Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of October 17, 2022.

Economist Views

Click to expand the below image.

Having weathered stronger-than-expected consumer inflation data for September, the market will contend with a series of second-tier economic reports this week. Both local and national industrial production reports are expected to show that activity was little changed from August. Closely followed housing statistics probably will be mixed in their respective reporting periods. Jobless claims likely will remain consistent with tight labor market conditions. A quintet of Federal Reserve officials are slated to address the public. The Federal Reserve’s Beige Book summary of economic conditions will provide useful color on FHLB-NY district conditions heading into the November Federal Open Market Committee meeting.

Empire State Manufacturing Survey: Manufacturing activity in New York State probably remained steady in early October, after a modest contraction in August.

Industrial Production & Capacity Utilization: A tug of war between reduced utilities output and modest increases in manufacturing and mining output likely pared this gauge by .1%, following a .2% dip in the preceding month. With additions to productive capacity expected to eclipse output during the reference period, the overall operating rate probably edged two ticks lower to 79.8%

NAHB Housing Market Index: Downbeat appraisals of current and future home sales, combined with a further erosion of prospective buyer traffic, probably left the National Association of Home Builders’ sentiment gauge at 44 – its weakest level since May 2020.

Housing Starts & Building Permits: Unusually dry and warm weather conditions across the continental U.S. hint that both starts and building permits issued will eclipse Street expectations.

Jobless Claims: New claims for unemployment insurance benefits likely remained in a historically low 215-230K range during the week ended October 15. Continuing claims probably clocked in below the 1.4mn mark once again during the week ended October 8, supporting the view that recently furloughed employees are having little trouble finding work.

Existing Home Sales: Home-purchase contract signings over the July-August span suggest that closings retreated by 1.3% to a seasonally adjusted annual rate of 4.74mn in September – the weakest showing since the pandemic low of 4.04mn posted in May 2020. With the number of homes on the market expected to dip by an estimated 1.6% to 1.26mn during the reference period, the stock of available dwellings likely registered at 3.2 months’ supply.

Index of Leading Economic Indicators: Highlighting growing recession risks, the Conference Board’s augur of prospective economic activity probably moved lower for a 7th consecutive month.

Federal Reserve Appearances:

- Oct. 18 Atlanta Fed President Bostic to take part in a virtual panel discussion hosted by Workrise.

- Oct. 18 Minneapolis Fed President Kashkari participates in an economic discussion with women corporate directors.

- Oct. 19 Minneapolis Fed President Kashkari to take part in a moderated Q&A hosted by Travelers with its employees.

- Oct. 19 Federal Reserve to release Beige Book summary of district economic conditions.

- Oct. 19 Chicago Fed President Evans to discuss the outlook with the Jefferson Scholars Foundation in Charlottesville, Virginia.

- Oct. 19 St. Louis Fed President Bullard to offer welcoming remarks at the Bank’s annual Homer Jones lecture.

- Oct. 21 New York Fed President Williams to make remarks on building talent at Columbia-Greene Community College.

