Member Advantage

REPORT FROM THE PRESIDENT

Second Quarter 2016

A Financially Strong Partner for Our Members

On May 6, Moody’s Investors Service issued credit opinions on both the FHLBNY and the Federal Home Loan Bank System. The rating agency’s report on our cooperative was very positive, highlighting our strong credit culture, stable profitability, exceptional asset quality and conservative interest rate risk management. Moody’s stated that the rating “reflects the FHLBank System’s financial strength, earnings stability, excellent asset quality and its special role as a provider of liquidity to US banks.”

This role was also highlighted in a speech given by Melvin L. Watt, Director of the Federal Housing Finance Agency, at the 2016 Federal Home Loan Bank Directors’ Conference on May 24. At the end of his remarks, Director Watt thanked the Federal Home Loan Banks “for all the work you have done to support the nation’s housing finance system by creating a stronger and more mission-focused FHLBank System.” As the Moody’s report affirms, the System is indeed stronger. In 2015, the System earned record net income and all 11 Federal Home Loan Banks were profitable. This performance continued in the first quarter of 2016, with the System posting a 23% quarter-over-quarter increase in earnings.

And it is our mission focus that drives the FHLBNY’s performance: at the end of the first quarter, we had the highest ratio of advances-to-assets in the System, reflecting our commitment to being a reliable funding partner for our members. Ours is a diverse membership, with a wide range of institutions that drive advance demand. We ended the first quarter with the third-highest level of advances in the System, and we have continued to experience increased demand for advances through the second quarter. Our balance sheet is stable and our funding profile is balanced, with lower reliance on short-term funding. We believe in our model, and the Moody’s report and Director Watt’s comments confirm the strength of our franchise.

This role was also highlighted in a speech given by Melvin L. Watt, Director of the Federal Housing Finance Agency, at the 2016 Federal Home Loan Bank Directors’ Conference on May 24. At the end of his remarks, Director Watt thanked the Federal Home Loan Banks “for all the work you have done to support the nation’s housing finance system by creating a stronger and more mission-focused FHLBank System.” As the Moody’s report affirms, the System is indeed stronger. In 2015, the System earned record net income and all 11 Federal Home Loan Banks were profitable. This performance continued in the first quarter of 2016, with the System posting a 23% quarter-over-quarter increase in earnings.

And it is our mission focus that drives the FHLBNY’s performance: at the end of the first quarter, we had the highest ratio of advances-to-assets in the System, reflecting our commitment to being a reliable funding partner for our members. Ours is a diverse membership, with a wide range of institutions that drive advance demand. We ended the first quarter with the third-highest level of advances in the System, and we have continued to experience increased demand for advances through the second quarter. Our balance sheet is stable and our funding profile is balanced, with lower reliance on short-term funding. We believe in our model, and the Moody’s report and Director Watt’s comments confirm the strength of our franchise.

