Member Advantage

REPORT FROM THE PRESIDENT

Fourth Quarter 2015

On November 19, the FHLBNY declared a 4.10% dividend for the third quarter of 2015. The following day, the FHLBNY distributed $54.5 million in dividend payments to our members. In each of the first three quarters of the year, our dividend has been 4.10% and, through the first nine months of 2015, the FHLBNY has paid $163.8 million in dividends, a steady return on our members’ investment in our cooperative. This stability in our dividend is consistent with our history: the FHLBNY has long provided our members with a consistent and reasonable quarterly dividend.

On November 19, the FHLBNY declared a 4.10% dividend for the third quarter of 2015. The following day, the FHLBNY distributed $54.5 million in dividend payments to our members. In each of the first three quarters of the year, our dividend has been 4.10% and, through the first nine months of 2015, the FHLBNY has paid $163.8 million in dividends, a steady return on our members’ investment in our cooperative. This stability in our dividend is consistent with our history: the FHLBNY has long provided our members with a consistent and reasonable quarterly dividend.

A Strategic Focus

This consistency in our dividend is reflective of the overall strength and stability of our franchise. This is seen in the daily availability of our advances – we closed the month of October with $88.8 billion in funding being put to work by our members.

It is seen in our steady performance: at the end of the third quarter, the FHLBNY was the largest cooperative in the Federal Home Loan Bank System as measured by advances and the second-largest in assets. And it is also seen in the very words that guide our institution, our Strategic Vision and our Mission:

Strategic Vision: “To be a balanced provider of liquidity to members in all operating environments.”

Mission: “To advance housing opportunity and local community development by supporting members in serving their markets.”

Our Strategic Vision and our Mission are at the center of our overall strategy. Our strategy has served us well over the years, evolving from a focus on growing our membership post-FIRREA to a commitment to being an “Advances Bank” a decade ago.

I am pleased to announce that at its November 2015 meeting, our Board of Directors approved the FHLBNY’s three-year Strategic Plan for 2016-2018. Our cooperative is financially and strategically strong and, as a result, the theme for our new Strategic Plan is to “Evolve from a Strong Base.” From this strong base, we are well-positioned to monitor emerging trends in our operating environment and determine which present the best opportunities for us to strengthen our cooperative, and which present challenges we must address to ensure our stability. We believe that our Strategic Plan is flexible enough to help us navigate through a wide variety of market conditions, continue to meet the daily and long-term needs of our members and fulfill our mission to advance housing and local community development.

Over the past 18 months, our Board and our management team have dedicated significant time and attention to developing our Strategic Plan. This effort was led by our Board’s Strategic Planning Committee and our internal Strategic Planning Team, which drew staff from every function across our institution to provide a holistic view of our franchise. The team worked closely with our Management Committee, as well as with outside experts, in developing this Plan. We took into account potential changes to the operating environment that could pose business or operational risks — both those that could be significant enough to affect our strategy or business model, and those small enough to be considered distractions that would require a refocusing of resources.

The FHLBNY continues to perform well and meet the needs of our members. Our Strategic Plan will provide us with flexibility to pursue and develop growth opportunities and, as always, continue to focus on enhancing the value of membership.

25 Years of the Affordable Housing Program and 20 Years of the First Home Clubsm

One of our Strategic Objectives is to provide value to the membership through relevant, mission-oriented products and services. Since its creation 25 years ago, the Affordable Housing Program (AHP) has become part of the fabric of our cooperative. It is a reflection of our mission and our purpose, and its relevance to our members and the communities we serve has never been stronger.

Last month, our AHP — and our Community Investment Officer, Joe Gallo, who will retire from the FHLBNY at year-end after serving our cooperative for 28 years and leading every AHP funding round we have offered — were celebrated by Neighborhood Housing Services of New York City, Inc. (NHS) at its annual gala. It was a true honor for our entire team to be recognized by NHS because the AHP continues to work so well, simply because it works in support of the terrific efforts of housing organizations like NHS, and the partnerships these organizations have with our members at the local level. Our members and these organizations are the ones who know the needs of the communities they serve. They are the ones who bring families and individuals to our attention and submit grant applications on their behalf. And they are the ones who keep coming back to these programs, year after year. Our members and their community partners are working to make people’s lives better, and for the past 25 years, we have been proud and honored to work alongside them.