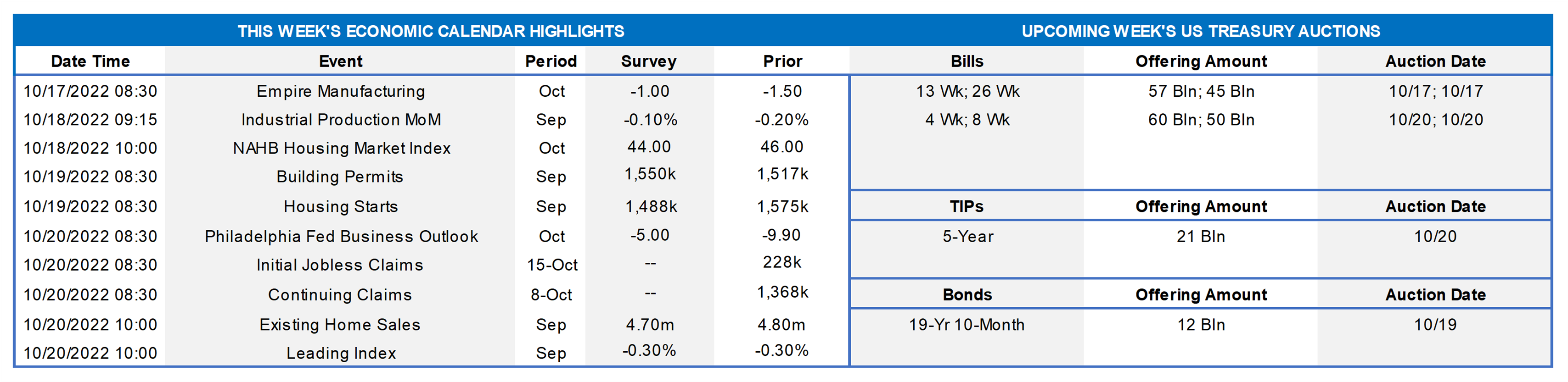

CHART 1 UPPER LEFT

Source: Bloomberg; FHLB-NY. Market expectations of the prospective path of the federal funds rate ratcheted higher in the wake of this past Thursday’s steamier-than-expected consumer price inflation report for September. Thought impossible just a week ago, the market now places the chance of a whopping 100 bps hike at the upcoming Federal Open Market Committee meeting on November 2nd at ~15%. Moreover, the probability of a 75 bps hike at the December 14 gathering has jumped from 6.5% to ~73%. The market also pushed higher its expectations for the “terminal” rate of the hiking cycle to ~4.95%, per April 2023 Fed funds futures, with the cycle terminating thereafter.

