Member Advantage

REPORT FROM THE PRESIDENT

Third Quarter 2017

Opportunities for Growth

Last month, I had the honor of speaking at both the NJBankers’ Senior Management Conference and the Independent Bankers Association of New York State’s Annual Convention. These two organizations are vital to community banking in New Jersey and New York, and their annual gatherings provide important platforms to exchange ideas, discuss key industry issues and develop the strategies that keep local lending thriving across the region. Our team always appreciates the opportunity to present at these events, as we believe they allow us another way in which to engage our members to ensure that they are getting the most value out of their FHLBNY membership.

Last month, I had the honor of speaking at both the NJBankers’ Senior Management Conference and the Independent Bankers Association of New York State’s Annual Convention. These two organizations are vital to community banking in New Jersey and New York, and their annual gatherings provide important platforms to exchange ideas, discuss key industry issues and develop the strategies that keep local lending thriving across the region. Our team always appreciates the opportunity to present at these events, as we believe they allow us another way in which to engage our members to ensure that they are getting the most value out of their FHLBNY membership.

The daily availability of our advances is the greatest value of membership in our cooperative. We are able to provide our members with the liquidity they need to optimize their balance sheets, build their infrastructure and achieve their strategic goals. The benefits of this support can be found within this newsletter, as we discuss how members can navigate through the challenges presented by reduced deposit growth, increased competition from traditional and non-traditional sources, enhancements in technology and shifting demographics to find opportunities for growth.

Disaster Relief

We are here to help our members facilitate their business plan and strategic objectives, leveraging FHLBNY membership so that we are able to achieve success together. Membership in our cooperative also allows us to work with our members to ensure that others are able to succeed, in a more immediate and direct manner. We see this in our Affordable Housing Programs, which support the creation of quality housing for those who need it most, benefitting communities across our region. But most recently, we have seen it in our Disaster Relief Funding, which our members can put to use to support recovery efforts in those very same communities following the devastating effects of hurricanes Harvey, Irma and Maria.

The $1 billion CLP commitment can be used for any residential lending activity for households whose incomes are at or below 115 percent of the area median income, as well as small business and economic development lending in FEMA-designated disaster areas, and bridge financing. These low-cost loans can be used by the FHLBNY’s member-lenders to support critical disaster relief financial activities, and meet the short-, medium-, and long-term funding needs of affected communities.

In any natural disaster, the local lender is key to relief and rebuilding efforts. The damage done by three powerful storms arriving virtually on top of each other is unprecedented. But our response has precedents: in 2011 and again in 2012, when Hurricane Irene and Superstorm Sandy battered our District, we made Disaster Relief Funding available. In 2012, our members accessed more than $950 million in funding to help rebuild after these storms. The recovery, especially in Puerto Rico and the U.S. Virgin Islands, will take time and significant effort, but these communities are resilient and this recovery will be achieved. The $1 billion in funding will help our members – the local lenders serving the affected communities – make a positive impact on relief, recovery and rebuilding efforts.

In addition to making this funding available, the FHLBNY has donated $1 million to a number of charities on the ground in Puerto Rico and the U.S. Virgin Islands – part of the Federal Home Loan Bank System’s broad response to the recent storms. If your institution is interested in supporting this effort, as well, please contact Adam Goldstein or Eric Amig for more information.

Board Election Update

The decisions involved in responding to these storms were supported by our Board of Directors. Ours is an active and involved Board, tasked with representing the needs of our members and the communities we serve. And now our Board is complete, as Ángela Weyne, former Commissioner of Insurance for the Commonwealth of Puerto Rico, recently joined as an Independent Director, filling the seat left vacant by the passing of our Director and friend, Caren Franzini, earlier this year.

Earlier this month, the 2017 Director Election ballots were sent to all eligible member institutions. Your responses are due by 5:00 p.m. ET on Monday, November 6. Our Board is vital to the success of our franchise, which is why it is in turn vital for our members to participate in our annual election process, and I encourage you all to do so. Whether positioning our members for long-term success, or working alongside them to provide immediate assistance to our communities, our Board and management team constantly strive to ensure that the FHLBNY is best-positioned to serve as a reliable partner to our members.

José R. González

President and Chief Executive Officer

FHLBNY SOLUTIONS

Challenges & Opportunities Amid a Rapidly Evolving Business Landscape

New industry-altering technologies and evolving consumer demographics, coupled with a difficult operating environment, are impacting our business landscape. Driver for growth and innovation, competition for retail deposits is a growing concern, and regulation continues to challenge traditional business models. The FHLBNY consistently monitors the operating environment of our district and across the nation, including our members’ behavior and industry best practices, so we can offer the products and services members rely on to help turn current business challenges into future opportunities.

