Member Advantage

REPORT FROM THE PRESIDENT

Fourth Quarter 2017

A Strong Partner in the New Year

In 2017, the Federal Home Loan Bank of New York reached several significant milestones. In the spring, we moved into our new headquarters – an office space that fosters enhanced collaboration, communication and innovation and positions us to better serve our members. Over the summer, we reached a new all-time high for advances – reflective of our ability to meet increased member demand in the current operating environment.

In 2017, the Federal Home Loan Bank of New York reached several significant milestones. In the spring, we moved into our new headquarters – an office space that fosters enhanced collaboration, communication and innovation and positions us to better serve our members. Over the summer, we reached a new all-time high for advances – reflective of our ability to meet increased member demand in the current operating environment.

In December we awarded our second-highest amount of Affordable Housing Program grant dollars – $36.9 million to help create or preserve nearly 2,900 affordable homes. And throughout the year, our performance remained strong, with our cooperative achieving near-record results for the year. In total, 2017 was an exemplary year for the FHLBNY.

But for all these milestones, no one event, action or achievement defined the year for our cooperative. Instead, 2017 was defined by the constant themes in all of these milestones: the stability and reliability of the FHLBNY. This is the hallmark of our cooperative. Our stability and reliability not only drove our performance in 2017, but positions us to continue to achieve success in 2018, together with our members.

The environment in which we operated in 2017 presented challenges, opportunities and uncertainties. And yet our cooperative and our members thrived. The year ahead will present its own challenges, but just as our members remain stable partners for your customers and communities, so too shall will remain your trusted partner. In the following pages, we offer strategies and suggestions for how you can best partner with the FHLBNY in the New Year to ensure that 2018 is another strong year for our membership. As we enter 2018, I am certain that our stable and trusted partnership will continue to benefit our institutions, our customers and the communities we all support. I thank you for your business, and look forward to building on our momentum in 2018.

