Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending December 16, 2022.

Economist Views

Click to expand the below image.

**The Weekly Update will return on January 6th. Best wishes for the holiday season; kindly contact the desk for questions or information.**

Having weathered yet another hike in the federal funds rate target range, the attentions of market participants will return to the economic release calendar. The latest housing readings probably will be decidedly mixed. While home sales are expected to have fallen in November, builder confidence likely improved in early December. Strong labor-market conditions likely buoyed consumers’ spirits heading into the holiday shopping season. A reported rise in jetliner bookings likely buoyed durable goods orders in November.

NAHB Housing Market Index: Buoyed by recent reductions in mortgage rates, the National Association of Home Builders’ sentiment gauge likely climbed to a three-month high of 40 in early December yet remained well shy of the 50-point mark associated with neutral market conditions.

Housing Starts & Building Permits: New activity likely ebbed in November, with the number of housing units started and building permits issued retreating to respective SAARs of 1.4mn and 1.5mn.

Current Account Balance: Prompted by a sharp narrowing of the merchandise trade gap, the current account deficit probably closed to $206bn during the third quarter from $251.1bn over the April-June span. If realized, the anticipated result would mark the smallest shortfall on international transactions since the winter of 2021.

Conference Board Consumer Confidence: Solid labor-market conditions probably propelled this sentiment gauge to a three-month high of 105 in December from 100.2 in the previous month.

Existing Home Sales: Home-purchase contract signings over the September-October span suggest that closings tumbled by 5% to a SAAR of 4.21mn in November – the weakest showing since the pandemic low of 4.07mn posted in May 2020. With the number of homes on the market expected to drop by an estimated 9.8% to a seven-month low of 1.1mn during the reference period, the stock of available dwellings likely retreated to 3.1 months’ supply.

Real GDP Growth: The Bureau of Economic Analysis’ final estimate of real GDP growth during Q3 probably will be marked one tick higher to 3%.

Jobless Claims: Initial claims for jobless benefits probably remained in the recent 225-245K range during the week ended December 17. Pay attention to continuing claims during the period ended December 10 for signs that recently furloughed employees are having a more difficult time finding work.

Durable Goods Orders: Powered by an aircraft-led rise in transportation equipment requisitions, durable goods bookings probably climbed for a fourth straight month in November, building on the 1.5% increase witnessed over the August-October span. Pay attention to core nondefense capital goods shipments for clues to business equipment spending thus far in the current quarter.

Personal Income & Spending: Personal income and consumer spending are both expected to post modest .2% gain in November, after respective .7% and .8% gains in October.

New Home Sales: The number of contract signings is expected to have fallen by 5.1% to a SAAR of 600K in November, reversing almost three quarters of October’s surprising gain.

Federal Reserve Appearances: None scheduled as of this writing.