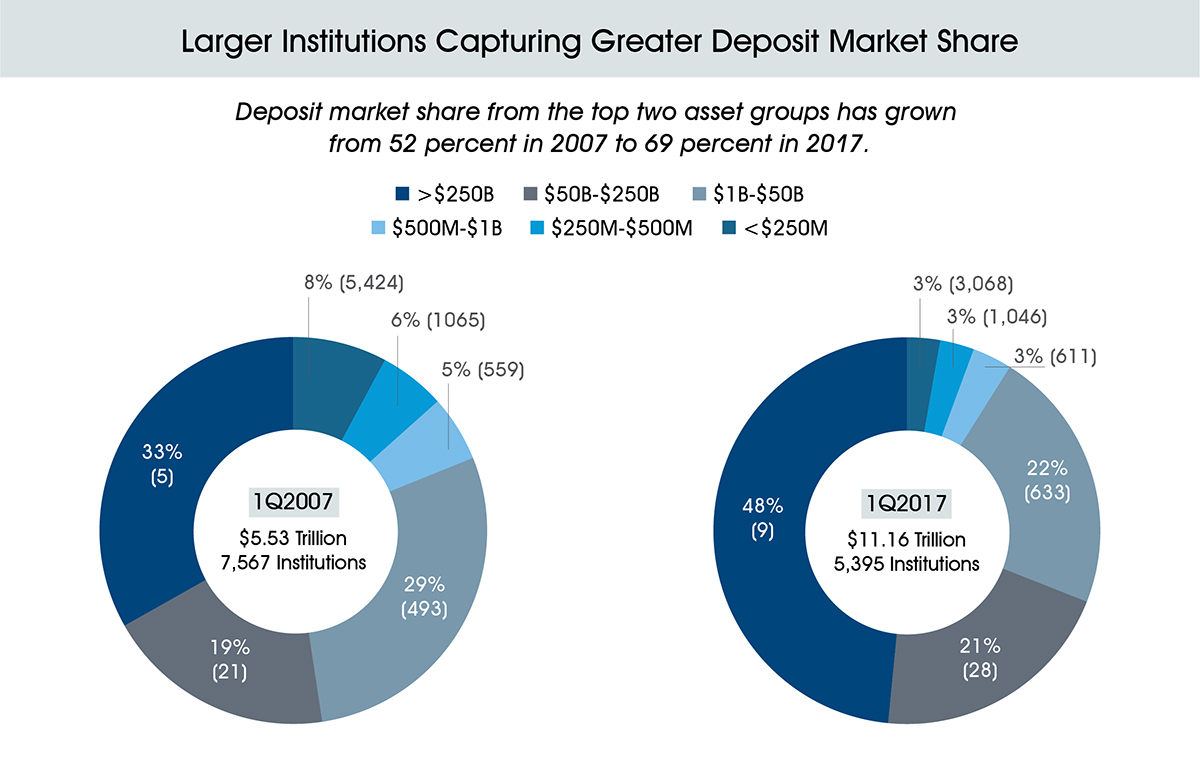

The Deposit Challenge

Loan demand continues to grow as the economy improves. History has shown that members’ assets tend to grow more quickly than deposits. However, this was not the case post-crisis when the majority of our members experienced a surge in deposits from customers seeking a safe haven for their money. Today, sustaining adequate deposit growth is becoming increasingly more difficult, largely due to game- changing post-crisis regulation that has created heightened competition for retail deposits. Large banks are now subject to the Liquidity Coverage Ratio (LCR) (The Liquidity Coverage Ratio requires that banking institutions with assets greater than $50 billion, or with international on-balance-sheet exposure greater than $10 billion, be required to hold high quality liquid assets at a rate equal to or above their net cash outflows over a 30-day stress period), which compels them to compete for retail deposits like never before. Mid-size and smaller financial institutions are impacted by the effects of this regulation because they now face fiercer competition for retail deposits, which threatens their liquidity and compromises their interest rate risk positions.

