Member Services Desk

Weekly Market Update

Economist Views

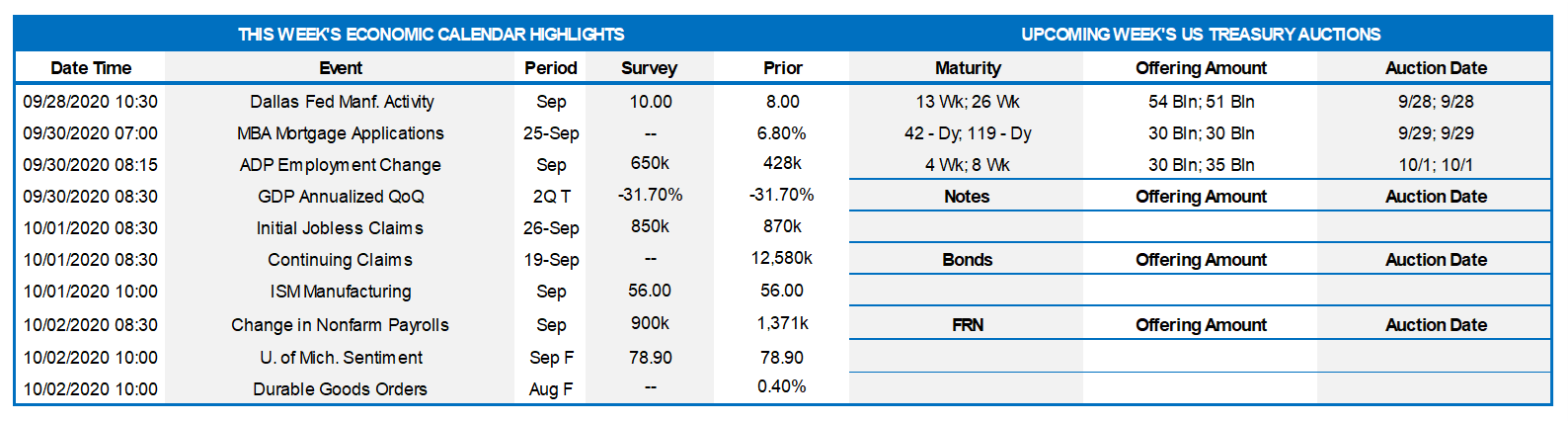

Click to expand the below image.

Ripping another page from the calendar, market participants will turn their attentions to initial readings on economic activity in September. Two reports likely will receive the most attention. Available regional reports suggest that the Institute for Supply Management’s (ISM) manufacturing barometer remained on an uptrend last month. Labor market conditions are expected to reflect more improvement in September, although considerable ground remains to be recovered before returning to pre-pandemic levels. Federal Reserve officials will make over a dozen public appearances this week on a variety of topics.

Conference Board Consumer Confidence: Available soundings suggest that the Conference Board’s sentiment gauge climbed to a 3-month high of 93.5 in September, from 84.8 in August. Pay particular attention to the so-called labor differential in this report. The percentage of respondents noting that jobs are plentiful less those feeling that they are hard to get likely moved back into positive territory.

ADP National Employment Report: Although underestimating private-sector job growth by sizable margins over the May-August span, ADP’s projection will still be monitored for clues to the Bureau of Labor Statistics’ (BLS) September report. The Street expects ADP to reveal that private payrolls expanded by 650K during the current month. Be on the lookout for a sizable upward adjustment to the previously published estimate for August. ADP’s preliminary tally of 428K was well below the government’s official 1.03mn count.

Pending Home Sales: Contracts on dwelling purchases likely rose by 3.2% in August, boosting the cumulative gain since April’s pandemic low to 82.6%. The consensus projection, if realized, would represent the strongest reading in 15 years.

ISM Manufacturing Index: In contrast to Street expectations of a pullback, district Fed canvasses hint that the ISM’s national factory activity gauge moved one point higher to 57 in September – the strongest reading since the 58.8 posted in November 2018.

Employment Situation Report: Reported declines in initial and continuing jobless claims between the BLS’ establishment canvassing periods suggest that job growth likely quickened from the 1.37mn net positions created in August. A concurrent drop in the state insured unemployment rate hints that another sizable drop in the national jobless rate from August’s 8.4% could be in store in the upcoming report.

Federal Reserve Appearances:

Sept. 28: Cleveland Fed President Mester to participate in economic equality webinar.

Sept. 29: N.Y. Fed President Williams to discuss LIBOR countdown.

Sept. 29: Fed Vice Chair Clarida to moderate a panel discussion on Treasury market.

Sept. 29: Fed Governor Quarles to speak on panel discussing financial regulation.

Sept. 29: Fed Governor Quarles to speak on a financial stability webinar.

Sept. 30: Minneapolis Fed President Kashkari to discuss COVID and the economy.

Sept. 30: Fed Governor Bowman to speak on community banks.

Oct. 1: Fed Governor Bowman to speak on community banks.