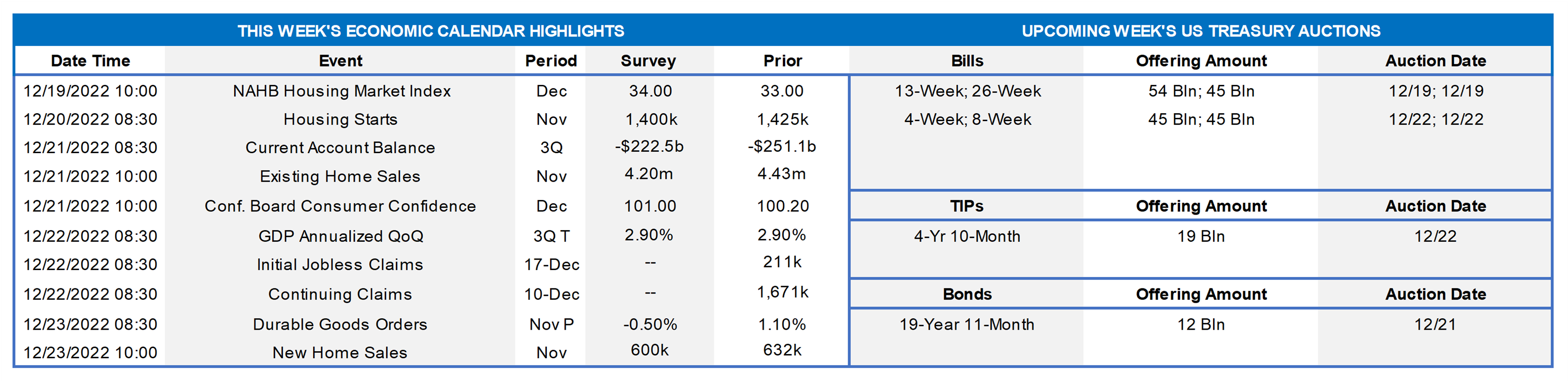

CHART 1 UPPER LEFT

Source: Federal Reserve Board of Governors; FHLB-NY. As per convention, the Fed released an updated Summary of Economic Projections, or SEP, following this past Wednesday’s FOMC meeting. Monetary policymakers now anticipate raising the fed funds rate target range by an additional 75 bps to 5-5 ¼% by the end of 2023, per the fresh “dot plot” seen here (Green dots are fresh dots, Red are from the September FOMC) and its median dot of 5.125%. The median projection for year-end 2024 anticipates a percentage-point reduction from that level to 4-4 ¼%, with additional cuts to 3-3 ¼% by the end of 2025. While the dots drifted upward slightly from those of the September SEP, Fed officials’ median expectation for the nominal federal funds rate over the longer term remains at 2½%. The Fed also announced that it would continue its planned and ongoing reduction of its UST and MBS holdings.