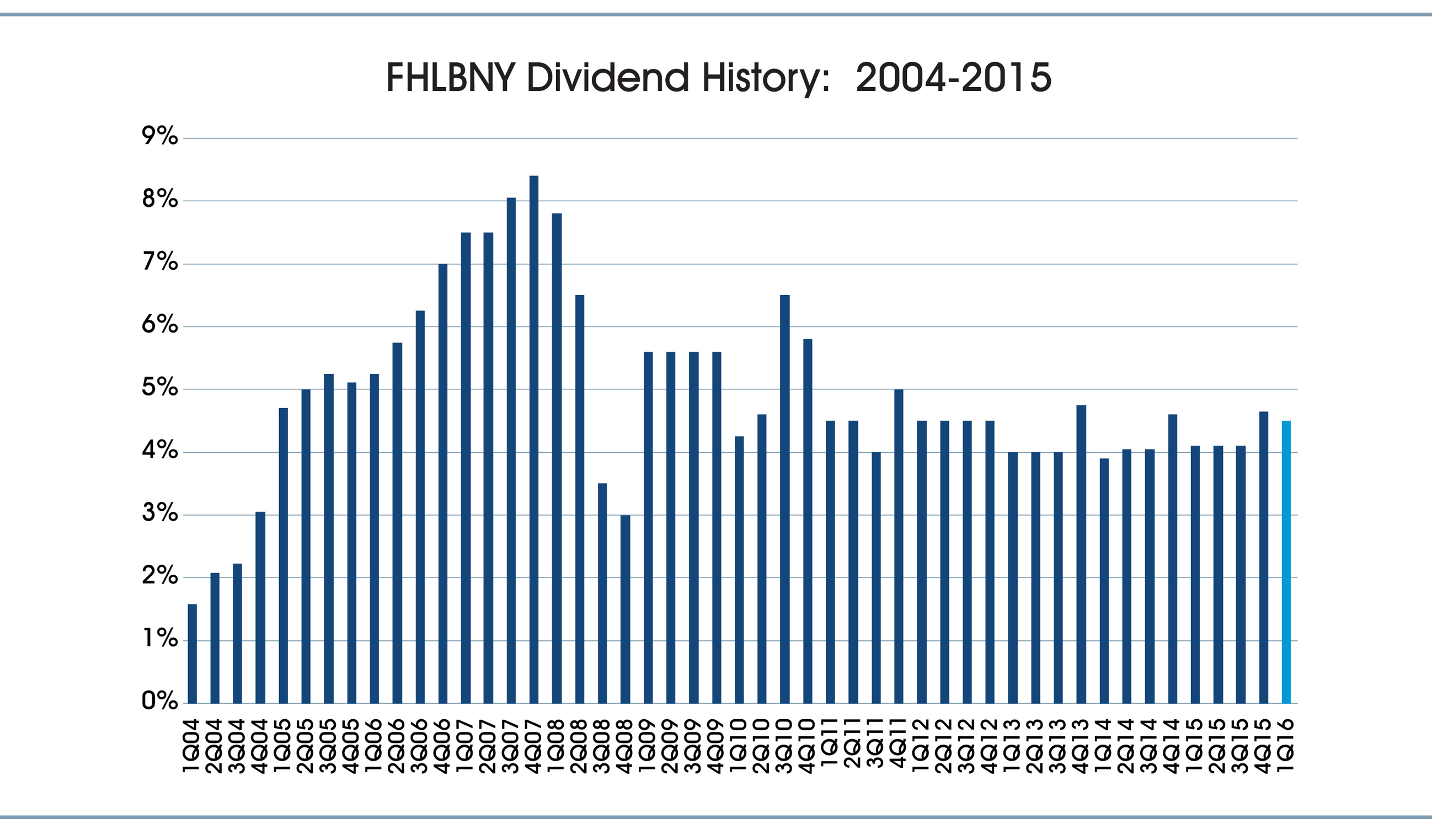

FHLBNY Declares 4.50% Dividend for the First Quarter of 2016

On May 19, your Board of Directors approved a 4.50% dividend for the first quarter of 2016. The cash value was approximately $61.5 million, and funds were distributed to our members on May 20. Our approach to our quarterly dividend has been to focus on providing a consistent and reasonable return to our shareholders, as we believe that a stable dividend is another way in which we provide member value.

As the chart below indicates, our dividend history speaks to our position as a reliable partner for our members.

Published 2015 Annual Report

Our steady dividend, healthy amount of core mission assets, stable balance sheet and reliable funding all contribute to the success of the FHLBNY. Our achievements throughout 2015 were captured in our Annual Report, which was sent to all members in May and is available here. We look forward to continuing to work with our members through the rest of the year to ensure that we have a strong story to tell in 2016.

Director Elections Process Underway

The FHLBNY’s 2016 Director Election process is currently underway. In total, five Directorships will be up for election in 2016: one New Jersey Member Director seat, two New York Member Director seats and two Independent Director seats. The knowledge and experience of our Board helps guide our franchise. Ours is an active and involved Board, much to the benefit of our cooperative.

I encourage all of our members to be involved in the election process. In this regard, I note that our cooperative is strengthened through diversity, be it in our membership, our employees or the communities we all serve. Our Board also benefits from diversity.

Please look out for our Director Election ballot package which is currently scheduled for distribution to eligible members on September 30. Your vote is very important, so we ask that you take the time to review the package upon receipt and promptly return your ballot to the FHLBNY.

Meeting with Our Members

On June 23, we hosted our first stockholders’meeting of the year in Westfield, New Jersey. Our management team was joined by our members to discuss our performance, our products and our partnership. The meeting also featured a presentation from Matt Pieniazek, President of Darling Consulting Group, who provided insights for developing appropriate total balance sheet strategies.

We have additional stockholders’ meetings planned for later in the year, and I hope you are able to join us for one of them. It is our belief that these events can provide our members with a better understanding of our cooperative, and help to ensure you are getting the most value out of your membership with the FHLBNY.