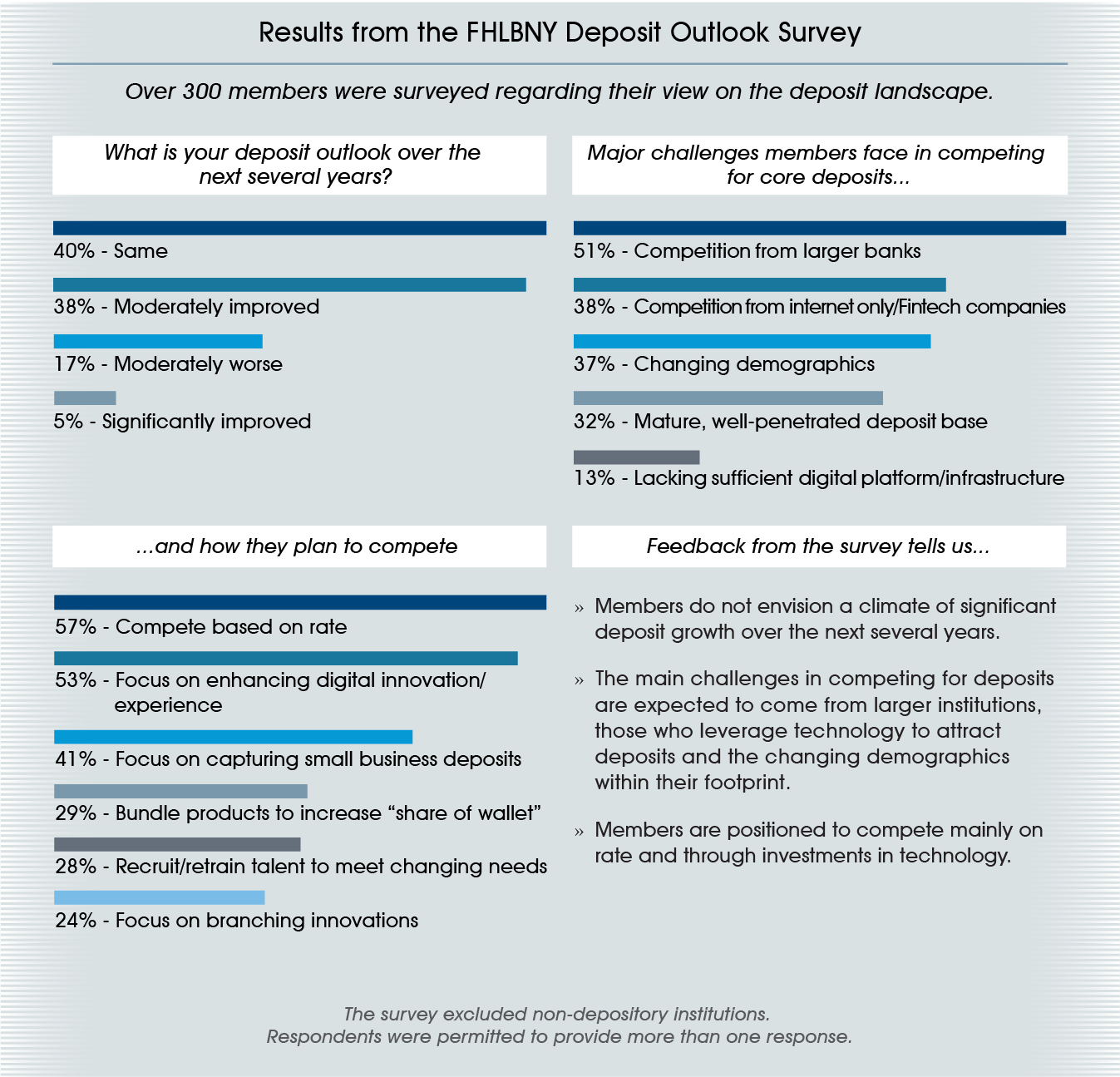

Earlier this year, we surveyed our membership to garner their outlook on the deposit landscape. The results showed that many members do not expect significant deposit growth over the next several years. Accordingly, many members expect the main challenges in deposit competition to come from larger banking institutions – particularly those who leverage technology as a means to adapt to changing demographics. Results also showed that members plan to compete for deposit share by offering competitive rates, aggressively investing in technology and selectively expanding their footprint.

Conversely, a select few of our members are optimistic and believe their deposits will remain “sticky.” However, there are many external factors that point to the contrary and show that the rate at which money transfers will increase. Younger generations, technology, big banks, and regulation are collectively reshaping the delivery of banking services and pressuring deposit bases like never before.