This work continued last month, when our Board approved our 2015 round of AHP grants. The FHLBNY will award $27.1 million to 35 initiatives to help create or preserve 2,576 affordable homes. Of this total, 1,955 units will support very low-income households, and 2,539 will be affordable rental units. Over the past 25 years, our AHP has awarded more than $515 million in grants to 1,450 projects across our District, helping to create or preserve more than 65,000 affordable homes. Check out the latest press release on “FHLBNY Awards $27.1 Million for 35 Affordable Housing Initiatives”.

This year’s NHS gala had the theme of “Connecting to Communities,” and our AHP provides us with a significant way to connect with the communities we serve. But it is not the only way we connect. This year also marks the 20th anniversary of our First Home Clubsm (FHC), which we launched in 1995 to offer an incentive for households with incomes at or below 80 percent of area median income to save towards the purchase of a new home. The FHC, which is a non-competitive set-aside of the AHP, provides down payment and closing cost assistance — often two significant barriers to homeownership — through grants of up to $7,500 by matching $4 for each $1 saved in a dedicated account to an eligible first-time homebuyer purchasing a home through one of our approved members. Since 1995, we have provided $74 million in grants to help assist 10,525 households become first-time homeowners, including 9,430 new homeowners in New York. For more information on these programs, please contact your Relationship Manager at (212) 441-6700.

COMMUNITY LENDING PROGRAMS (CLP)

Obtain funding at our lowest advance rates for projects that create housing, improve business districts, and strengthen neighborhoods.

In 2015 total CLP advances funded were over $1.4B (as of 11/16/15).

More information on CLP advances can be found here.

Giving Back

Providing community support is a priority for our business, and it is also a personal focus of our employees. This year, our employees adopted the theme of “Let’s Give Back” for all of our employee teambuilding events, centered on activities that help our communities across the District. We started with “PaintFest,” an event organized by The Foundation for Hospital Art to boost the spirits of patients and help the healing process.

We started with “PaintFest,” an event organized by The Foundation for Hospital Art to boost the spirits of patients and help the healing process. Our employees gathered to paint murals, which were donated to centers providing family and veteran care. Our employees have filled and distributed backpacks for foster children for the school year, volunteered in our annual Habitat for Humanity home build, fed 500 homeless through their work with NYC Relief Bus, raised money for the Special Olympics of New Jersey through family activities, helped “Make Strides against Breast Cancer,” raised money for the Ronald McDonald House, and sponsored a winter coat drive. These events have helped bring our colleagues closer together and build on our connection to the community, all while strengthening the culture of our cooperative. Read more on LinkedIn.

Our community-focused culture drives us. The 2016-2018 Strategic Plan is a result of a significant amount of work and analysis. But at the end of that work, we determined that the FHLBNY’s mission and vision are still as relevant today as they were three years ago when we last developed a strategic plan. And they are as relevant today as they have been at any point during our 83-year history. We developed our Strategic Plan with our Guiding Principles in mind, and as a result, our Strategic Plan will help us make decisions that strengthen our cooperative, advance our people, uphold our integrity and sustain the communities we serve in partnership with our members. We have long taken pride in being a reliable partner for our members, and our strategy will ensure that we remain your reliable partner.