Sincerely,

José R. González

President and Chief Executive Officer

FHLBNY SOLUTIONS

HAVE YOU HEARD ABOUT OUR NEW SYMMETRICAL PREPAYMENT ADVANCE (SPA) FEATURE?

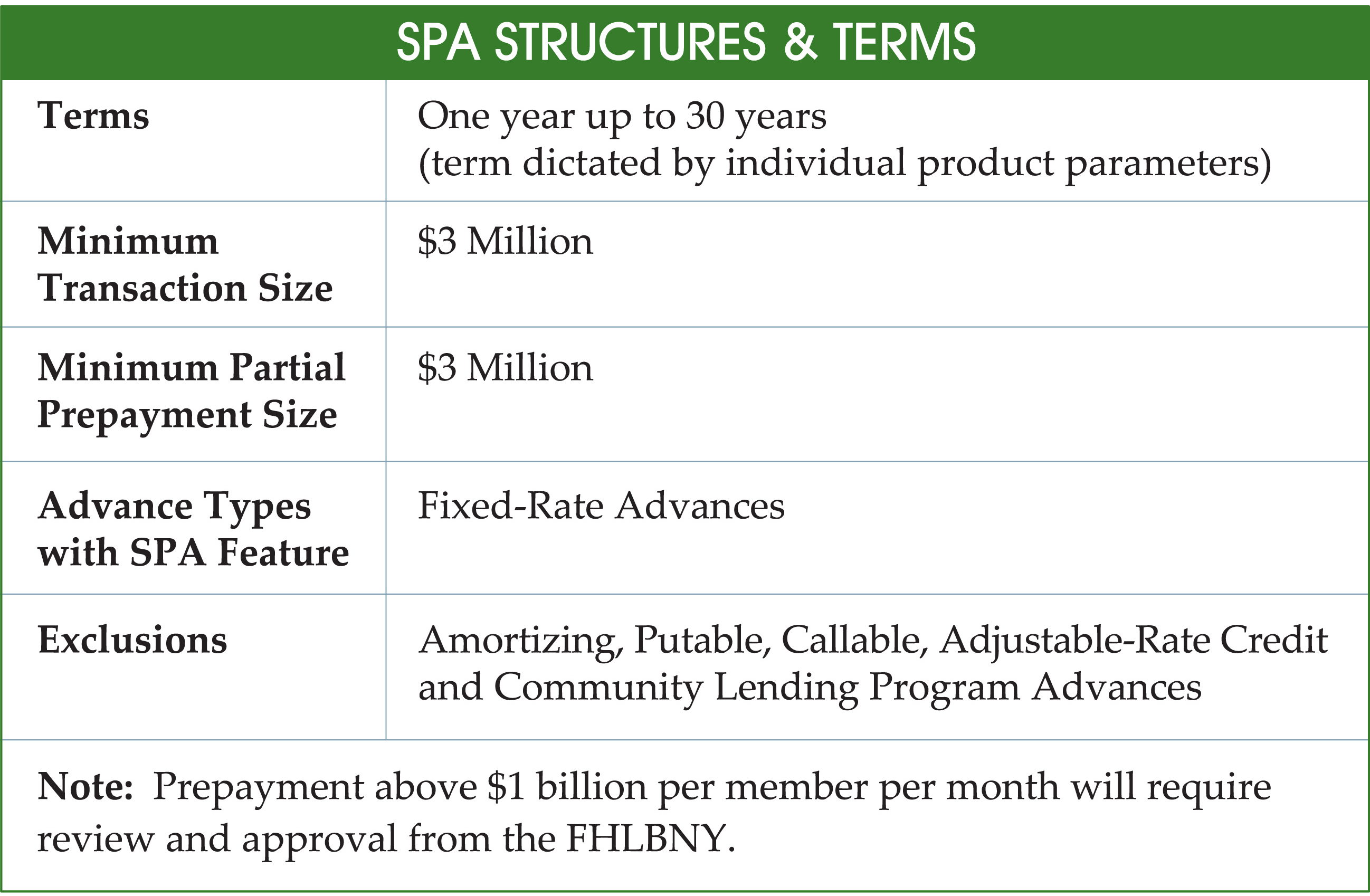

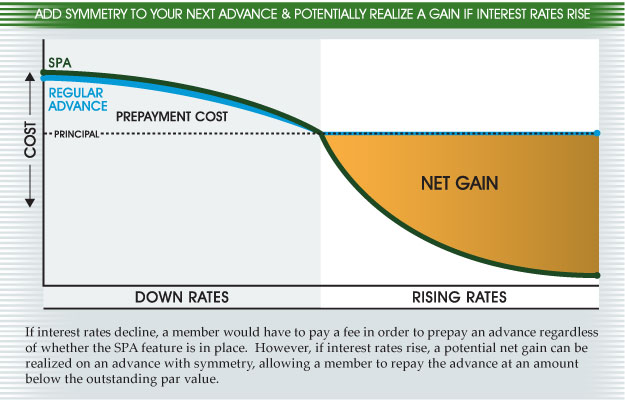

The FHLBNY is continually seeking ways to support members’ business in all operating environments. New product development activity focuses on providing flexible liquidity that is responsive to the balance sheet management needs of our members. As members manage and restructure their balance sheets more dynamically, the FHLBNY has reviewed the parameters of prepaying advances and now offers a new feature — the Symmetrical Prepayment Advance (SPA) feature.

At the time of booking an advance, members will have the ability to add symmetry on certain fixed-rate advances with maturities of one year or greater, as listed in the table on the right. For a two-basis point premium, members can activate the SPA feature which allows them to receive compensation for favorable changes in the Fair Value of the advance when prepaying. This compensation is net of prepayment fees. In a rising rate environment, members may find this particularly valuable.

While most members may not make it a practice to extinguish advances with below market rates for a gain, having the ability to do so can be advantageous.

POTENTIAL BENEFITS OF THE SPA FEATURE

OFFSET TO UNREALIZED LOSSES IN HELD TO MATURITY (HTM) SECURITY PORTFOLIOS

Since the financial crisis of 2008, depository institutions across the nation have experienced significant increases in liquidity and balance sheet growth. Much of this liquidity has been deployed in securities. Since 2008, increases in security portfolios account for 55% of bank balance sheet growth and 25% of credit union balance sheet growth.1 Additionally, slack post-crisis loan demand and significant margin compression have caused many financial institutions to seek additional return by investing further out on the yield curve. To shield Risked-Based Capital from potential unrealized securities losses, institutions have been increasingly categorizing securities as Held to Maturity (HTM). Although unrealized securities losses in HTM portfolios are not captured in regulatory capital calculations, such losses could give regulators “pause” when assessing capital during safety and soundness examinations. Market values of advances with the SPA feature will have an inverse relationship to fixed-rate security portfolio valuations. In a rising rate environment, advances with the SPA feature can create unrealized gains on the liability side of the balance sheet, which can be monetized — these unrealized gains could be perceived as an offset to unrealized losses in security portfolios.