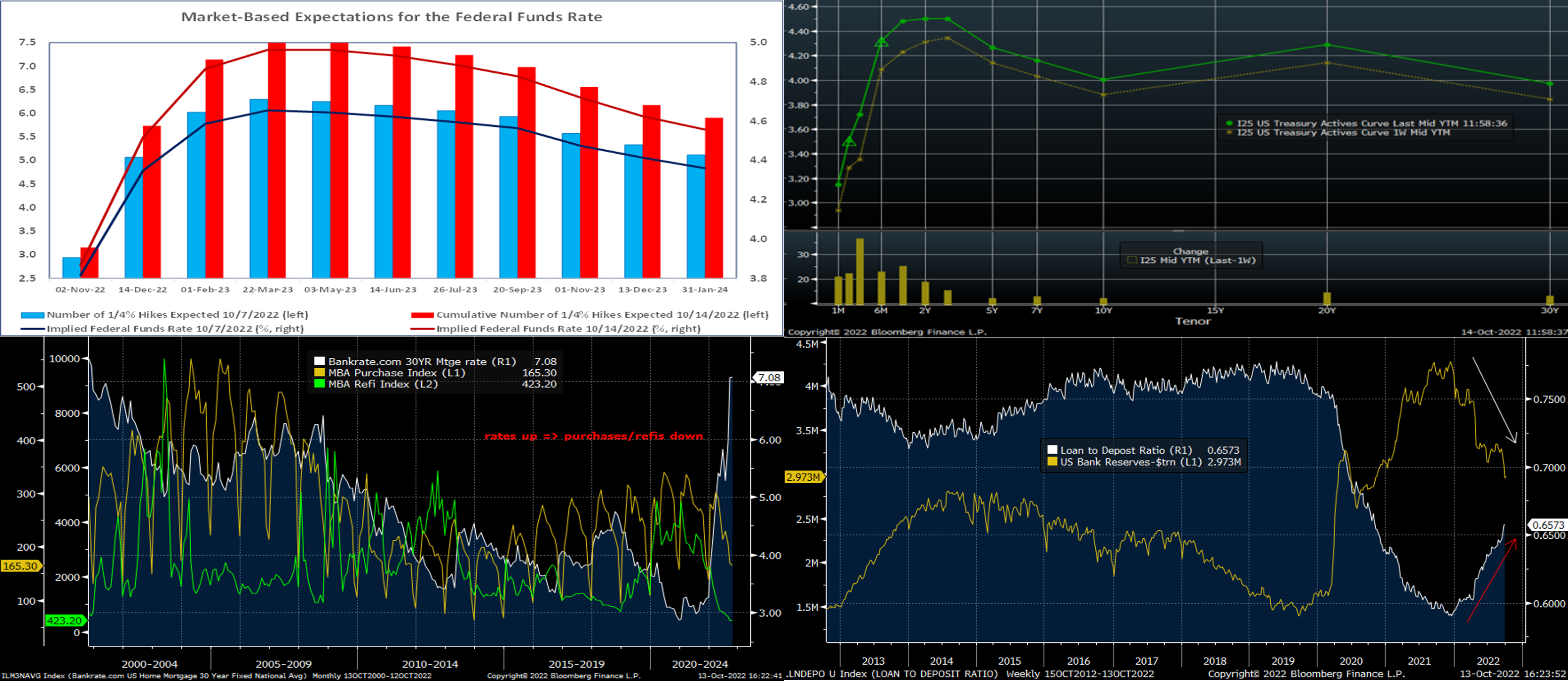

CHART 2 UPPER RIGHT

Source: Bloomberg. Note: Top pane is yield (%), bottom pane is change (bps). The UST curve, as of Friday midday, finished higher yet again from the week prior. The CPI report essentially solidified a 75 bps hike for the November 2 FOMC and led the market to price a more aggressive tightening cycle, per the comments above. Short tenors 1-year-and-in moved notably higher, consequently. The 2-year was ~20 bps higher and the 5 to 10-year sector ~13-14 bps higher from the week prior. The 2 to 5-year sector now trades at the highest levels since 2007. The markets remain volatile, and we continue to encourage members to engage with the desk for rate updates and product information. As a reminder, our advance rates are influenced by and dynamically move with market rates. For an example of the market volatility, we can assess the recent behavior of the 5-year SOFR swap. It traded as low as 3.83% early Thursday only to shoot higher, post the CPI report, to 4.06% and then subsequently trade down again to ~3.88% later in the day. It opened Friday morning ~3.84% but then bounced higher to trade ~4.01% as of this writing midday on Friday.

CHART 3 LOWER LEFT

Source: Bloomberg. Here is historical context on this year’s dramatic rise in interest rates. The Bankrate.com 30-year mortgage rate (RHS, white) has more than doubled this year and reached 7% this past week, a level not seen in ~22 years! In turn and expectedly, the Mortgage Banker Association’s Purchase (LHS-1, gold) and Refinancing (LHS-2, green) Indices have both trended decidedly downwards. Indeed, the Refi index has plunged to historical lows. The Fed’s tightening cycle has clearly impacted conditions in this sector, with various ramifications on home prices, rental levels, and affordability still to unfold in the months ahead.

CHART 4 LOWER RIGHT

Source: Bloomberg. In recent editions we touched on the topic of the Fed’s balance sheet runoff, lower bank reserves levels, and downward pressure on bank deposits. Here can be seen the decline in bank reserves (LHS, gold, $trn) held at the Fed, as the Fed is effectively reversing the liquidity injections of the pandemic relief era. Meanwhile, with less liquidity in the banking system but loan growth still solid across the industry, bank loan-to-deposit ratios (RHS, white) have trended decidedly higher from lowly levels of late 2021. As these dynamics continue to evolve, the FHLB-NY will remain ready as a flexible source of funding and liquidity needs for our members.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates finished notably higher week-over-week, with 1-month-and-out tenors leading the way by rising ~25 bps on average. Post this past Thursday’s CPI report, the market raised the odds of more aggressive forthcoming Fed hikes, as covered in the previous slide. As of this past Friday midday and much higher from the week prior, the market priced for a 100% chance of a 75 bps hike at the November 2 FOMC, with now ~73% chance of another 75 bps hike at the December 14 FOMC. For 2022 cumulatively from now, the market prices for ~143 bps (up 16 bps from last week) of hikes.

- Given the Fed’s tightening and data-dependent posture, rates will remain highly responsive to economic data and Fed-speak.

Term Rates

- The longer-term curve finished higher from the week prior by ~14 to 24 bps, with the 1 and 2-year leading the changes and generally mirroring the move in UST and swaps markets. Kindly refer to the previous section for relevant market color. The advance curve remains extremely flat overall and inverted at various points, thereby offering opportunities to extend in advance duration for minimal or lower coupon cost. The flat curve and high implied volatility environment also can serve to make putable advances more compelling.

- On the UST term supply front, this upcoming week offers a 5-year TIPS and a 20-year auction. Market focus will remain on Fed-speak and the week’s economic data. Please call the Member Service Desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce the reintroduction, after a temporary suspension owing to Libor-cessation, of the Putable Advance, Fixed-Rate with SOFR Cap Advance, and ARC with SOFR Cap/Floor Advance. The Callable Advance continues to be offered. This expansion of the product menu will provide members with more options and flexibility for the management of funding and/or hedging needs. Please call the Member Service Desk at (212) 441-6600 for more information.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please call the Member Service Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Service Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.