Member Advantage

FHLBNY Municipal Letters of Credit (MULOCs) — a Low-Cost, Efficient Way to Collateralize Public Funds While Maximizing Your Liquidity Position

August 2015

As we exit the summer and head into autumn, we expect to see our usual seasonal decline in usage of short-term advance products, which coincides with the inflows of municipal deposits at member institutions. Many of our members benefit from relying on municipal deposit liquidity during the year and supplementing that funding with FHLBNY advances as they experience seasonality. To help further support members with their municipal deposit programs, the FHLBNY offers the Municipal Letter of Credit (MULOC) program as an alternate way to secure municipal deposits.

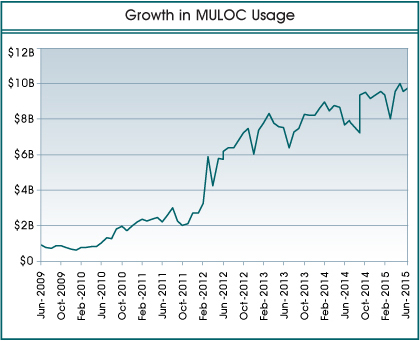

Increasingly, members have been partnering with the FHLBNY to support their municipal deposit business by using our MULOCs as collateral, where they use whole loan mortgage collateral to secure deposits in lieu of securities.1 Members have found that they are able to enhance profitability and benefit from the operational ease of using the MULOC program, in addition to bolstering their liquidity position by keeping securities unencumbered. In fact, our MULOC program has gained significant traction over the past six years – outstanding balances have grown from approximately $932 million in June 2009 to just over $9.5 billion as of June 2015 (see chart provided). This upward trend is expected to continue given our current operating environment as members are leveraging our MULOC program for the following strategic uses.

MULOCs to Enhance Margins

Why purchase low-yielding securities as collateral for municipal deposits? Instead, consider using our low-cost MULOCS as collateral and deploy available liquidity in higher yielding assets such as loans.

MULOCs to Reduce Operational Expenses

The MULOC can also be used to help reduce or completely eliminate the costs associated with holding and reporting securities collateral at a third-party correspondent. The resulting savings and convenience can easily offset the cost of the MULOC.

Refundable MULOCs for Additional Savings and Operational Ease

A Refundable MULOC is also available for those members that hold municipal deposits in fluctuating transaction accounts. The Refundable MULOC is priced the same and offers all of the benefits of a MULOC, but is more efficient for collateralizing transaction accounts since it provides an opportunity for a partial fee reimbursement if the MULOC is not fully utilized. Members can request a Refundable MULOC equal to the highest expected balance in a transaction account during the term of the letter of credit.3 If the actual high-balance in the transaction account remains below the notional value of the Refundable MULOC during its entire term, a portion of the fee can be refunded to the member upon maturity.

The Value of MULOCs in the Current Environment

Numerous converging factors in the current banking and regulatory environment have made the MULOC program particularly attractive. The following three factors may offer more compelling reasons to consider MULOCs when making liquidity decisions in the coming years.

Intense Competition for Retail Deposits.

New BASEL III Liquidity Funding Ratio (LCR) and Net Stable Funding Ratio (NSFR) liquidity requirements4 are influencing larger banks (with assets > $50 billion) to keep their highly liquid assets unencumbered. Using MULOCs in lieu of securities collateral makes sense for larger institutions as they move toward compliance with the LCR and NSFR liquidity measures.

Outflow of Surge Deposits.

In the event of rising rates, “surge” deposits that accumulated at member institutions post-crisis could quickly move off balance sheets in a search for higher yields. Should members need to liquidate securities to reposition their balance sheet in the event of significant deposit outflows, the ability to use whole loan collateral to secure municipal deposits will be even more important.

Municipal Deposit Migration.

Larger institutions are incented to primarily focus their efforts on growing retail deposits to assist with LCR and NSFR compliance. As a result, smaller members have an opportunity to obtain municipal relationships and grow their deposit base. Regional and community banks have and will continue to experience growth with their municipal deposit relationships. Significant inflows will warrant considerable collateralization and our MULOC program can assist in that regard.

MULOCs are accepted under both New York and New Jersey law as eligible collateral, and municipalities within these districts have increasingly become more familiar with the MULOC as an alternate way to secure their deposits. Municipalities find MULOCs appealing because they eliminate the need to monitor the value of pledged securities. Unlike securities, the value of a MULOC remains constant and does not change with market fluctuations. In addition, in the unlikely event of a member default, the municipality can submit a draw request directly to the FHLBNY for prompt payment, as opposed to waiting for securities to be liquidated. We encourage you to review the section of our website that is dedicated to educating municipalities on the virtues of our MULOC program.

More information on MULOCs, as well as our regular Letters of Credit, can be found here. Here you can also obtain all required forms and agreements. As always, the FHLBNY strives to meet the liquidity and funding needs of our members. If you have any questions about the strategies presented, contact your Relationship Manager at (212) 441-6700.

1 Regular MULOCs are available in terms from 2 weeks to 3 years.

3 Refundable MULOCs are available in terms from 2 weeks to 1 year.

4 The U.S. Interagency LCR measures an institution’s liquidity available to cover short-term liquidity needs over a 30-day stress scenario, while their NSFR calibrates the required and available “stable” funding looking out over a 1-year time horizon. The LCR is being phased in over a multi-year time horizon that started in January 2015. The NSFR is in the proposal stages and its planned “rollout” is not expected to be until 2018.

OTHER ANNOUNCEMENTS

Have You Considered the Economic Impact of Your Dividend?

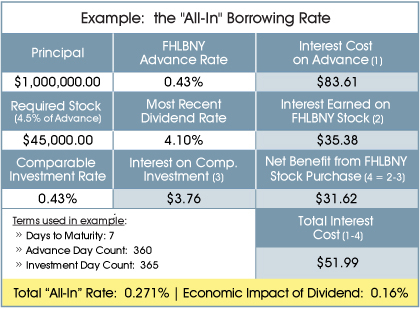

Members may wish to keep in mind the potential economic benefit of the FHLBNY’s dividend, which, depending on the advance term, can substantially lower the “all-in“ borrowing cost of an advance. The FHLBNY has an activity-based stock requirement equal to 4.5% of its outstanding advances. The performance of our capital stock has been historically strong, and has benefitted members by offsetting or lowering the “all-in” cost of the advance. For example, if a member borrows a one week advance for $1 million at 43 bps, with a capital stock requirement of $45,000 (with a dividend yield assumption of 4.10%), the net income from the activity-based stock purchase would effectively reduce the interest expense of this trade by $35.38, or effectively lowering the “all-in” rate to 27 bps — 16 bps less than the coupon rate.

As illustrated in the example provided, the economic impact of our activity-based capital stock can be determined by comparing an alternative investment yield to that of our dividend. Assuming a member can receive an alternative short-term investment yield equivalent to the cost of the advance (43 bps in this case), the positive spread created by the yield of our stock dividend effectively lowers the overall cost of the transaction, and quite substantially in the shorter tenors. For longer-term advances the dividend would impact the borrowing cost to a lesser degree; however, a benefit would remain and the “all-in” borrowing rate would be lower than the regular posted rate.

Please note that although FHLBNY capital stock has been high-performing and has had a very competitive dividend rate for a long period of time, the dividend rate is not guaranteed, and as such, may fluctuate throughout the life of the advance. The economic impact of the stock dividend will vary based on your assumption of the dividend rate.

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product