FDIC Q1 2016 Quarterly Report and NCUA Credit Union Data Summary Q1 2016.

BALANCE SHEET MANAGEMENT

Members may need liability extension now in order to stay within their asset/liability management guidelines. To address this need, members can opt for a term fixed-rate advance with the SPA feature. If rates rise and the composition of your balance sheet changes, such as if your core deposit base increases or if assets shrink, you could potentially harvest a gain on extinguishment of term funding that you no longer require.

POTENTIAL TO MONETIZE GAINS

If an advance with the SPA feature achieves a favorable change in its Fair Value, you may opt to extinguish the symmetrical advance to monetize gains and boost bottom-line earnings. Should earnings and capital growth be needed now, you have the flexibility to extinguish the advance with SPA feature and take the gains into income. If you are rebooking advances with terms of six months or greater, you may also benefit from our Advance Rebate Program to receive back part of the prepayment fee associated with prepaying an advance.

MERGER AND ACQUISITION SITUATIONS

If there is a possibility of an imminent or future merger or acquisition and you require immediate funding, an advance with the SPA feature may be the solution.

Rising Rates:

An acquirer may desire to de-lever upon a merger with another institution. However, liquidating underwater securities is detrimental, especially following a period of historically low rates. By funding security portfolios with an advance with the SPA feature, there could be less loss when de-levering due to the potential gains on symmetrical advances. These gains could accumulate and be harvested after a period of rising rates.

Highly Levered Institutions:

Entities considering an acquisition or merger may seek to partner with deposit-rich institutions to boost their funding base and reduce reliance on wholesale funding. If rates rise, highly levered institutions could potentially harvest gains when unwinding an “in the money” SPA portfolio upon the acquisition of liquidity, offering additional value when considering the “all in” economic cost of an acquisition or merger.

How Does the SPA Feature Work?

