Member Advantage

Addressing Potential Risks with the Fixed-Rate Advance with a LIBOR Cap

May 2015

As noted in the February 2015 edition of the FHLBNY Advantage, since the “Great Recession” began, there has been a significant inflow of deposits to the U.S. banking industry — $3.08 trillion has flowed into U.S. banks (as of Q1 2015). The majority of this inflow has been into non-maturity deposit accounts, which now comprise 84% of domestic deposits (up from 62% in Q4 2008), and are traditionally categorized as “core” deposits with long durations. Post-crisis asset growth was largely concentrated in security portfolios, accounting for 64% of asset growth. Due to the extended period of low interest rates and a flat yield curve, many institutions sought to invest in securities with longer maturities. Regulators have become increasingly concerned that liquidity and interest rate risk positions could change dramatically if depository institutions experience significant deposit outflow during a rising rate environment, as investors might seek higher yielding investments elsewhere. To fend off liquidity shortfalls, members are also concerned they may have to resort to paying much higher rates for shorter-duration deposits, further pressuring margins and creating larger funding mismatches.

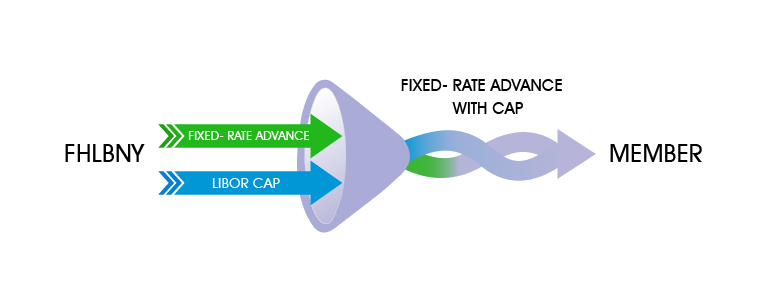

Members may want to consider our Fixed-Rate Advance with a LIBOR Cap (Fixed-Rate with Cap) product to help assist with addressing funding mismatches now. The additional protection of a rate cap is designed to reduce interest expense in the event short-term rates rise sharply.

Hybrid Funding Opportunity for Balance Sheet Management

The Fixed-Rate with Cap is a FHLBNY advance product in which a 3-Month LIBOR interest rate cap is embedded into a traditional fixed-rate, long-term advance. This hybrid product was designed to both “lengthen” the duration of liabilities and respond favorably in a rising interest rate environment. As interest rates rise and 3-Month LIBOR increases and breaches a pre-determined strike threshold, the coupon on this advance could decline, either one basis point for every basis point 3-Month LIBOR is above the strike threshold (1× multiplier), or one basis point for every 2 basis points 3-Month LIBOR is above the strike (0.5× multiplier), with an ultimate floor of 0%. As rates rise, the interest expense associated with this advance can decline (quarterly resets with a floor of zero), while other liability categories on the balance sheet may become more costly. If 3-Month LIBOR falls back below the strike threshold, the advance will reset to its original coupon rate.

The Fixed-Rate with Cap can help with match funding long-term assets and assist with improving spread in a rising rate environment. This advance can be particularly helpful when running regulatory interest rate-shock scenarios. For example, potentially sharp rate spikes could cause the coupon rate of this advance to rapidly decline, which would improve the present value of this advance, and serve to assist with a member’s Economic Value of Equity at Risk measures.

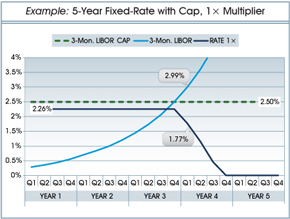

The following example illustrates the mechanics of the Fixed-Rate with Cap under a hypothetical interest rate scenario. In this scenario, the 5-year Fixed-Rate with a 1× cap and strike of 2.50% has an initial rate of 2.26% — 27 basis points higher than the regular 5-year Fixed-Rate Advance. As shown, the advance rate will decline in a rising rate environment. Once 3-Month LIBOR rises and breaches the cap strike of 2.50% in Q1 of year 4, the Fixed-Rate with Cap will reset on quarterly basis, downward a basis point for every basis point 3-Month LIBOR is above the cap (floored at zero percent). If 3-Month LIBOR sets below the cap strike, the advance will return to its initial rate of 2.26% on the quarterly reset date.

The cap threshold or “strike” is determined by the member at the inception of the advance. There is a $5 million minimum to this advance and a minimum term of 1 year.

Take Advantage While Rates are Still at Historic Lows

Although there is an additional cost to the Fixed-Rate with Cap, rates are still at historic lows, and 5-year money with the embedded 3-Month LIBOR cap is still historically inexpensive. The cost to this advance is dependent on the strike of the cap and the term of the advance.

The following graph is an interesting look at the rate history of our 5-year Fixed-Rate Advance over the past 30 years. Although rates appear to be off the lows experienced in 2012, they are still hovering at historically low levels. To address liquidity risk and funding mismatches, we have seen members increasingly borrowing further out on the curve. Some members are being opportunistic and have taken advantage of rate volatility experienced thus far in 2015, as the 5-year advance has fluctuated by as much as 43 basis points.

To achieve further savings, members may explore incorporating the Fixed-Rate with Cap into one of the FHLBNY’s Community Lending Programs (CLP). CLP Advances are offered at a reduced rate if qualified lending is demonstrated — either residential mortgage lending, which benefits lower income individuals, or non-housing related lending in lower-income census tracts

As always, the FHLBNY strives to offer members funding and hedging solutions. To learn more about the potential strategy discussed in this article, or any other funding option, contact your Relationship Manager at (212) 441-6700.

OTHER ANNOUNCEMENTS

1LinkSK®— Have You Made the Switch to the FHLBNY’s New Safekeeping Platform?

Have You Considered the Economic Impact of Your Dividend?

On May 22, 2015, the FHLBNY distributed a dividend of 4.10% to members for the first quarter of 2015 (annualized). The FHLBNY has provided members with a consistent and reasonable quarterly dividend.

It is important for members to factor in the economic benefit of the dividend, which, depending on the advance term, can substantially lower the “all-in“ borrowing cost off an advance. For a detailed analysis, Contact your Relationship Manager at (212) 441-6700.

Note: There is no guarantee that the level of future dividends will match or be comparable to the level of previous dividend payouts.

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product