Member Advantage

MESSAGE FROM THE PRESIDENT

First Quarter 2019

The FHLBNY begins 2019 with a healthy and thriving membership, a talented and committed team, a strong balance sheet and a continued focus on our mission. We also begin 2019 with our new three-year Strategic Plan in place, focusing our strategy on our core values – the principles that have long reflected our culture and guided our decision-making. Chief among these Core Values is “Focus on Members.” It is our focus on members that has driven our past performance, and it is this focus that will drive our cooperative forward in 2019.

The FHLBNY begins 2019 with a healthy and thriving membership, a talented and committed team, a strong balance sheet and a continued focus on our mission. We also begin 2019 with our new three-year Strategic Plan in place, focusing our strategy on our core values – the principles that have long reflected our culture and guided our decision-making. Chief among these Core Values is “Focus on Members.” It is our focus on members that has driven our past performance, and it is this focus that will drive our cooperative forward in 2019.

In this edition, we have outlined a number of ways members can leverage their FHLBNY membership in 2019 to grow their balance sheets, support deposit strategies, reduce risk, and meet the needs of customers and communities. This partnership will benefit both our members and our cooperative, and positions us all to meet the challenges and take advantage of the opportunities that the new year may present.

Sincerely,

José R. González

President and Chief Executive Officer

HIGHLIGHTS @ FHLBNY.COM

New SOFR-ARC Advance

Learn more about our new Secured Overnight Financing Rate (SOFR)-Linked Adjustable Rate Credit (ARC) Advance.

2019 Fee Schedules

2019 Fee Schedules are available on 1Link® and several ancillary fees were eliminated effective January 1, 2019.

Welcome New Members

Two new members were welcomed into our cooperative since the last edition:

