Collateral Guide

Collateral Guide

We are delighted that you have decided to take advantage of the Federal Home Loan Bank of New York’s (FHLBNY) Collateral guide. As you know, members must have sufficient qualifying collateral pledged in order to obtain borrowing potential to secure credit extensions.

This guide will assist you through the process of maximizing your borrowing potential by providing an overview of the identification, submission, reporting and valuation of eligible collateral. You can navigate through each tab above. At any time, we encourage you to contact your Relationship Manager who will be happy to provide assistance.

As always, we value your membership and look forward to our ongoing partnership.

Key Contacts

Relationship Managers

(212) 441-6700

FHLBNY@fhlbny.com

Member Services Desk

(212) 441-6600

MSD@fhlbny.com

Safekeeping Department

(800) 546-5101, Option 3-1

Collateral Analysis Department

(201) 356-1069

Identifying Eligible Collateral

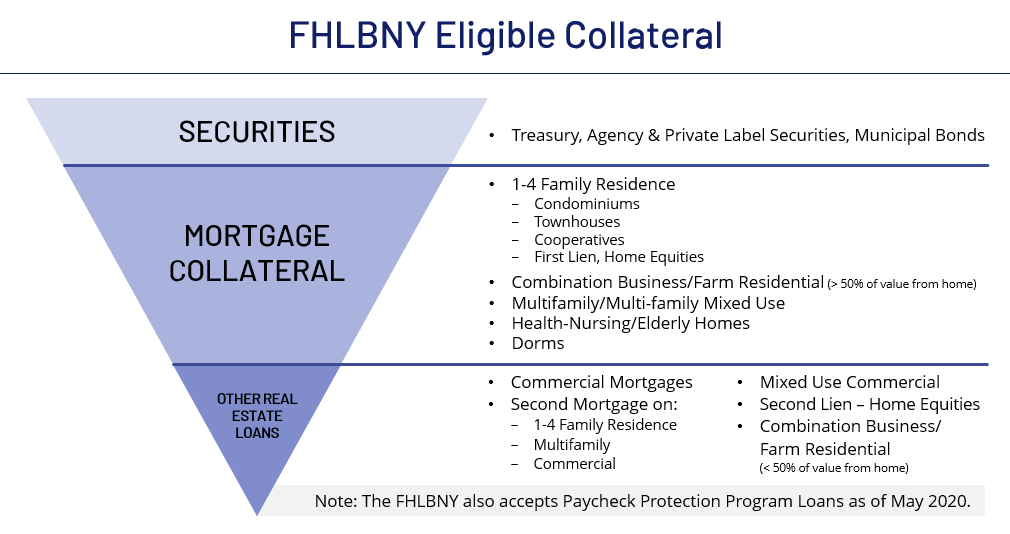

The FHLBNY accepts eligible mortgage loans on 1-4-family residential properties, home equity lines of credit (HELOC), multi-family, and commercial real estate. Agency and U.S. Treasury securities, certain private-label mortgage-backed securities, and certain municipal bonds, as well as cash are also accepted as collateral. Additionally, as of May 2020, the FHLBNY also accepts Paycheck Protection Program (PPP) Loans.

For complete details regarding eligible forms of collateral and their specific haircuts and qualification guidelines, please refer to the Member Products Guide. To obtain a copy, please log onto 1Link®, our secure internet banking system.

Key Contacts

Relationship Managers

(212) 441-6700

FHLBNY@fhlbny.com

Member Services Desk

(212) 441-6600

MSD@fhlbny.com

Safekeeping Department

(800) 546-5101, Option 3-1

Collateral Analysis Department

(201) 356-1069

Submitting Collateral

Securities Collateral: Pledging eligible securities collateral is accomplished by requesting a safekeeping account and delivering your securities. Securities are marked-to-market on a daily basis and a haircut is applied to arrive at your borrowing potential for those pledged assets.