Sincerely,

José R. González

President and Chief Executive Officer

FHLBNY SOLUTIONS

Partnering with Your FHLBNY in the New Year

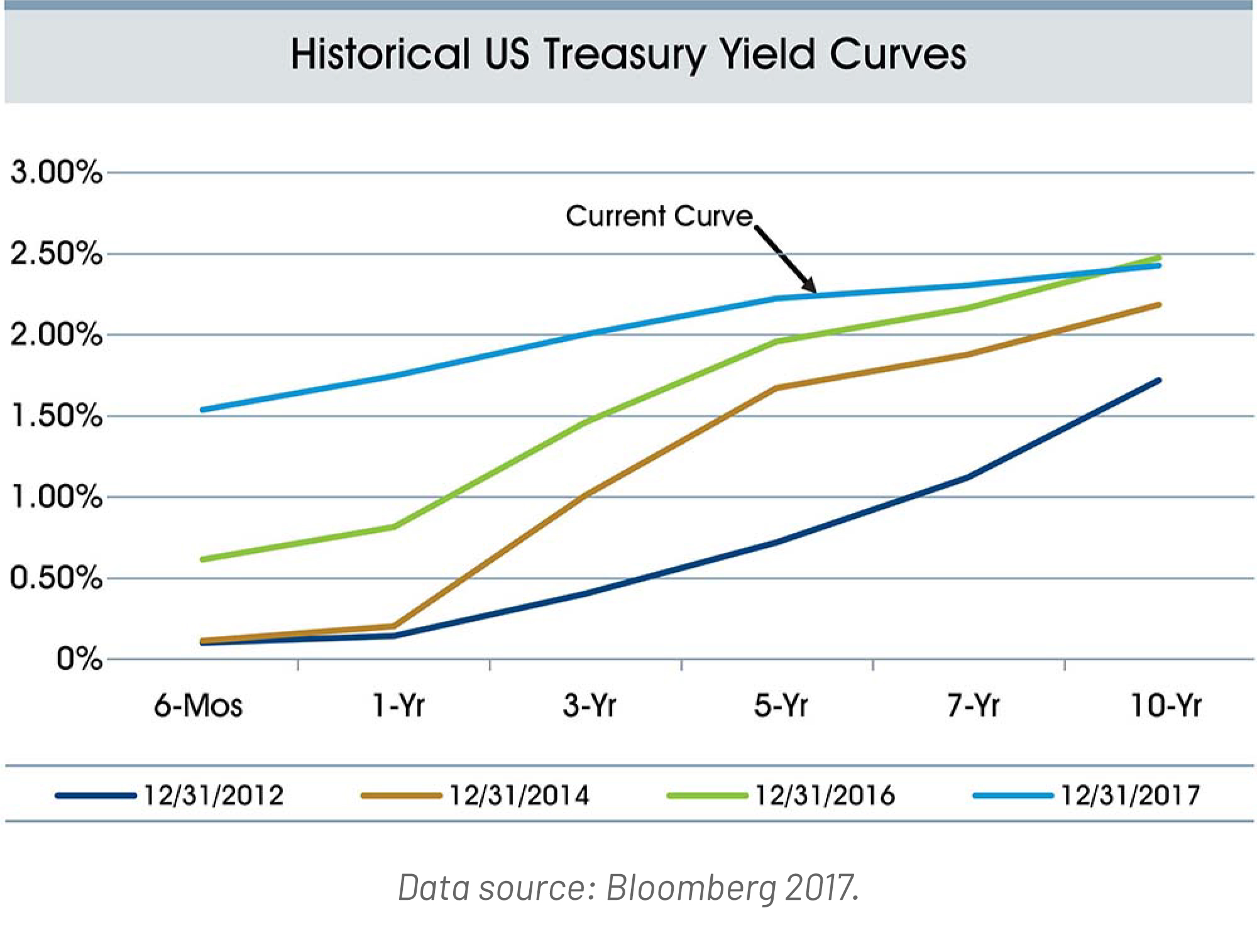

The interest rate environment was challenging for our members in 2017 as short-term rates rose with only modest changes to long-term rates, leading to a flatter yield curve and additional pressure on net interest margins (NIMs). Looking at the following Historical Treasury Yield Curve chart, you can see that the current curve is significantly flatter when compared to 2016 and previous years, and is poised to potentially be even flatter in 2018.

On the positive side, our members generally experienced solid loan demand in 2017. Additionally, members in general were able to maintain good profitability in 2017, largely due to “holding the line” on their deposits rates. However, achieving deposit growth commensurate with asset growth still has its challenges. Considering the potential of an even flatter yield curve in the New Year, and mounting consumer pressure to raise deposit rates, 2018 could potentially be a challenging year.