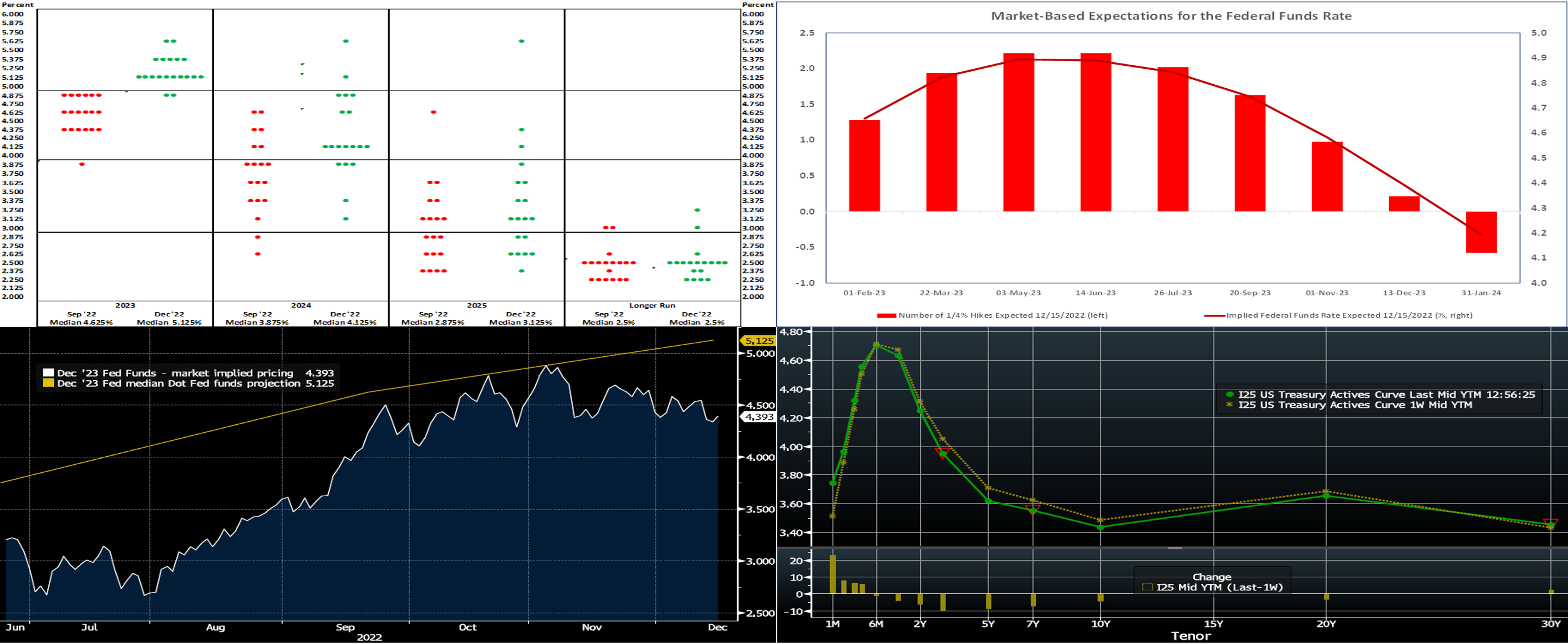

CHART 2 UPPER RIGHT

Source: Bloomberg; FHLB-NY. Reflecting the view that a recession next year likely will be unavoidable, market participants currently expect the current monetary policy tightening cycle to end next May with a federal funds effective rate of ~4.89%. Looking further out in time, futures markets are now pricing a year-end 2023 fed funds effective rate of roughly 4.39%, well below the 5.125% median in the latest Federal Reserve dot plot, despite Fed Chair Powell’s declarations that there is “more to do” and that rates could be elevated for “some time”.

CHART 3 LOWER LEFT

Source: Bloomberg. Further on the observation that the market prices the year-end 2023 fed funds rate well below the dots/projections of the Fed, here we can see that this dynamic, excepting a few brief periods in autumn, has been in place for most of this year. Shown here is the trend of the Fed’s year-end 2023 dot (gold, RHS, %) and the market’s implied pricing (white, RHS, %) for year-end 2023 fed funds. The market is clearly forecasting a higher probability of recession and, consequently, the need for future rate cuts, than the Fed. Also, the market is aware that the Fed has been wildly wrong on its past dot-plot projections and so, in this light, may feel it is prudent to discount the Fed’s projections accordingly. Meanwhile, the Fed may be attempting to “jawbone” its commitment to fighting inflation via a higher range of rate projections and thereby prevent market exuberance about future rate easing and a loosening of financial conditions. Perhaps too, the Fed may be trying to avoid an outright and unpopular acknowledgment that a recession is likely in the year ahead. For sure, this topic and its impact on the rate curve will be an area to watch in 2023.

CHART 4 LOWER RIGHT

Source: Bloomberg. Note: Top pane is yield (LHS,%), bottom pane is change (bps). Perhaps surprising for a Fed-hike week, UST term yields, as of Thursday afternoon, were trading lower from the week prior. The 5-year point led the move and was ~9 bps lower. The main catalyst for the move was the lower-than-expected CPI inflation data released this past Tuesday morning. Meanwhile, stocks suffered a slide and a few other economic data points were on the weak side, especially Thursday’s retail sales figures, and the FOMC outcome was, all-in-all, largely as expected. Clearly now anticipating a slower pace of further Fed rate increases, the market now prices for a 100% chance of a 25 bps hike for the February 1st FOMC and with ~28% probability of a 50 bps hike. The peak funds rate in spring 2023 last stands at ~4.89%, down from 4.95% a week ago and the same as two weeks ago, in a clear sign that the FOMC did not persuade the market to alter its thinking.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates are mostly higher from a week ago, with changes led by the 1-month-and-in sector which crossed deeper and into the Fed’s 50 bps hike of this past Wednesday; please see the prior slide for more Fed-pricing color. Rates in the 4 to 6-month zone were minimally changed to down a few bps, as the Fed-pricing out the curve remained roughly the same as last week and typical year-end “safety inflows” to short-end investments have occurred. At this stage before year-end, direction will be dictated by data and technical year-end money flows.

- Given the Fed’s tightening and data-dependent posture, rates will remain responsive to economic data this upcoming weeks.

Term Rates

- The longer-term curve finished lower from a week ago, roughly mirroring moves in the UST and swaps markets. The 2 to 10-year sector, as of Thursday afternoon, was 7 to 10 bps lower than the week prior. Kindly refer to the previous section for relevant market color. The advance curve remains inverted out to 5-year, thereby offering opportunities to extend in advance duration for minimal or lower coupon cost. The flat curve and still relatively high implied volatility environment also can serve to make putable advances more compelling.

- On the UST term supply front, this upcoming week serves a 20-year nominal and a 10-year TIPS auction. Kindly call the desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce the reintroduction, after a temporary suspension owing to Libor-cessation, of the Putable Advance, Fixed-Rate with SOFR Cap Advance, and ARC with SOFR Cap/Floor Advance. The Callable Advance continues to be offered. This expansion of the product menu will provide members with more options and flexibility for the management of funding and/or hedging needs.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please contact the Member Services Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Service Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.