President’s Report

July 5, 2022

Report from the President

Federal Home Loan Bank System Turns 90

Upon entering our headquarters, visitors are presented with a collection of items that provide a bit of the history of both the Federal Home Loan Bank of New York and the Federal Home Loan Bank System as a whole. This history began 90 years ago this month, with the Federal Home Loan Banks launching our operations on July 22, 1932.

The headline on that day – from an article on display at our office – notes that the newly created institutions “will begin work of thawing out frozen mortgages.” Created by Congress at the height of the Great Depression, the Federal Home Loan Banks were initially tasked with providing the liquidity local lenders needed to support the then-ailing mortgage market, helping to pull our country out of the crisis. That liquidity mission has expanded in the 90 years since, with each Federal Home Loan Bank serving as a reliable liquidity partner to its members in all market environments – a nationwide partnership through which funding flows to support housing, small business lending and investment and development opportunities in every community across the country.

The headline on that day – from an article on display at our office – notes that the newly created institutions “will begin work of thawing out frozen mortgages.” Created by Congress at the height of the Great Depression, the Federal Home Loan Banks were initially tasked with providing the liquidity local lenders needed to support the then-ailing mortgage market, helping to pull our country out of the crisis. That liquidity mission has expanded in the 90 years since, with each Federal Home Loan Bank serving as a reliable liquidity partner to its members in all market environments – a nationwide partnership through which funding flows to support housing, small business lending and investment and development opportunities in every community across the country.

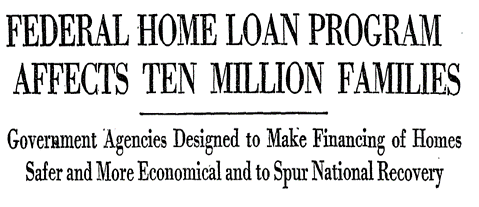

There is another headline on display in our office, one that ran in March of 1934, 15 months after the Federal Home Loan Banks’ doors first opened. It reads: “Federal Home Loan Program Affects Ten Million Families: Government Agencies Designed to Make Financing of Homes Safer and More Economical and to Spur National Recovery”. We take pride knowing that, in the decades since, the Federal Home Loan Banks, working in partnership with our members, have impacted not ten million families but hundreds of millions.

There is another headline on display in our office, one that ran in March of 1934, 15 months after the Federal Home Loan Banks’ doors first opened. It reads: “Federal Home Loan Program Affects Ten Million Families: Government Agencies Designed to Make Financing of Homes Safer and More Economical and to Spur National Recovery”. We take pride knowing that, in the decades since, the Federal Home Loan Banks, working in partnership with our members, have impacted not ten million families but hundreds of millions.

Across our 90-year history, as our membership and mission have evolved to meet the needs of the market, the defining principle of the Federal Home Loan Bank System has remained our stability. At the FHLBNY, we constantly strive to be a funding and community partner that our members can rely on in any and all environments. This is the purpose of the Federal Home Loan Banks, what we were in fact designed to be: critical during times of crisis, steady during calm markets, and dependable in every economic cycle. For 90 years, our members have had a stable partner in the Federal Home Loan Bank of New York, and our entire team is focused on ensuring that you always will.

2022 Director Elections Now Underway

That focus is shared by our Board, which takes an active role in helping to ensure that the FHLBNY is always well-positioned to act on our mission and deliver value to our stakeholders.

I encourage all of our members to participate in the election process. This year, five Directorships – two seats representing our New Jersey members, one seat representing our New York members, and two Independent Directorships representing the whole District – will be up for election for four-year terms commencing on January 1, 2023.

As reported earlier this year, we will continue to conduct our Director Election process electronically, once again partnering with Survey & Ballot Systems (“SBS”), the firm that has administered our recent Director Elections. On June 27, all eligible members were sent an email titled “Commencement of FHLBNY 2022 Director Election Process” from the sender noreply@directvote.net, which contained a link to materials regarding the elections. Eligible New Jersey and New York members may, using the electronic Certificate of Nomination included with the election materials, nominate one person for each of the open Member Directorships in their respective regions. Separately, the materials indicated that those individuals interested in being considered for nomination by the FHLBNY’s Board for the two open Independent Directorships must first submit an Independent Director Application Form and resume to the FHLBNY.

Copies of this Form and submission information can be found at our Corporate Governance page.

All electronic Certificates of Nomination must be submitted, and all emailed Independent Director Application Forms and resumes must be received by the FHLBNY, by 5:00 p.m. ET on July 28, 2022.

Like the FHLBNY itself, our Board consists of a talented group of dedicated individuals that benefits from, among other things, demographic (including gender, racial and ethnic) diversity. As you consider diverse Member Director candidates to possibly nominate, please remember that officers at member institutions serving below the CEO level and all member institutions’ board members, not just the board chair, are eligible to serve on the FHLBNY’s Board. We also ask that you encourage diverse candidates outside your institution to consider applying for the open Independent Director seats. Your participation in this year’s Director election process is greatly appreciated, and will help continue to keep the Board and the FHLBNY diverse – and strong. If you have any questions, please contact our general counsel, Paul Friend, at generalcounsel@fhlbny.com.

FHLBNY Announces Update to Membership Stock Requirements

As we announced last month, the FHLBY will reduce the maximum cap on membership stock purchases from $100 million to $50 million, effective August 1, 2022. This change is reflected in the Appendix to the FHLBNY’s Capital Plan, available here. We believe that this action will enhance Dividend Capacity and further strengthen the value proposition we deliver to our members.

***

Our 90th anniversary is an appropriate moment to reflect on all that has made the FHLBNY successful for the past nine decades. It starts with our people, who remain focused on supporting each other, serving our members, assisting our communities and executing on our mission. But the underlying strength of our franchise comes from our cooperative structure. We are both owned by and a partner to our members. You trust us with your capital, and rely on us for funding on demand, and together, we raise up the communities we all serve. It is this partnership, one that is shared between each Federal Home Loan Bank and its membership, that has kept our System such a vital and reliable part of the economy for 90 years, and it is upon this partnership that we will continue to build and strengthen the Federal Home Loan Banks over our next 90 years.

Sincerely,

José R. González

President and Chief Executive Officer

# # #

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This report may contain forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and speak only as of the date hereof. These statements may use forward-looking terms, such as “projected,” “expects,” “may,” or their negatives or other variations of these terms. The Bank cautions that, by their nature, forward-looking statements involve risk or uncertainty and that actual results could differ materially from those expressed or implied in these forward-looking statements or could affect the extent to which a particular objective, projection, estimate, or prediction is realized. These forward-looking statements involve risks and uncertainties including, but not limited to, regulatory and accounting rule adjustments or requirements, changes in interest rates, changes in projected business volumes, changes in prepayment speeds on mortgage assets, the cost of our funding, changes in our membership profile, the withdrawal of one or more large members, competitive pressures, shifts in demand for our products, and general economic conditions. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

Prior releases can be found on the SEC's EDGAR System.

Latest News

09/02/2024

pr090224

06/06/2024

Report from the President: National Homeownership Month, Local Support

06/03/2024

FHLBNY Affordable Housing Advisory Council Open Nomination Period – For 2025 Service

05/08/2024

FHLBNY Has Made $120 Million In Affordable Housing And Community Development Support Available Through First Four Months of 2024

04/25/2024

FHLBNY Announces First Quarter 2024 Operating Highlights