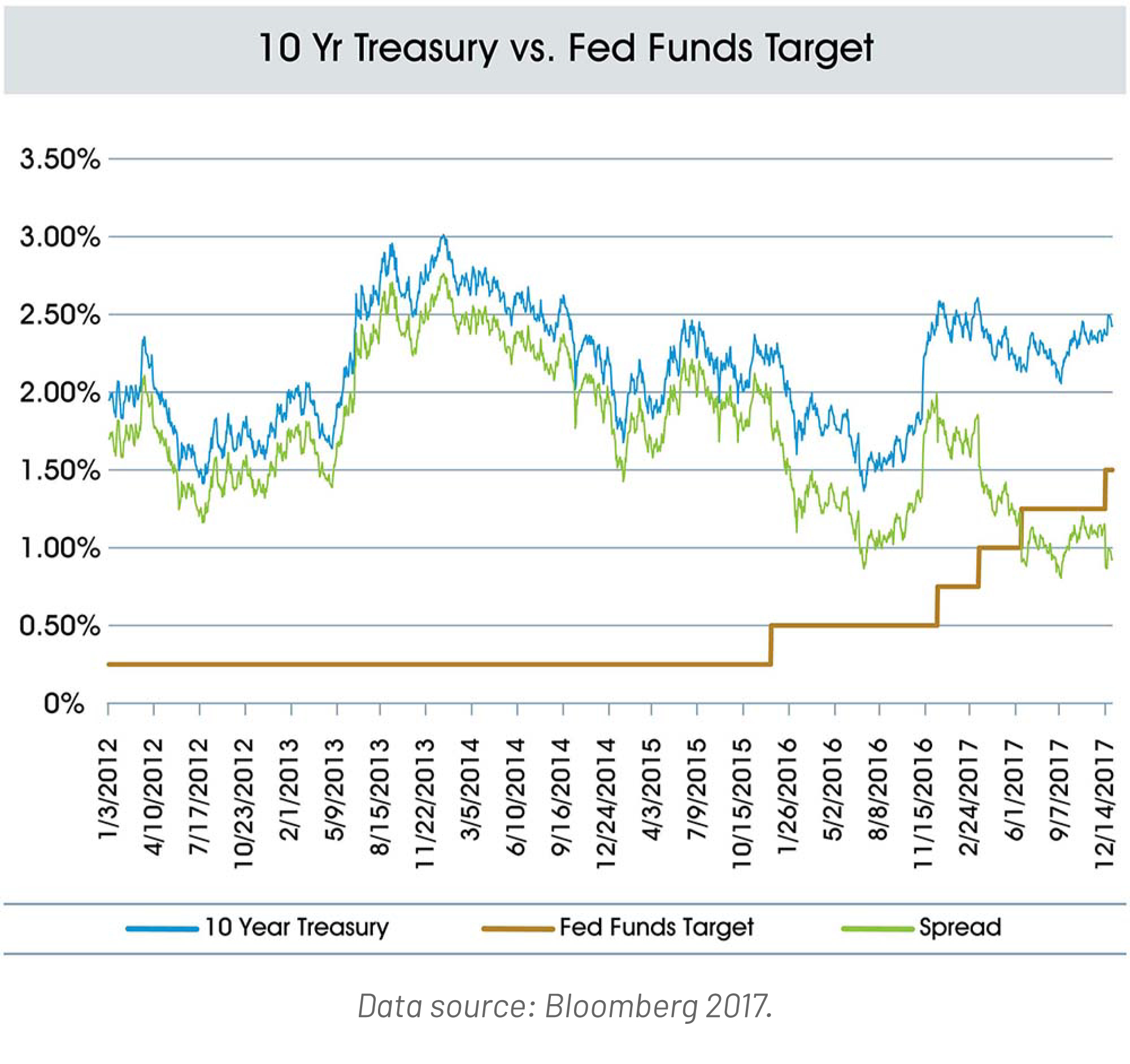

There has been persistent pressure on the long-end of the curve. Looking back over the past several years, the benchmark 10-Year Treasury has been trading within a tight band, hitting a five-year low of 1.37% in mid-July of 2016, then climbing to a recent high of 2.61% in mid-March of 2017 and reverting to the current level of 2.41% as of December 31, 2017. The average yield on the 10-Year Treasury for 2017 was 2.33%, or just 21 basis points over the average of the previous five years. Some members are optimistic that the curve will steepen upon the economy improving and as the Fed starts to unwind their balance sheet. Others are concerned that rising short-term rates could potentially lead to a yield-curve inversion should long-term rates remain relatively static.

Get Ahead of Deposit Pressure

We are all aware of the significant competition from large banks (assets > $50 billion) to capture retail deposits, due largely to the requirement to comply with the Liquidity Coverage Ratio, an interagency liquidity standard that addresses on-balance sheet liquidity requirements over a 30-day stress scenario. Retail deposits are highly desirable because they receive the most positive treatment for this measure. As a result, the deposit bases of smaller institutions are under stress.

Large institutions often have the bandwidth to offer strong electronic delivery systems and/or attract retail deposits by “paying up” for these deposits. Members that are “holding the line” on deposit rates have benefitted from consumer indifference in the post-crisis, low-rate environment. However, indifference could soon change if short-term rates get up to the 1.50% plus levels. Technology has advanced dramatically since the last series of Fed rate hikes we experienced pre-crisis. With a rising rate environment, the speed of transfer of funds could surprise us all. Are you prepared for the potential rapid outflow of funds once rates hit the inflection point where consumers are no longer indifferent and move deposits to seek higher returns?