Sincerely,

José R. González

President and Chief Executive Officer

FHLBNY FUNDING STRATEGY

Considerations to Address Risk and Capitalize on Your FHLBNY Relationship in the New Year

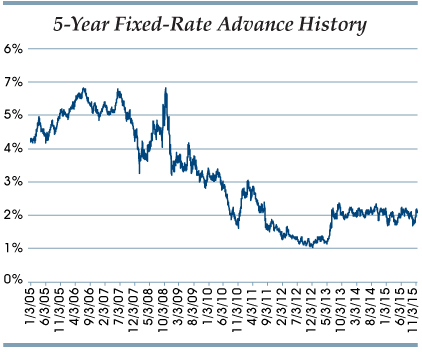

As we head into year-end, it appears that the Federal Reserve (Fed) is finally reaching a point where they are reducing their level of significant accommodation. The Fed Fund Futures indicates that there is a 68% chance that the Fed will soon have its first rate increase since June 29, 2006. In 2015 short-term interest rates remained virtually unchanged, while longer-term advances moved within a tight range, as seen in the following chart — the 5-year benchmark Fixed-Rate Advance rate varied by as much as of 54 basis points.

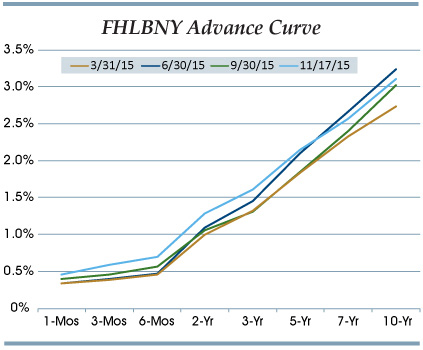

Heading into the Fed’s December Federal Open Market Committee meeting we are seeing our advance curve begin to steepen. While members may welcome higher rates and the ability to book higher yielding assets, regulators are concerned that the many years of “reaching for yield” and funding long-term assets with short-term liabilities could be costly should the economy warrant a fast-paced program of rate hikes by the Fed.

|

|

Another significant regulatory concern is the fate of the $3.1 trillion in “surge deposits” that flowed onto the balance sheets of U.S. banks since 20081. These funds reside in deposit accounts traditionally defined as “core” and proved to be stable for many years. However, should rates rise and these deposits exhibit a high degree of elasticity they could migrate to higher yielding assets elsewhere resulting in members being caught off guard with serious liquidity and funding mismatches to address. Compounding the issue is the fact that larger financial institutions are competing fiercely for retail deposits now more than ever. This is guided by the Inter-Agency Liquidity Coverage Ratio (LCR) and the proposed Net Stable Funding Ratio (NSFR), which look at respective liquidity stress scenarios of 30 days and 1 year, and the ability of an institution to withstand those stress scenarios — retail deposits are highly advantageous in meeting those measures.

Many of our members have been keeping their wholesale funding short over the past several years, waiting for a clear indication that rates would indeed increase. This strategy has proved to be fruitful during the prolonged period of historically low rates — but we are now potentially facing the first rate hike in over nine years. During the past several years, net interest margins have been under significant pressure and operating costs continue to increase. We have seen financial institutions across the nation reach for yield and add longer-term assets to their balance sheets. Now that it appears there is a clear indication that the Fed is ready to start increasing rates, perhaps it’s time to consider adding term funding to extend liabilities and mitigate interest rate risk.

We are certainly operating in challenging times, and the FHLBNY is here to help you navigate through these “unchartered waters” profitably while minimizing risk exposure.

Consider the following strategies to take advantage of membership and address issues as you plan for the New Year and beyond:

THE CALLABLE ADVANCE

“The Callable Advance gives the member the option to extinguish funding after a pre-determined lock-out period.”

The Callable Advance gives the member the option to extinguish funding after a pre-determined lock-out period. For example, a member can book a 5-year fixed-rate Callable Advance with a one year “non-call” period. After one year, the member can extinguish this advance with no prepayment charge, either one time or on a quarterly basis thereafter. With the possibility that short-term rate hikes may be part of the Fed’s monetary policy, you may want to consider adding a term Callable Advance to extend liabilities and shield yourself against rising rates.