- Jersey Shore Federal Credit Union

- Transamerica Financial Life Insurance Company

LEVERAGE YOUR MEMBERSHIP IN 2019

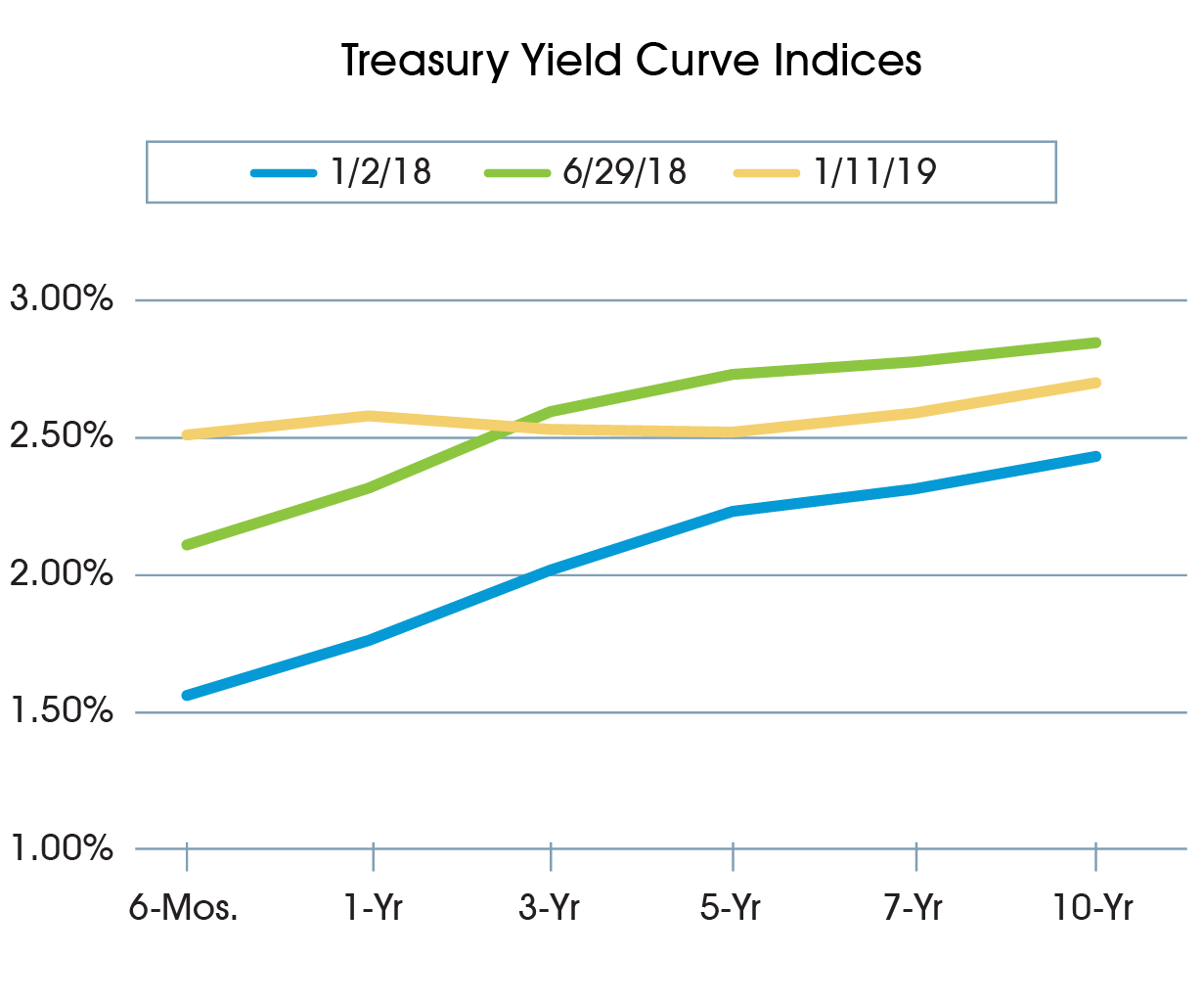

Last year was an interesting one for our industry, as we navigated through a substantially flattened Treasury yield curve and an environment of rising rates and growing deposit betas, while intense competition for loans kept yields suppressed. Deposit pressures from the largest financial institutions persists as their significant investment in technology has positioned them well to strongly compete for market share. Residential mortgage lending has also been pressured as the refinance business is soft and purchase mortgage transactions are down. In addition, the stock market has been extremely volatile, with concerns of an impending bear market for equities and growing concern that additional short-term rate hikes by the Fed could lead us to a fully inverted yield curve and a potential recession. Despite these challenges, the fundamentals of the economy appear strong for 2019, with historically low unemployment, growing wages and solid GDP estimates.

The following article presents how each of our membership sectors are leveraging the capabilities of the FHLBNY cooperative and provides strategies to consider when negotiating this challenging environment.

Commercial Bank & Thrift Members

Depository institution members have traditionally relied on FHLBNY funding to achieve balance sheet growth as assets tend to grow faster than retail deposits and capital. With FHLBNY funding, members can leverage capital to achieve their balance sheet goals without having to “put on the brakes” and curtail their business or balance sheet strategies because of a lack of liquidity.

Additionally, members often use their available FHLBNY borrowing capacity as a tool to embark on deposit strategies designed to test the elasticity of their deposit base and lower overall interest expense. Within membership sectors of our district, significant net interest margin (NIM) pressure persists – members continue to be hampered by escalating deposit betas that are outpacing the speed of the yield increases on loans. On a national level, deposit betas rose from 19.6% in the 2017 calendar year to 43.2% in the 12-month period ended September 30, 2018*. As funding needs intensify, deposit betas are poised for further escalation in 2019 should the Fed continue to move away from an accommodative interest-rate posture.

The FHLBNY can assist with mitigating your rising cost of funds by helping you manage your deposit expense at the margin. Embarking on deposit pricing strategies tailored toward lowering your cost of funds and using FHLBNY funding to backfill deposit outflows could potentially enable you to lower your overall interest expense. You can do this in conjunction with taking action to preserve rate-sensitive balances by offering CD specials catered toward maintaining your valued customers.