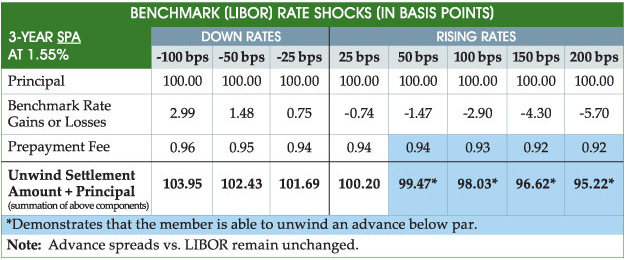

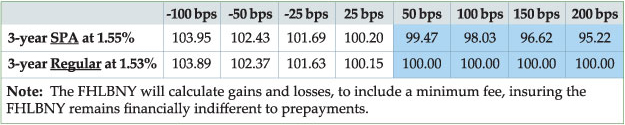

Table 1 builds on a hypothetical example illustrating how changes in the benchmark (LIBOR) rate impact the unwind settlement amount of an advance with three years remaining until maturity.

TABLE 1: UNWIND SETTLEMENT AMOUNT PROFILE OF A SPA FIXED-RATE ADVANCE

A 100 basis point reduction in the benchmark (LIBOR) curve would result in a loss upon prepayment. In this scenario, you would pay an unwind settlement amount of 3.95% plus the outstanding principal balance, resulting in a total prepayment cost of $103.95. Conversely, a 100 basis point increase in the benchmark (LIBOR) would return a gain upon prepayment. To prepay an advance in this scenario, you would be entitled to a net credit of 1.97%, which would be subtracted from the outstanding principal balance, resulting in a total prepayment cost of $98.03.

Table 2 illustrates the prepayment fee profile for a comparable traditional advance. The prepayment fee for a traditional advance in a down-rate scenario is similar to an advance with the SPA feature (though slightly lower due to the interest rate of the traditional advance being lower by two basis points). The difference between an advance with the SPA feature and a traditional advance is apparent in a 100 basis point, upward-rate scenario since the traditional advance will not receive the 1.97% benefit afforded with the SPA feature.

TABLE 2: COMPARISON OF UNWIND SETTLEMENT PROFILES FOR SPA AND REGULAR FIXED-RATE ADVANCE

Adding the SPA feature on certain advances affords members greater flexibility to respond to today’s fast changing environment. We would be happy to discuss this option and any other funding solutions in greater detail with you, your management team and/or your board as part of our Member-Director Education Program (read the following highlight for more information). To learn more about the SPA feature, or the Rebate Program mentioned in this article, please consult with your Relationship Manager at (212) 441-6700.

HIGHLIGHTS / NEWS & UPDATES

Welcome New Members

Since our last edition, the FHLBNY has welcomed Countryside Federal Credit Union into our cooperative.

The Advance Rebate Program — Offering Added Funding Flexibility

Our Advance Rebate Program provides members with a cash rebate on a portion of the fees paid relating to the early extinguishment of eligible advances when new eligible advances are obtained within 30 calendar days. To receive the cash rebate, the prepaid advance(s) must have a remaining term of one year or longer, and new advance(s) must have a term of six months or longer.

Terms and restrictions apply. Visit the article page for program details and more information, or contact your Relationship Manager at (212) 441-6700.

Take Advantage of Our Member-Director Education Program

The unprecedented pace of change in the global and domestic economies and the associated impacts can be difficult to monitor and manage. The FHLBNY has a diverse membership and analyzes the operating landscape of all our members very closely. Regulators such as the OCC and the FDIC; place a large emphasis on board education. The FHLBNY can help in this regard with our Member-Director Education Program.

Our program can be tailored to meet your specific needs and will cover

top of mind issues such as:

The current operating and regulatory environment

Market changes, how they impact our members, and tactic members are using to manage their balance sheet

Strategic planning topics such as: asset and liability management, deposit pricing and funding essential technology advancements

Leveraging FHLBNY products to hedge risk, provide contingent and strategic liquidity, assist with your business model, and ultimately enhance earnings and preserve capital

We encourage you to use us as a resource by taking advantage of our Member-Director Education Program for your board of directors and management team. We can visit your institution, or host your team at our corporate headquarters in New York City. Contact your Relationship Manager at (212) 441-6700 to schedule a program.

Industry Events

The FHLBNY will be attending the upcoming industry events where we look forward to seeing you. Updates are posted on our website under the “Industry Events” section.

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product