as well. Your investment portfolio may also present another opportunity to broaden your pledged collateral. Be ready for that rainy day— let us do a diagnostic collateral check-up to see if there are opportunities to expand your available liquidity.

Know Your Credit Score

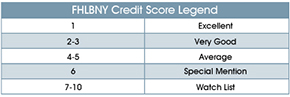

Just as credit scores are used to evaluate the potential risk in consumer lending, the FHLBNY uses an internal credit rating model to calculate a credit score for each member. Credit scores are calculated using several factors that assess liquidity, asset quality, capital adequacy, and earnings. The credit score is used as a screening tool and could potentially impact your institution’s collateral pledging category, collateral haircuts, term of credit extensions, the ability to participate in our Mortgage Partnership Finance® (MPF®) Program and affordable Housing Programs, in addition to affecting pricing of MULOCs and L/Cs. Our credit rating is on a scale from 1 to 10, with 1 being the strongest rating.

The “Special Mention” rating, which begins when a member’s score falls between 6 and 6.99, is the category where a member may begin to experience some restrictions. If you would like to discuss your credit score, contact your Relationship Manager to arrange a call with our Credit Risk Management Department.

Achieve Savings with the FHLBNY’s Community Lending Program (CLP)

CLP advances can be an economical option to add duration to your liabilities to better match- or pool-fund long-term assets. Regulators are concerned that funding mismatches could pose a significant threat if we enter a period of enhanced economic growth with the potential for rate hikes by the Federal Reserve. CLP advances are offered at preferential rates to help create housing, improve business districts, and strengthen the neighborhoods you serve. If members demonstrate qualified lending that meets the criteria of the following three CLP advances, then funding can be obtained at a savings of approximately 20-25 basis points off regular advance rates. CLP advances require a term of 1 year or greater. Additionally, a 90-day “look back” for qualified lending is an available option. Specific information about CLP products follows.

Community Investment Program (CIP): CIP advances apply to residential lending, either to families purchasing 1-4-family homes, or for lending to projects that provide housing. For 1-4-family home lending, if the borrower’s household income level is at or below 115% of the area median income (AMI), that loan would qualify for CIP funding. If a member books a loan to fund a housing project, the loan would qualify for CIP funding if either 51% of the occupants of the housing units earn at or below 115% of the AMI, or, 51% of the units have rents that are affordable to households with incomes at or below 115% of the AMI.

Urban Development Advance (UDA): UDA funding is for non-residential lending conducted in urban2 census tracts that are at or below 100% of the AMI. For example, if a member originates a $500,000 loan to a commercial business located in a qualified census tract, then that loan would enable the member to book a $500,000 advance at a reduced rate. Small Business Association (SBA) loans issued in an urban region also qualify for UDA funding.

Rural Development Advance (RDA): Like the UDA, members are incentivized to engage in commercial lending in lower-income census tracts. However, RDA funding is for areas deemed rural3, where the project is located in a census tract at or below 115% of the AMI. SBA loans issued in a rural area would also qualify for the RDA funding.

Separate applications are required for CIP, UDA, and RDA advances. Currently there is an annual limit per member on CLP application submissions, which is less than or equal to $100 million, or 5% of total advances outstanding as of 12/31/14, whichever is greater.

Consider FHLBNY Member-Director Education

Over the past several years, the FHLBNY has visited with many of our members’ Board of Directors and management teams to discuss our business model and how to best leverage the relationship with our cooperative. As we may be approaching a period of more robust growth, it is important to be prepared and have your directors and executives informed on how the FHLBNY can help you mitigate risk, assist you with your business model, and ultimately enhance earnings and preserve capital. We can visit you, or you can use our board room to conduct your board meeting at our headquarter office located in Manhattan. We can tailor a presentation to your liking and then you can proceed to meet in private. Schedule your 2015 session early as our calendars are filling up fast.

To discuss the products, programs, and services presented in this article, contact your Relationship Manager at (212) 441-6700.

1 The U.S. Interagency LCR measures an institution’s liquidity available to cover short-term liquidity needs over a 30-day stress scenario, while their NSFR calibrates the required and available “stable” funding looking out over a 1-year time horizon. The LCR is being phased in over a multi-year time horizon starting in January 2015. The NSFR is in the proposal stages and its planned “rollout” is not expected to be until 2018.

2An urban area is defined as a unit of general local government with a population of more than 25,000.

3 A rural area is defined as a unit of general local government with a population of 25,000 or less.

“Mortgage Partnership Finance” and “MPF” are trademarked by the Federal Home Loan Bank of Chicago.

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product