* Source: S&P Global Market Intelligence

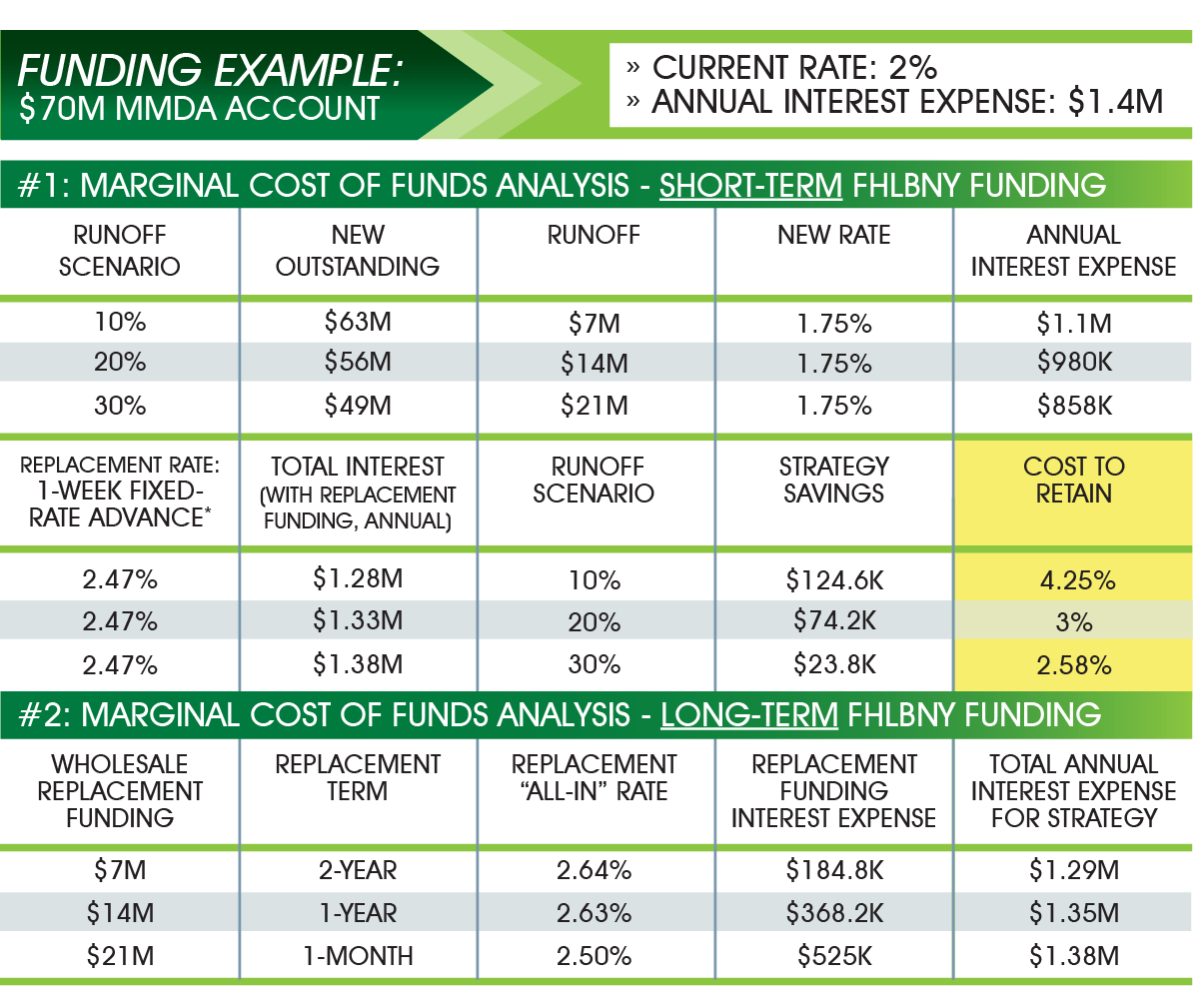

Take a look at the above table illustrating a money market deposit account (MMDA) and the potential outcomes if a member chooses to either lower their rates or lag their deposit rate increases. In this example, you can see how FHLBNY advances can be used to backfill potential deposit runoff. Here the member chose to pay a 1.75% rate on MMDAs instead of paying a prevailing rate of 2%. Different deposit runoff scenarios are shown – 10%, 20% and 30%. In each scenario a member can achieve savings by backfilling the potential deposit runoff with short-term advances (the current 1 week “All In”2 advance rate is 2.47%). Even in an extreme scenario that assumes a 30% runoff of your deposits, you would still be achieving significant savings. Furthermore, if you are concerned about the volatility of short-term funding, you could opt for longer-term funding options to backfill outflow in some instances and still achieve cost savings.

