Member Advantage

Don’t Get Caught on “Empty.” Ensure Borrowing Potential and Fill up Your Collateral “Tank” Today

March 2015

Spring is in the air and things are beginning to thaw out, if not heat up, in the banking world. Our members face both challenges and opportunities, as improved economic metrics point to a more robust lending environment, but recent regulatory developments and a heated economy could impose significant pressure on our members’ liquidity.

In last month’s FHLBNY Advantage, we had the pleasure of hearing from Robert Colvin, Chief Executive Officer of Bank Strategies Group, who discussed the potential impact of the new post-crisis liquidity regulations. The issue at hand is that financial institutions across the country are experiencing heightened competition for retail deposits, as this type of funding greatly assists larger institutions with complying with BASEL III’s Liquidity Coverage Ratio and Net Stable Funding Ratio. Combine the intense competition for retail core deposits with significant deposit outflow, which could occur during a rising rate environment as funds flow toward higher yielding investments, and there is the potential for significant pressure on liquidity industry-wide.

Shifting gears for a moment, economic indicators are pointing to a recovery that appears to be gaining steam. Lower oil prices have given consumers more spending power. Improving employment numbers, along with increasing consumer confidence, both point to members being on the cusp of an improved spring season with heightened loan demand. However, members and regulators alike are justifiably concerned that liquidity could soon be an issue.

Consider Broadening Collateral Pledged

As you know, members must have sufficient qualifying collateral pledged in order to secure credit extensions at the FHLBNY. The ability to use whole loan mortgage collateral to secure advances from the FHLBNY allows you to keep your highly liquid securities unencumbered and at your disposal.

The FHLBNY accepts whole-loan mortgage collateral for 1-4-family residential properties, multi-family, and commercial properties (in addition to eligible securities). Here, we note that in recent years we have been accepting 1st and 2nd lien home equity lines of credit (HELOC) loans. HELOCs are a growing category of collateral in which our members pledge. Eligibility criteria does exist for pledging HELOCs, including requirements for data submission and a combined loan-to-value ratio limitation of 80% or less with stringent delinquency provisions. We encourage you to explore different eligible collateral categories with your Relationship Manager, who can assist you in evaluating your balance sheet and determining the best opportunities to expand your borrowing capabilities.

Take Advantage of the New Online Collateral Guide

Our new online Collateral Guide is intended to help you maximize your borrowing potential by providing an overview of the identification, submission, reporting, and valuation of eligible collateral. The Collateral Guide will walk you through the steps of setting up a security safekeeping account to pledge security collateral (see following article about the new 1LinkSK® platform), in addition to introducing you to the process of getting approved to pledge whole loan mortgage collateral and the steps that are required to assemble and submit your loan data submission. Lastly, the Collateral Guide also discusses how your borrowing potential is determined. This new reference tool can be found on our website here.

As we enter a new economic cycle with both potential threats and significant opportunities, the FHLBNY stands ready as your strategic partner to assist in maximizing your earning potential and minimizing risk. If you have any questions, contact your Relationship Manager at (212) 441-6700.

1LinkSK® — the FHLBNY’s New Safekeeping Platform. Make the Switch Today!

The FHLBNY has implemented a new Securities Safekeeping platform called 1LinkSK®. This new online platform includes intuitive self-service features that provide your institution’s authorized users with the opportunity to:

Perform trades,

Pledge transactions,

View “real-time” monitoring of account activity, and

Customize reports and delivery methods.

These new self-service capabilities should help improve efficiencies and reduce operating costs. In addition, 1LinkSK® offers “real-time” income posting to members’ Overnight Investment Accounts.

Conversations with members reflect that they benefit from performing their own trades and pledges, as well as customizing reports that can be received via automated delivery. The FHLBNY continues to encourage members to take charge of their own accounts through trade monitoring. All of the features on 1LinkSK® are significant enhancements to what is currently available on the legacy 1Link® Safekeeping Module.

Save Money with 1LinkSK®

Take full control of your transactions and reap the cost savings of self-service on 1LinkSK®. There will continue to be a per transaction discount for each settled trade performed on our new 1LinkSK® platform as we begin to phase out the legacy 1Link Safekeeping Module later this year.

We’re convinced that once you process your own trade or execute a pledge transaction with the new state of the art system, you’ll realize the ease and cost benefit of self-service over traditional faxing and or e-mailing. You can continue to submit trades through fax and/or e-mails; however, there are higher fees associated with these methods.

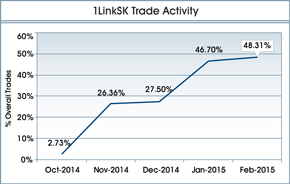

More and more members are enjoying the cost savings and convenience of 1LinkSK® — currently, 48.31% of trades are handled through our new platform, and the number has increased steadily month-over-month.

1LinkSK® is All about Our Members! Check out the New Enhancements Today and Make the Switch

The FHLBNY is pleased to offer our members the best possible self-service platform supported by our member service staff. Based on the advanced features of the new 1LinkSK®, we are confident that our members will see the benefits of taking control of their safekeeping transactions. To help ease security concerns, the FHLBNY utilizes advanced features in the 1LinkSK® platform to provide a highly secure banking environment. This platform empowers our members to conveniently perform security movements and pledge transactions with multiple compensating checks and balances.

The FHLBNY will phase out the legacy 1Link® Safekeeping system later this year. To facilitate the transition, your institution was sent a pre-filled Global Authorized Form (GAF) Addendum with authorized users in March via e-mail. The GAF Addendum is a certification document listing user(s) authorized by our members to access the 1LinkSK® platform, and was created to offer a quick and easy safekeeping certification. We encourage all of our members to execute the GAF Addendum now and return it to the FHLBNY to get an early start with 1LinkSK®. Tutorials are also available to help users get started on the Transaction Manager and Custody Reporting functions, which are sent via e-mail after you have signed up for 1LinkSK®.

Feedback has been positive on the new 1LinkSK® Safekeeping platform and its self-service functionality. A member and the Federal Deposit Insurance Corporation (FDIC) share their experience:

“The new 1LinkSK® system is very user friendly. The FHLBNY has done a great job with enabling the processing of all types of transactions on 1LinkSK®. It is a very interactive and easy to use system and one that we feel greatly enhances our operating efficiency.”

Kyle Sevey, Accountant II

Tioga State Bank

“The FDIC currently utilizes FHLBNY’s 1LinkSK® to process our security safekeeping transactions. We find that this new system provides us more control over our transactions. The best part is our ability to monitor the status of each transaction as it moves through the settlement process. This real-time view allows us to resolve potential issues with our counterparties in a timely manner, helping eliminate unnecessary DK’s [unknowns].”

Barbara Paxson, Bank Account Control Unit Team Lead,

Resolutions and Receivership Specialist FDIC,

Division of Resolutions and Receiverships

Should you need assistance or more information about 1LinkSK®, our Custody and Pledging Services team are readily available every step of the way, at (800) 546-5101, or by e-mail at CustodyandPledgingServices@fhlbny.com.

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product