Step 1: Set up a Safekeeping Account

Members who currently do not have a 1LinkSK® safekeeping (SK) custody account at the FHLBNY will need to request one in order to deliver securities collateral. To open a SK custody account each member is required to fill out and mail the “hard copies” with original signatures on the following forms – emailing signed documents will not be sufficient.

- A new or updated Global Authorization Form (HLB-106) indicating staff SK permissions

- Two* Amendment to Correspondent Services Agreements (HLB-110)

- Three* Securities Account Control Agreements (SFK-007)

*Members will receive back an executed original for their records.

Please note that FHLBNY will open three custody accounts on your behalf; a “Free”** custody account where your unencumbered holdings will remain, a “Pledge to Third Party” custody account to hold assets that are pledged to third parties (service offering), and a “Pledge to the FHLBNY” custody account which houses assets pledged for Regular or Repo Advances. All street side settlements will occur in your “Free” custody account with a subsequent movement into a pledged account in the event you require an asset to be pledged.

For a list of safekeeping fees, log on to 1Link® to view the Correspondent Service Fees Schedule.

Step 2: Receive/Deliver Securities

- Delivery Instructions and Deadlines for Securities (SFK-001)

Your account numbers will be provided to you when you open your SK custody accounts and your sub account number will be your FHLBNY member number. For street side settlements always provide the “Free” custody account number in your instructions to your broker or agent. - Purchase(s)/Receive(s) Form (SFK-002)

Submit this form when you are purchasing/receiving securities into your custody account. - Sale(s)/Delivery(ies) Form (SFK-003)

Submit this form when you are selling/sending securities out of your custody account.

Instead of submitting forms, you can also use 1LinkSK® to transact securities.

Step 3: Move Securities to Collateral Custody Accounts

After you have been notified that your securities have settled into your “Free” custody account, you will need to enter a transaction on 1LinkSK® or send an email to CustodyandPledgingServices@fhlbny.com and instruct to move the securities from your “Free” SK custody account into the “Pledge to FHLBNY” custody account. Be sure to designate which indebtedness program you require the securities to be pledged under:

Repo Advance Program

This category is for when you would like to execute a Repo Advance transaction – which can only be collateralized by using securities or cash as collateral. You will receive a benefit to your advance coupon by engaging in a Repo Advance with terms of two days or greater. You cannot execute an overnight Repo Advance under this category; overnight advances are available under the Regular Advance Program.

Regular Advance Program

This category is used when you would like to execute a Regular Advance transaction which can be collateralized with cash, loan and/or securities collateral. You can execute overnight advances in addition to term advances.

If you are currently relying on the FHLBNY strictly as a contingent funding source you may want to pledge securities under the Regular Advance Program. This will enable you to execute overnight advances. If you wanted to engage in a funding strategy and execute a term advance under the Repo Advance Program, then simply enter transactions on 1LinkSK® or send another email to switch the collateral designation.

**A general account of securities which are free from encumbrances.

You may pledge Paycheck Protection Program (PPP) loans to the FHLBNY. To determine if your institution is eligible to pledge these loans as collateral, please contact your Relationship Manager at (212) 441-6700, or Anthony Kobel, manager of the FHLBNY’s Collateral Analysis Group, at (201) 356-1069.

Mortgage Loan Collateral: Pledging whole-loan mortgage collateral is more complex as it involves submitting a data feed. Members are assigned collateral categories and some entail additional mortgage documentation requirements. Based on the attributes of your loans, they are marked-to-market (residential loans on a monthly basis & income producing loans on a quarterly basis) and a haircut is applied to arrive at your borrowing potential.

Pledging whole loan mortgages begins with a discussion with your Relationship Manager, who will guide you through this multi-step process. The FHLBNY will determine whether your institution can pledge whole loan mortgages either on a “Listing Only” basis, “Listing and Segregation I or II” basis or on a “Possession” basis. The latter two will require legal files to be physically segregated in your vault location or delivered into the FHLBNY.