To get in front of this move, some members have made enhancements to their delivery systems, conducted “careful” branching and/ or are raising rates on deposits. Although steps such as these could further exacerbate earnings pressure in 2018, the alternative could compromise both your liquidity and interest- rate risk positions. Other members have sharpened their deposit “tiering” practices, ensuring they pay appropriate rates that will help retain large rate-sensitive deposits, while “holding the line” on smaller, less rate-sensitive balances.

Balance Sheet Growth Considerations for the New Year

With members facing a flattening yield curve and a potential higher cost of funds going into 2018, some members may seek balance sheet growth to mitigate the impact of further NIM compression in the New Year. Depending on their interest rate risk position, members may want to add longer-term loans and/or securities to obtain income that can offset a reduction in earnings. While most members will likely benefit from rising long-term rates, that scenario has proved to be elusive post crisis, and not guaranteed going forward. With rising cost of funds, layering in additional assets could help you preserve your earnings now, while you await a more profitable environment with a steeper yield curve and normalized NIMs.

Manage Municipal Deposits with Municipal Letters of Credit (MULOCS)

As large banking organizations focus on retail deposits and shed “non-operating” deposit businesses, many of our smaller commercial banks have benefitted by growth in their deposit relationships with municipalities. In this regard, the FHLBNY enables members to collateralize their municipal deposits through its MULOC product. The MULOC is a unique instrument that allows an institution to use whole-loan mortgage collateral to secure municipal deposits, instead of encumbering liquid security investments. MULOCs enable members to use municipal deposits to fund lending in their communities, instead of “locking up” those funds in security collateral.

Lock in Spread with Long-Term FHLBNY Advances

Depending on your institution’s rate outlook and interest rate risk position, you may want to preserve and “lock in” spread by using medium to long-term FHLBNY advances. With the Fed Funds rate now at 1.50% as of year-end 2017, today’s cost to extend borrowings to a 3- or a 5-year advance from a short-term borrowing will only cost an additional 84 and 108 basis points, respectively (assuming term rates remain static). The curve is currently flat and now could be the time to lock in spread for a duration of time until we emerge into another rate cycle.

In addition, consider adding symmetry to your term Fixed-Rate Advances for an extra 2 basis points. In a rising rate environment, our Symmetrical Prepayment Advance (SPA) feature could allow a Fixed-Rate Advance to incur an unrealized gain that can be monetized, serving as an offset to unrealized losses that would occur in your fixed-rate security portfolios. If you no longer require term funding and your SPA is “in the money,” you can simply unwind and harvest the gain. The following table outlines some specifics with respect to the SPA feature.

Check Your Collateral Position

Members must have sufficient collateral pledged in order to secure borrowings from the FHLBNY. Pledging whole-loan mortgages is a cornerstone of our business model, and it is critical, especially at this time, to have ample collateral pledged in the event you need to borrow. Additionally, regulators have been focused on ensuring that lenders have adequate on-balance sheet liquidity, so keeping securities unencumbered has increasingly become more important.

Explore eligible collateral categories with your Relationship Manager who can assist you in evaluating your balance sheet to help determine ways to expand your borrowing capabilities. We stand ready and look forward to serving your needs in 2018 and growing our business relationship.

Check out the Collateral GuideThe guide offers an overview of how to identify, submit and report eligible collateral, and the valuation of submissions.

Questions regarding lendable value?

Contact your Relationship Manager at (212) 441-6700 or our Member Services Desk at (212) 441-6600.