DEMOGRAPHIC SHIFTS IN THE MARKET

Millennials – those born between 1980 and 2000 – represent the largest generation in history, with a population estimated at over 90 million. Millennials have already entered the workforce, with more joining every day. While you might see this population segment as a potential opportunity to gain deposit share and grow loans, this younger generation generally has two important challenges driving their financial decisions: (1) they are burdened with student debt, and (2) their earnings have remained relatively flat over the years. A significant portion of this group came of age and graduated college at or around the time of the financial crisis, where they faced high unemployment, limited job opportunities or were forced to make alternate career choices. With their career progression stunted and being burdened by student loan debt, it is understandable why many are postponing milestones in life such as marriage, children and purchasing a home.

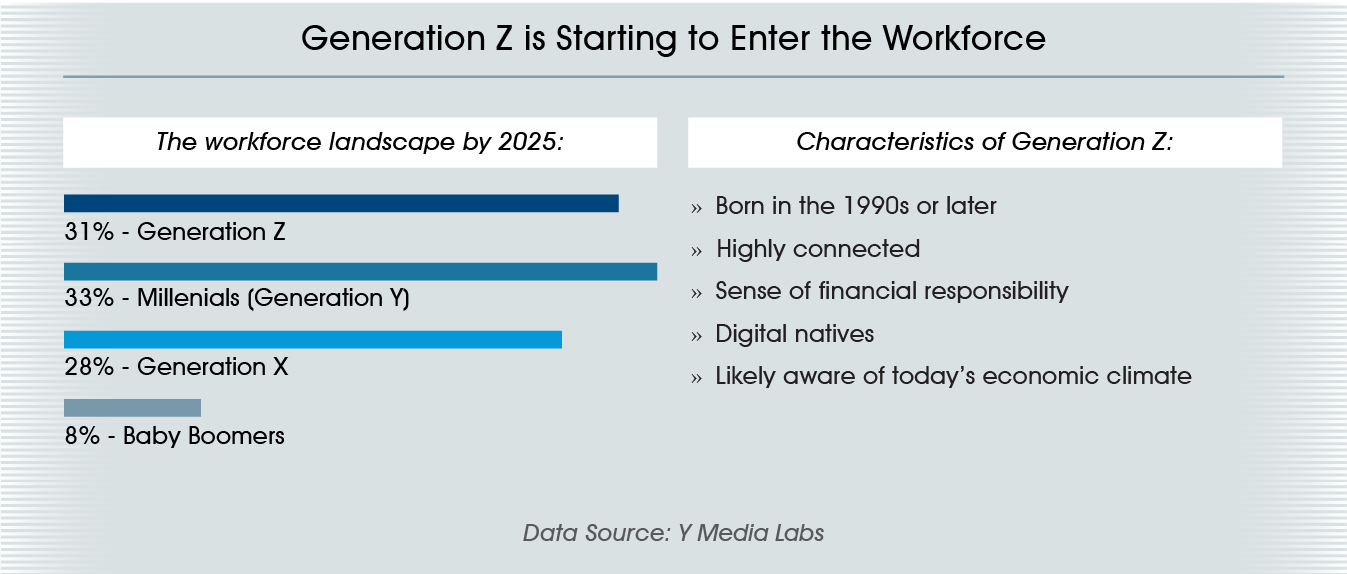

Although Millennials receive the most attention in the press, Generation Z, the demographic cohort following Millennials, will represent 31 percent of the workforce by 2025. This generation will reach approximately 85 million by the year 2020 in the U.S. alone. Generation Z’s financial situation will be largely influenced by their account of the “Great Recession” and how it affected their families. This cohort witnessed their parents’ and/or older siblings’ economic struggle and employment challenges, and as a result, developed a natural distrust towards traditional financial institutions.

Both demographic cohorts value the use of technology to build relationships, on both a personal level and when conducting business as a consumer. Technology is prevalent in every aspect of their lives, and they are accustomed to the convenience, speed and efficiency it offers.

As Millennials and Generation Z come of age, their influence will shape the economy and housing market of the future. Ramping up and improving mobile delivery systems will continue to be a focal point for potential growth to attract and retain this demographic.

THE ACCELERATED PACE OF TECHNOLOGICAL EVOLUTION

Undeniably, technology platforms are transforming the way people bank, from making loans to managing deposit accounts. It is estimated that more than 50 percent of mortgage loans originated are underwritten by non-depository or Fintech (financial technology) companies.

Large banks have found a variety of ways to manage technological innovation in the financial sector, be it acquisitions, partnerships, and even in-house development. In stark contrast, the majority of local community lenders invest less than 0.20 percent of their assets on improving technology – quite a disparity despite the rise of Fintech being a key differentiator.

It appears we are at the early stages for technological innovation in financial services. Large financial institutions are also heavily investing in technologies that include machine learning and cloud computing to automate operations. Fintech has greased the wheels of finance, automating decision-making and reducing the costs of transactions, offering consumers speed and efficiency like never before.