In addition, you can use this advance to protect yourself from rates remaining stagnant or even declining, as this advance can be extinguished and rebooked down the line at potentially lower rates while maintaining the same average life of the existing advance. If the composition of your balance sheet changes (i.e., if mortgage prepayments speed up and balances decline), the Callable Advance allows for a partial prepayment as well, and the member can extinguish unneeded funding. If you need liability extension now, but are considering being a part of a merger or acquisition, you may want to consider the Callable Advance. In the event balance sheet repositioning may be required upon the deal closing, the Callable Advance will allow you to minimize your prepayment costs.

FIXED-RATE ADVANCE WITH A LIBOR CAP (FIXED-RATE WITH CAP)

This advance is structured as a fixed-rate advance with an embedded option tied to 3-Month LIBOR (3ML). As 3ML rises and breaches a pre-determined strike threshold, the coupon on this advance will reset downward, on a quarterly basis, either a basis point for every basis point 3ML is above the strike threshold (1× multiplier) or one basis point for every two basis points that the index is over the strike (0.5× multiplier). The value in this advance is twofold; it offers:

Real interest rate risk protection — should short-term rates rise rapidly causing deposits to reprice upward, the Fixed-Rate with Cap can offer interest expense relief and reprice downward, and

Value when running your regulatory shock scenarios. For example, if you have a 3ML strike threshold of 2.00% (with a current 3ML level of approximately 38 basis points) and you “shock” your balance sheet upward 200, 300, or 400 basis points, this advance quickly becomes “in the money.” If you booked this advance with a 1-year or 2-year term with a high cap, the cost of the cap is minimal but very supportive of your Economic Value of Equity at Risk measurements.

KEEP HIGH QUALITY LIQUID ASSETS (HQLA) UNENCUMBERED

One of the competitive advantages of the FHLBank System is the ability of members to obtain liquidity from whole loan mortgage collateral, a relatively illiquid asset. Keeping high quality liquid assets unencumbered has become part of the regulatory framework for larger financial institutions (> $50 billion in total assets), which are now guided by the inter-agency LCR and the proposed NSFR. These liquidity measures stemmed from BASEL III reform, a response to the financial crisis with an objective “to improve the banking sector’s ability to absorb shocks arising from financial and economic stress, whatever the source, thus reducing the risk of spillover from the financial sector to the real economy.”* As a result of the LCR and the proposed NSFR ratio standards, those required to comply are incented to keep HQLAs unencumbered, thus using FHLBNY advances to a larger degree versus other wholesale funding substitutes requiring securities as collateral. In addition to our advance products, members have found significant value in using whole loan collateral to secure municipal deposits. Our Municipal Letter of Credit (MULOC) program has expanded exponentially over the past several years, and now hovers at the $12 billion mark. This is largely a result of members desiring to keep their HQLAs unencumbered, ease of use, and an improving economy causing security portfolios to shrink in lieu of loan growth. The cost of our MULOC and its par value never fluctuates, so there is no need to monitor collateral levels based on market conditions. MULOCs are available in terms from two weeks to one year.

*Bank for International Settlements: Basel III: A Global Regulatory Framework for More Resilient Banks and Banking Systems, December 2010 (revised June 2011).

MEMBER-DIRECTOR EDUCATION PROGRAM

The unprecedented pace of change in the global and domestic economies and the associated impacts can be difficult to monitor and manage. The FHLBNY has a very diverse membership and we monitor the operating landscape of all our members very closely. We offer an education program specifically created for our members’ directors and managers and we encourage you to use us as a resource. We will visit your institution or you can use our corporate headquarters in New York City. We welcome the opportunity to discuss the operating landscape, trends for the future, and strategies to consider to help address current and future risks.

Session held at the FHLBNY’s corporate headquarters in New York City for member, The North Country Savings Bank, Canton, NY

Our message to you as we head into 2016 is this: consider the many ways in which you can leverage your relationship with the FHLBNY. We are here to serve you, our shareholders. Contact your Relationship Manager at (212) 441-6700 to discuss your specific business needs.

As reported in the FDIC’s Statistics on Depository Institutions Report and Quarterly Banking Profile – Second Quarter 2015.

Four New Members Welcomed in 2015

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product