The example also shows the significant cost of paying up for those rate sensitive deposits (highlighted). For example, in the 10% runoff scenario, to retain $7 million of deposits on a marginal cost basis, a member is effectively paying a yield of 4.25% on those rate sensitive deposits — versus paying 2.47% using a 1-week FHLBNY advance to fund the outflow.

Credit Union Members

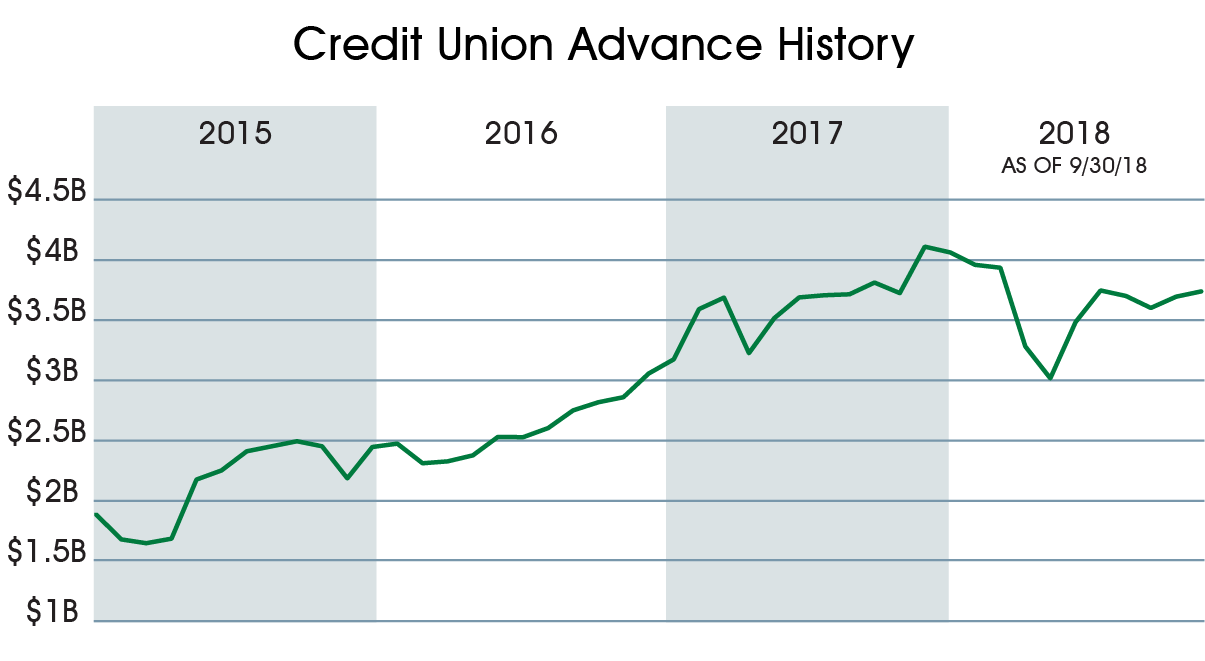

Credit union members continues to blossom, with 94 credit unions currently in our cooperative. Credit unions have been a fast-growing sector of our membership post-financial crisis, looking to the FHLBNY as a reliable liquidity provider. In recent years, we have also seen credit union advance usage grow substantially (as shown below).

Credit unions are steadily growing advances and leveraging their relationship with the FHLBNY for several reasons:

Manage Interest on a Marginal Cost Basis

Some credit unions have deployed deposit strategies (similar to the MMDA funding example provided) designed to lower their overall cost of funds by relying on FHLBNY liquidity to backfill outflows.

Leverage Capital

The challenging post-crisis operating environment has pressured NIMs, restricted earnings and capital growth among many in our cooperative. Credit union members have benefited from the capability to leverage their capital and achieve balance sheet growth using FHLBNY advances.

