Financial Intelligence

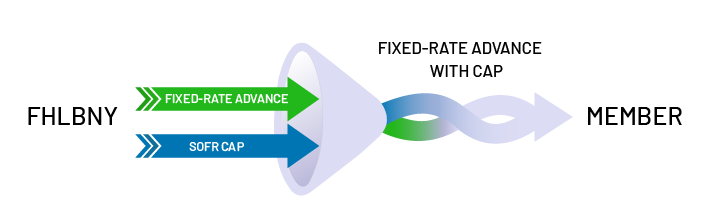

Addressing Potential Risks with

the Fixed-Rate Advance with a SOFR Cap

As we emerge from the pandemic we are now in a new interest-rate cycle highlighted by a rising rate of inflation accompanied by the Fed taking significant action to tighten, raising short-term interest rates at a rapid cadence while at the same time shrinking the size of their balance sheet.

Since YE 2019, there has been a significant inflow of deposits to the U.S. banking industry — $5.03 trillion as of Q2 2022 to be exact. Approximately 67% of these new deposit proceeds were deployed in loan and security portfolios during a time of relatively low rates. Some of our members have retained long-term mortgage production to a larger degree, either due to more attractive returns versus alternative investment options, or because rates moved upward so quickly that fixed-rate mortgages couldn’t be sold profitably. As a result, some of our members’ balance sheet profiles have changed and now have a higher concentration of longer-term assets.

The changing interest rate environment has been pressuring the market valuations of our members assets and is also straining Interest Rate Risk (IRR) measurements. Should there be a rapid outflow of “core” non-maturity deposits, IRR positions will be further strained. As a result, regulators have become concerned.

Members may want to consider our Fixed-Rate Advance with a SOFR Cap (Fixed-Rate with Cap) product to help assist with addressing funding mismatches now. The additional protection of a rate cap is ideal to reduce interest expense when short-term rates rise sharply.

Hybrid Funding Opportunity for Balance Sheet Management

The Fixed-Rate with Cap is a FHLBNY advance product in which a Secured Overnight Financing Rate (SOFR) interest rate cap is embedded into a traditional fixed-rate, long-term advance. This hybrid product is designed to both “lengthen” the duration of liabilities and respond favorably in a rising interest rate environment. As interest rates rise and the quarterly SOFR average increases and breaches a pre-determined strike threshold, the coupon on this advance could decline, either one basis point for every basis point that the average quarterly SOFR is above the strike threshold (1× multiplier), or one basis point for every 2 basis points that the average SOFR is above the strike (0.5× multiplier), with an ultimate floor of 0%. When rates rise the cost of this advance could decline, while other liability categories may become more costly. If the SOFR average falls back below the strike threshold over a quarterly period, the advance will reset to its original coupon rate.

The Fixed-Rate with Cap can help with match funding long-term assets and assist with improving spread in a rising rate environment. This advance can also be particularly helpful when running regulatory interest rate-shock scenarios. For example, potentially sharp rate spikes could cause the coupon rate of this advance to rapidly decline, which would improve the present value of this advance and serve to assist with a banking member’s Economic Value of Equity at Risk measurements (or with the NEV Supervisory Test for credit union members).

