Member Advantage

Potential Funding Opportunities for a Persistent Low Rate Environment

October 2015

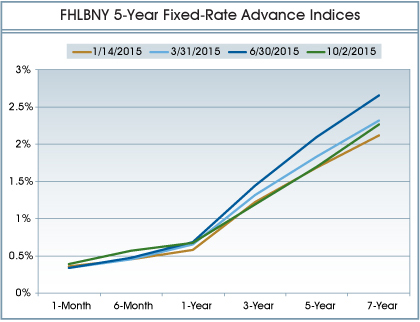

Although the U.S. economy has made strides in 2015 with decent GDP growth and improving economic metrics, we have yet to see the Federal Reserve (Fed) move away from a stance of significant accommodation, which has been in place since the financial crisis. The Fed decided to remain “dovish” and held off on a rate hike at the September 2015 Federal Open Market Committee meeting. As seen from the FHLBNY advance rate curves in the following chart, term advance rates have been moving within a 55 bps range since year-end 2014 (as evidenced by the benchmark 5-year Fixed-Rate Advance rate). Progressing into Q4, interest rates are still hovering at annual lows.

Significant pressure on net interest margins has caused financial institutions across the country to reach for yield by extending loan terms, purchasing longer-term securities, or by maintaining long-term mortgage production. Although you may believe that low rates will persist for the foreseeable future, interest rate risk is still a concern and regulators must be satisfied that this risk is properly addressed. You may wish to consider the following strategy to help address interest rate risk while maintaining an advantageous cost of funds.

Adjustable Rate Credit (ARC) Advance with a LIBOR Cap

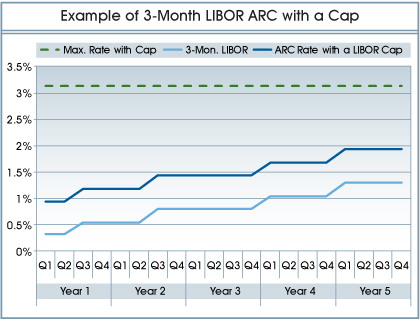

The ARC with a LIBOR Cap is a floating rate advance tied to either 1-month or 3-month LIBOR, but contains an embedded cap, which would serve to “cap” or limit the cost of the floating rate advance to a maximum rate should LIBOR rise to its “cap” threshold. This would be a strategy for a liability sensitive member to consider, who needs protection from a rising rates but believes that we are in a low rate environment for the foreseeable future.

The example provided illustrates the mechanics of a $10 million 3-month LIBOR ARC with an embedded cap of 2.50% (advance was priced at 3-month LIBOR plus 63 bps). Through the life of this advance scenario, 3-month LIBOR rises at a gradual pace and never breaches the cap limit of 2.50%. In this case, the advance starts out at a rate of 0.95% and gradually climbs to a rate of 1.93% in year 5, and never hits the maximum possible coupon rate of 3.13% (2.50% cap plus spread of 0.63%). This strategy would have saved a member $149,000 versus booking a regular 5-year Fixed-Rate Advance at 1.78% (indication from October 6, 2015). If rates remain static or just move slightly, the savings would be markedly higher. In an environment with more rapid rate increases, the regular Fixed-Rate Advance may potentially be more appropriate — it all depends on your rate outlook.

This advance strategy is particularly helpful for liability sensitive members in mitigating Economic Value of Equity at Risk. A member can enjoy the lower-cost funding of the floating rate advance, but has the protection of the embedded cap, which quickly becomes “in the money” when running upward regulatory shock scenarios. The cap effectively turns the floating rate advance into fixed-rate funding if 3-month LIBOR rises above the cap. The advance would reset lower should 3-month LIBOR fall below the cap threshold (quarterly resets).

Update to the Putable Advance Modification Program

We are pleased to announce that the Putable Advance Modification Program has expanded to include modifications of previously modified Putable Advances. Putable Advances can now be re-modified into new Putable or Fixed-Rate Advance structures. Members who have taken advantage of this program in the past have enjoyed the benefit of a lower coupon rate on their modified Putable Advances by extending their maturities. Members are now able to re-modify their Putable Advances and again are able to obtain a lower coupon rate by extending the life of the advance. We believe that the expansion of this program can help members lower their cost of funds, reduce pressure on net interest margins, and add duration to liabilities for asset liability management purposes. Eligible advances under the expansion of the Modification Program are subject to the same guidelines and controls of the existing program. In addition, advances being re-modified must have a maturity and effective duration greater than or equal to the original advance. Other provisions may apply.

If you would like more information on the ARC with a LIBOR Cap or would like to discuss our Putable Advance Modification Program in further detail, please contact your Relationship Manager at (212) 441-6700.

OTHER ANNOUNCEMENTS

Now Accepting: Split-Rated, Private Label Commercial Mortgage Backed Securities

In an effort to provide maximum liquidity and expand members’ borrowing potential, the FHLBNY now accepts split-rated, private label commercial mortgage backed securities (PL CMBS) as collateral to secure all extensions of credit. Previously PL CMBS collateral required a minimum “AAA” rating across all nationally recognized statistical rating organizations (NRSROs). Eligible split-rated PL CMBS must carry at least one “AAA” rating and a minimum rating of any form of “AA” (i.e., AA+/-). The FHLBNY acknowledges ratings from Fitch, Moody’s, Standard & Poors, DBRS, Morningstar and Kroll. Additionally, split-rated PL CMBS will be subject to a pipeline delinquency screen and must carry a readily ascertainable price.

To learn more about pledging these types of securities, visit the Collateral Guide or contact a Relationship Manager at (212) 441-6700.

Have You Taken Advantage of the FHLBNY’s Member-Director Education Program?

The FHLBNY visits with many of our members’ Board of Directors and management teams to discuss our business model and how to best leverage the relationship with our cooperative. As we may be approaching a period of more robust growth, it is important to be prepared and have your directors and executives informed on how the FHLBNY can help you mitigate risk, assist you with your business model, and ultimately enhance earnings and preserve capital.

We can visit you, or you can use our board room at our headquarter office in Manhattan. The FHLBNY presentation can be tailored for your specific needs, and then you can proceed to meet in private.

No cost to you — it’s a benefit of your membership.

Contact your Relationship Manager at (212) 441-6700 to schedule your program today.

Education Topics Include (but are not exclusive to) :

FHLBank System Overview, Earnings, and Financial Highlights

- FHLBank Debt Issuances Program and Washington Update

FHLBNY Membership Benefits and Trends

- What is the FHLBNY and what makes our partnership “unique”?

FHLBNY Products, Services, and Programs

- Advance Product Offerings/Trend

- Letters of Credit

- Community Lending and Housing Programs

- Mortgage Partnership Finance (MPF®) Program (secondary market outlet)

- Correspondent Services

- Credit Monitoring and Collateral Management

- Capital Stock Requirements and Dividends

Strategic Planning

- Branching Innovation and Trends

- Liquidity Planning and Industry Trends

- Deposit Pricing Practices

- Funding Strategies (Whole Loans and Investment Securities)

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product