Consider the Economic Impact of Our Dividend

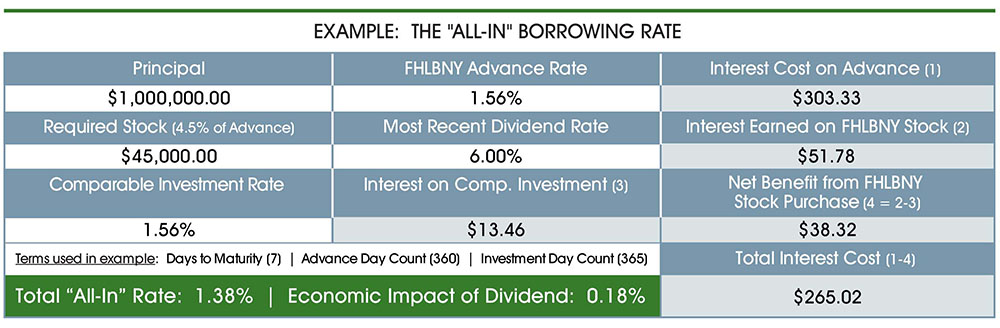

Members may wish to keep in mind the potential economic benefit of the FHLBNY’s dividend, which, depending on the advance term, can substantially lower the “all-in“ borrowing cost of an advance. The FHLBNY has an activity-based capital stock requirement equal to 4.5% of its outstanding advances. The performance of our capital stock has been historically strong, and has benefitted members by offsetting or lowering the “all-in” cost of the advance.

For example, if your institution borrows a one- week advance for $1 million at 1.56%, with a capital stock requirement of $45,000 (with a dividend yield assumption of 6.00%), the net income from the activity-based stock purchase would effectively reduce the interest expense of this trade by $38.32, or effectively lowering the “all-in” rate to 1.38% — or approximately 18 basis points less than the coupon rate.

As illustrated in the example below, the economic impact of our activity-based capital stock can be determined by comparing an alternative investment yield to that of our dividend. Assuming you can receive an alternative short-term investment yield equivalent to the cost of the advance (1.56% in this case), the positive spread created by the yield of our stock dividend effectively lowers the overall cost of the transaction, and quite substantially in the shorter tenors. For longer-term advances the dividend would impact the borrowing cost to a lesser degree; however, a significant benefit would remain making the “all-in” borrowing cost lower than the regular posted rate.

CHANGES TO ENHANCE MEMBERSHIP VALUE

Capital Plan Revisions

The FHLBNY’s Capital Plan is continuously evaluated to protect the cooperative. A 17% reduction in the Membership Stock Purchase Requirement (MSPR) went into effect on August 1, 2017. Now the capital that members are required to hold as owners of the cooperative is the greater of $1000 or 12.5 basis points of Mortgage-related Assets (previously 15 basis points).

Collateral & “Haircuts”

The “haircut” for pledging Private Label CMBS as collateral was recently decreased from 21% down to 15%, increasing the lendable value for these assets. Pledged collateral is marked-to-market, and a “haircut” is applied to arrive at a member’s borrowing potential.

As a reminder, 1st and 2nd lien home equity line of credit loans are eligible to be pledged as collateral, in addition to eligible whole-loan mortgage collateral and securities.

2018 Fee Schedules & Overnight Advance Transactions

All Credit, Collateral and Correspondent Services Fees will remain the same for 2018. The FHLBNY’s Fee schedules can be accessed by signing on to 1Linksm (our internet banking portal) and clicking on the ‘Manuals and Guides’. And did you know that when you request an Overnight Advance by calling the Member Services Desk you receive the same low rate as processing this transaction on 1Link®?

1Link® | 1LinkSK® Upgrade

The signing process for 1Link® transactions will be updated during the first quarter of 2018 to further enhance the security and sustainability of our portal. The update will impact the signing process for 1Link® Wires, Book Transfers and Advance transactions. Be on the lookout for instructions regarding the upgrade in the coming weeks.

NEWS / HIGHLIGHTS

Welcome New Members

Since our last edition, three members joined the FHLBNY cooperative:

Hudson River Community Credit Union

Stratford Insurance Company

Tudor Insurance Company

Upcoming Events

The FHLBNY looks forward to connecting with our members and business associates in person at the following upcoming events. Please visit the Upcoming Events section on our website.

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product