INVESTING IN TECHNOLOGY

Although the pace of technological evolution can be overwhelming, it is imperative that mid-size and smaller financial institutions embrace the shift and find ways to invest in technology to meet customer needs and remain competitive.

While it may not be necessary to acquire a Fintech company or build a branch on every corner to capture more market share, there are ways members can augment their business strategies. More and more members are offering their customers multi-channel distribution options by investing in user-friendly mobile platforms and/or online depositories, and by forming partnerships with existing Fintech and/ or branch networks that are already equipped to accommodate tech savvy consumers.

Several members are using one or more of the following three approaches to strengthen their technology-based platforms.

Invest: Some members are actively investing in the development of their own Fintech platforms. This approach requires a sizeable capital investment and it can be difficult to attract the necessary talent required to develop proprietary platforms. The “speed to market” or time it takes to develop a platform and market it to the consumer is also a concern when considering this approach.

Buy: Another approach is to purchase an existing Fintech company, which could address the risks of obtaining talent and “speed to market.” However, the high degree of creative ingenuity that is often characteristic of Fintech firms can conflict with the highly regulated structure of a financial institution.

Rent: Creating alliances may be a viable approach for some of our members. “Off the shelf” platforms already exist that are specifically developed to help achieve customer experience demands, whether it be with residential mortgages, commercial real estate or consumer loan underwriting. Significant costs can be associated with such a partnership; however, they offer the potential to position your institution for the years to come to enter new markets, offer new products and capture market share with the younger generations.

The FHLBNY stands ready to provide liquidity to help our members position themselves to capture deposit growth and market share as new consumers become more economically viable and active in the housing market.

Consider the following funding solutions:

Amortizing Financing: Amortizing Advances offer the ability to gradually pay down funding through principal and interest payments over a sufficient period of time while you monetize the benefits of your infrastructure investment.

Amortizing Advance

» Enhance match funding of long-term assets

» Borrow fixed-rate funds with the option of customizing the amortization schedule to match a selected prepayment profile

» Maturities and amortization schedule from 1 to 30 years

“Principal Deferred” Financing: A Principal-Deferred Advance has an “interest only” period followed by an amortizing period. The principal-deferred period can be as long as 5 years and the amortizing portion can span for another 30 years. This option could be especially advantageous if you are building or implementing a new deposit or mortgage platform, where payments can be low during the buildout and/or implementation, and then the advance can start amortizing once the new technology comes “online” and starts to yield results.

Principal-Deferred Advance

» Valuable asset/liability management tool

» Fully amortizing back-end with a choice of varying balloon terms

» Mirrors characteristics of a typical construction deal with a permanent take-out

» No embedded options in the advance

Interest Only Financing: Regular “bullet” Fixed-Rate Advances are interest only with payment of principal at the time of maturity. This option can also help keep payments low for a period to time to allow your investment to yield results before the principal payment is required.

Fixed-Rate Advance

» Fund long-term assets

» Forward start are available to lock in rates for future funding purposes

» Available with Symmetry for advances with maturities of one year or greater and minimum advance size of $3 million

Take advantage of your FHLBNY membership to help assist with optimizing your balance sheet, achieve greater profitability, compete for deposit share, and access the liquidity required to achieve your infrastructure goals. We are committed to supporting the long- term growth of our local lenders. If you have questions regarding any information or strategy discussed in this article, contact your Relationship Manager at (212) 441-6700 or our Member Services Desk at (212) 441-6600.

NEWS / HIGHLIGHTS

Welcome New Members

Since our last edition, five members joined the FHLBNY cooperative:

Horizon Healthcare Services

Kingstone Insurance Company

New Jersey Manufacturers Insurance Company

Nova UA Federal Credit Union

Western World Insurance Company

Upcoming Events

The FHLBNY looks forward to connecting with our members and business associates in person at the following upcoming events. Please visit the Upcoming Events section on our website.

Ballots must be received at the FHLBNY by 5:00 p.m. ET on Monday, November 6.

Participate in our annual election process.

MEMBERS, HOST YOUR NEXT MEETING IN OUR NEW HOME

Explore the FHLBNY’s corporate headquarters as a resource for your next business meeting, and the Education Programs the FHLBNY can easily provide as an educational segment to your agenda.

Contact your Relationship Manager today to schedule your visit and tour.

We look forward to hosting you.

Phone: (212) 441-6700

Email: fhlbny@fhlbny.com

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product