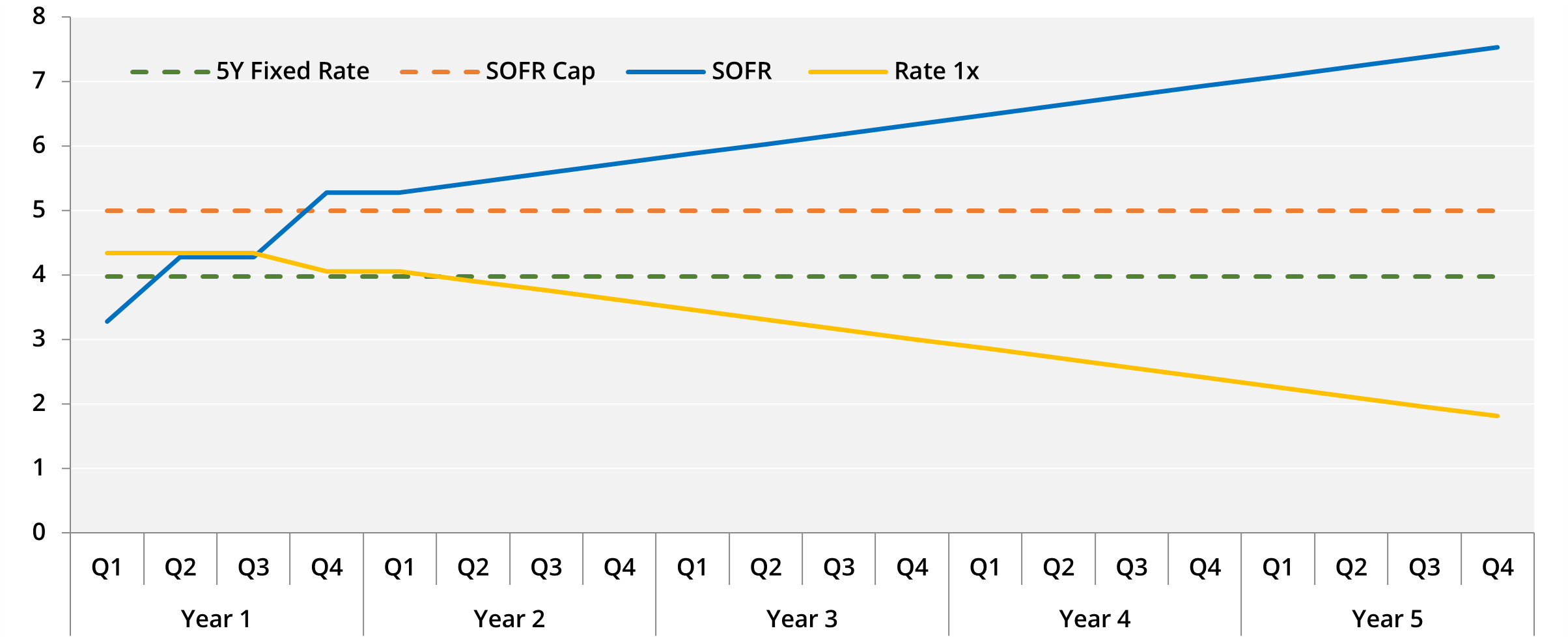

The following example illustrates the mechanics of the Fixed-Rate with Cap under a hypothetical interest rate scenario. In this scenario, the 5-year Fixed-Rate with a 1× cap and strike of 5.00% has an initial rate of 4.34% — 36 basis points higher than the regular 5-year Fixed-Rate Advance. As shown, the advance rate will decline in a rising rate environment. Once SOFR rises and its quarterly average breaches the cap strike of 5.00% (as seen in Q4 of year 1 in the illustration below), the Fixed-Rate with Cap coupon will decline a basis point for every basis point SOFR averages above the cap over a quarter (floored at zero percent). If SOFR subsequently averages below the cap strike over a quarterly period, the advance will return to its initial rate of 4.34%.

The cap threshold or “strike” is determined by the member at the inception of the advance. There is a $5 million minimum to this advance and a minimum term of 1 year.

Although there is an additional cost to the Fixed-Rate with Cap, the product could provide significant assistance in addressing interest rate risk, especially when confronted with interest rate shock scenarios.

To achieve further savings, members may explore incorporating the Fixed-Rate with Cap into one of the FHLBNY’s Community Lending Programs (CLP). CLP Advances are offered at a reduced rate if qualified lending is demonstrated — either residential mortgage lending, which benefits lower income individuals, or non-housing related lending in lower-income census tracts.

As always, the FHLBNY strives to offer members funding and hedging solutions. To learn more about the potential strategy discussed in this article, or any other funding option, contact your Relationship Manager at (212) 441-6700 or the Member Services Desk at (212) 441-6600.

Have You Considered the Economic Impact of Your Dividend?

On August 19, 2022, the FHLBNY distributed a dividend of 5.50% to members for the second quarter of 2012 (annualized). The FHLBNY has provided members with a consistent and reasonable quarterly dividend. It is important for members to factor in the economic benefit of the dividend, which, depending on the advance term, can substantially lower the “all-in“ borrowing cost off an advance. For a detailed analysis, Contact your Relationship Manager at (212) 441-6700 or the Member Services Desk at (212) 441-6600.

Disclaimer: Notwithstanding any language to the contrary, nothing contained in these disclosures is intended to constitute an offer, inducement, promise, or contract of any kind. Any product descriptions and pricing may be subject to change without notice.

The content provided in these disclosures is presented as a courtesy to be used only for informational purposes and is not represented to be error free. The FHLBNY makes no representations or warranties of any kind with respect to the content contained herein, such representations and warranties being expressly disclaimed. The FHLBNY is not a financial or investment advisor.

Moreover, the FHLBNY does not represent or warrant that the content of these disclosures is accurate, complete or current for any specific or particular purpose or application. It is not intended to provide nor should anyone consider that it provides legal, accounting, tax or other advice. Such advice should only be rendered in reference to the particular facts and circumstances appropriate to each situation. The FHLBNY encourages you to contact appropriate professional(s) and consultant(s) to assess your specific needs and circumstances and to render such advice accordingly. In addition, the FHLBNY is not endorsing or recommending the use of the means or methods contained in or through these disclosures for any special or particular purpose.

It is solely your responsibility to evaluate the risks or merits of any funding or investment strategy. In no event will FHLBNY or any of its officers, directors or employees be liable for any damages — whether direct, indirect, special, general, consequential, for alleged lost profits, or otherwise – that might result from any use of or reliance on these materials.