Prior to considering mortgages for pledging, please keep in mind that all third-parties associated with the mortgages must be disclosed and legal agreements provided (i.e., use of third-party servicer/custodian, purchased pools, third-party originations, etc). Additional agreements may be required based on the nature of the third-party relationship. Mortgage collateral must be reported monthly regardless of your institution’s collateral category and must be submitted to the FHLBNY via secured server.

Once you have received preliminary approval to pledge mortgage loans, you must then complete an electronic loan submission file. The following are the steps to proceed with this process:

Step 1: Complete, execute and email back the Pledge Questionnaire (COL-125)

Every institution must complete this questionnaire prior to transmitting a new test file for the purpose of pledging.

Step 2: Complete, execute and email back the Member Secure Server Enrollment form (COL/APP-002)

This form needs to be completed to establish a secure connection to the FHLBNY.

Step 3: Get started with your test mortgage data listing: Mortgage Data Reporting (COL-012)

This is an overview for submitting your collateral using the FHLBNY File Transfer System. You will be notified by the FHLBNY once the successful transfer of your test mortgage data listing is completed.

Additional forms to enroll in the FHLBNY File Transfer System can be found here. If you have any further questions, please call the Collateral Analysis Department at (201) 356-1069.

The Federal Home Loan Bank of New York (FHLBNY) has established a “standing instruction” process to more effectively and efficiently assist our members in curing collateral shortfalls. By completing the Collateral Standing Instructions Agreement, your institution can choose the actions the FHLBNY can take to either re-allocate securities collateral between Repo and Non Repo indebtedness, and/or pledge on your behalf unencumbered securities from your primary account and/or from your subsidiary/affiliate pledge account(s).

The Collateral Standing Instructions (COL -150) agreement is available and a completed Sample Collateral Standing Instructions (COL -151) agreement to serve as a guide. If this is of interest to you, please complete the form and return it to:

Federal Home Loan Bank of New York

70 Hudson Street

Jersey City, NJ 07302

Attn: Adele Pobega, Senior Manager, Collateral, Custody, and Pledging Services

Key Contacts

Relationship Managers

(212) 441-6700

FHLBNY@fhlbny.com

Member Services Desk

(212) 441-6600

MSD@fhlbny.com

Safekeeping Department

(800) 546-5101, Option 3-1

Collateral Analysis Department

(201) 356-1069

Determine Borrowing Capacity

About Lendable Value

Maximum Lendable Values are established to ensure that the FHLBNY always has sufficient eligible collateral securing credit extensions. Maximum Lendable Values are typically designated by the type of collateral pledged. The collateral is periodically evaluated and adjusted to reflect current market conditions. In establishing the various Maximum Lendable Values, the FHLBNY considers the potential market, credit and liquidity risks associated with each type of pledged collateral. In addition, the Maximum Lendable Value allows for reasonable costs associated with the liquidation of collateral as well as any remaining unknown factors.

However, the Maximum Lendable Values may also be impacted by the overall financial condition of the members, or third-party entities (i.e., pledgors, servicers, custodians) involved in the relationship between the member and the FHLBNY.

Members with a weakened financial condition may be assigned a lower Maximum Lendable Value and may be required to provide additional collateral to cover accrued interest, and estimated early termination fees on outstanding advances.

For a summary of Maximum Lendable Value requirements and how it applies, please refer to the Member Products Guide.

Current Borrowing Potential

Members can view their Collateral Position Report on 1Link® which enumerates a member’s borrowing potential.

Once you log into 1Link®, click on the “Information Reporting” tab, then under “Reports” drop-down list click on “Special Reports,” then select “Collat Customer Summary Report.” Through 1Link®, you can also arrange to have your report automatically delivered to you via email. If you are not signed up on 1Link®, please contact your Relationship Manager.

Key Contacts

Relationship Managers

(212) 441-6700

FHLBNY@fhlbny.com

Member Services Desk

(212) 441-6600

MSD@fhlbny.com

Safekeeping Department

(800) 546-5101, Option 3-1

Collateral Analysis Department

(201) 356-1069