Reduce Risk

FHLBNY liquidity gives members the capability to add different asset classes to their balance sheet mix, and attain the appropriate funding with the proper duration to mitigate risk. Liability-sensitive credit unions find term advances to be an effective way to mitigate interest-rate risk.

Deploy Excess Cash

Armed with FHLBNY borrowing capacity, credit unions can comfortably deploy excess cash and attain greater spread, while relying on the ability to use FHLBNY advances to fund cash shortfalls should they arise – potentially a more profitable strategy versus “stockpiling” cash for contingent liquidity.

Residential Mortgage Loan Outlet

Credit unions are active participants in our Mortgage Partnership Finance® (MPF®) program. Under MPF, the FHLBNY purchases qualified residential mortgages from our members to help them reduce interest rate risk and preserve liquidity. MPF is a popular among credit unions because pricing is competitive, members may retain servicing and they are not beholden to volume commitments.

As credit unions increasingly leverage their relationship with the cooperative, they are benefitting from strategic funding to help boost bottom line earnings and capital.

Community Development Financial Institutions (CDFIs) & Housing Associate Members

CDFIs are an emerging class of members with a mission to support housing and community development, consistent with our cooperative. We presently have four CDFI members; however, interest has been growing and this membership sector will likely grow in the coming years. CDFIs find that our liquidity options can assist with funding their long-term assets while mitigating interest-rate risk. FHLBNY advances can also be used to help manage contingent funding needs as they arise.

Since 1993 Housing Associate members have been integral to the cooperative and have come to rely on our funding for contingent and strategic liquidity. The missions of our Housing Associate members also align closely with our cooperative. In addition to providing funding alternatives, the FHLBNY is an active investor in various Housing Associate bond issuances. The increased need for affordable housing across our district in recent years has also caused the FHLBNY to experience increased interest from several Housing Associates on ways they can use FHLBNY funding to meet strategic objectives and grow their balance sheets. Popular funding uses for Housing Associates include:

Short-term Liquidity Management – Housing Associates can rely on FHLBNY short-term liquidity to meet their immediate funding needs, affording them with the flexibility to be strategic in their term-debt issuances.

Financing Projects – Our funding is often used to help finance rehabilitative/restorative projects or projects held in portfolio.

Letters of Credit – The FHLBNY is a triple-A rated institution that offers performance letters of credit at advantageous rates. Housing Associate members often require letters of credit to secure construction projects.

Insurance Company Members

Insurance companies are another growing membership sector within our district. We have 26 insurance company members that consist of life and health insurers along with property and casualty insurance companies. Insurance companies are increasingly seeing the value in FHLBNY membership. They benefit from low cost and reliable funding, available in all operating environments without the costs associated with maintaining a traditional line of credit. Advance volumes from insurance companies within our district are substantial, comprising over $21 billion (20.9%) of our advance portfolio as of September 30, 2018. Funding uses of our insurance company sector includes the following:

Spread Borrowing

Insurers often use FHLBNY liquidity to fund security purchases or lending programs. This strategy can help bolster earnings and on-balance sheet liquidity depending on the asset being funded.

Short-Term Liquidity Management

Insurers also use FHLBNY funding to help manage their short-term liquidity position, allowing them to be fully invested while relying on their borrowing capacity to manage cash fluctuations.

Interest Rate Risk Management – FHLBNY advances can be used to help extend liability duration to attain asset/liability management goals.

Create Liquidity from Illiquid Assets – Members have the ability to pledge whole-loan mortgages to the FHLBNY to obtain strategic and contingent liquidity.

Take advantage of membership and look to your FHLBNY to provide the strategic and contingent funding solutions that complement your business goals.

Contact us to discuss how the strategies in this article could perform for you.

Member Services Desk: (212) 441-6600

Relationship Managers: (212) 441-6700

CONNECT WITH US

Have suggestions for a future topic? E-mail your thoughts to fhlbny@fhlbny.com

Latest News

09/02/2024

pr090224

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

08/24/2021

Important Announcement for Community Lending Programs Users

06/01/2020

Enhancements to the Refundable MULOC Product