Oct. 2: Philadelphia Fed President Harker to discuss an inclusive workforce recovery.

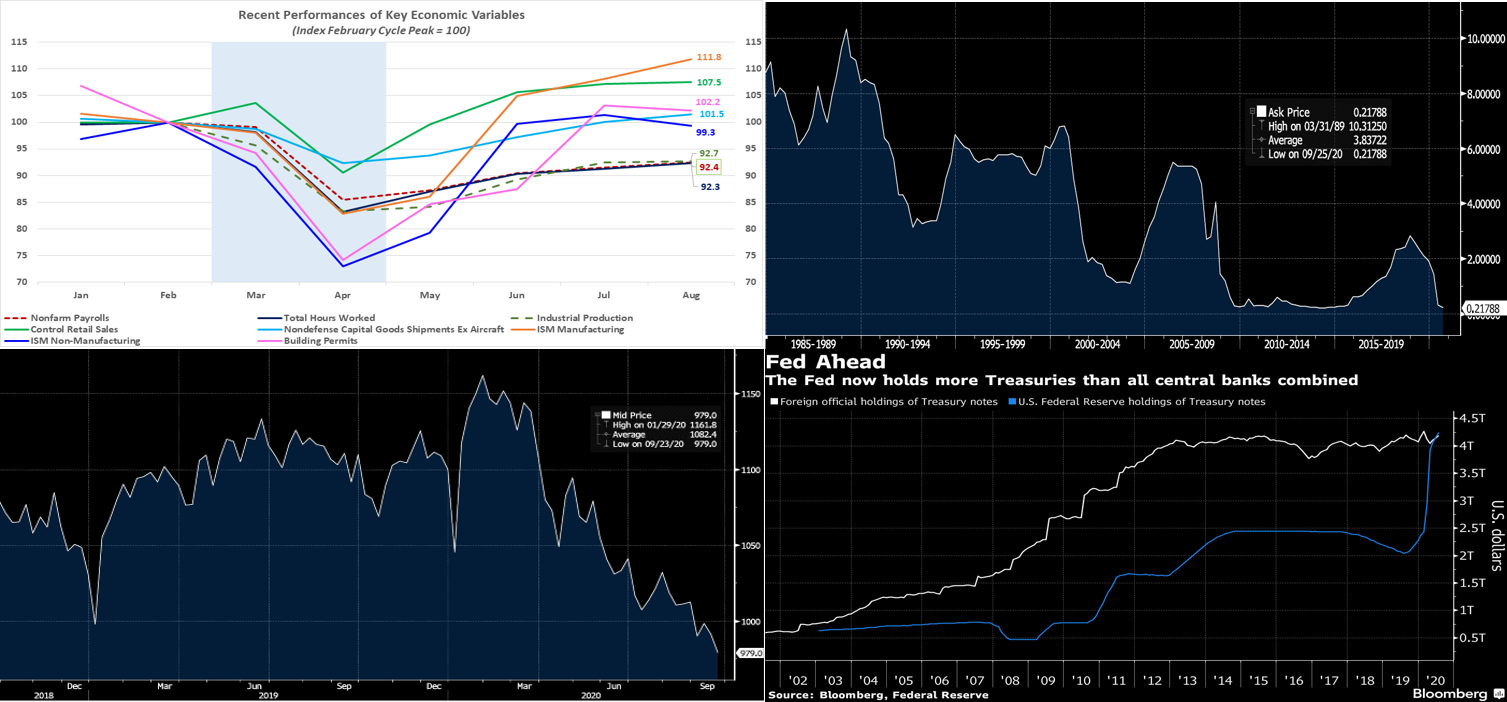

Click to expand the below images.

CHART 1 – UPPER LEFT

Source: BLS; Census Bureau; FRB; ISM; FHLBNY. While employment conditions have admittedly lagged, broad sections of the economy have recovered from their respective pandemic lows over the past four months. Available data point to a sharp rebound in GDP growth during the summer, following the massive 31.7% contraction in Q2. Note: Shaded area denotes COVID-19 downturn period.

CHART 2 – UPPER RIGHT

Source: Bloomberg. As seen here, a historical low was reached on 3-month Libor (3mL) this past week, fixing at .21788% on Friday. Likewise, 1-month Libor hit a record low of .14613%. The Fed’s arsenal of programs deployed to combat the pandemic crisis and its associated liquidity constraints have greatly served to drive all short rates lower in the past few months. At this stage, Libor may have limited room to decline further. The lowest point on the 3-month Eurodollar futures (proxy for 3mL) curve is .20% for the September 2021 contract. Moreover, 3mL is now only ~14bps over Fed Funds and 3-month OIS (Overnight Indexed Swap, a proxy for the Fed Funds over a term) which is ~4-5bps above the low mark of the past 10 years.

CHART 3 – LOWER LEFT

Source: Bloomberg. FRB. An additional contributor to the decline in Libor has been a notable decrease in Commercial Paper (CP) outstanding, as evidenced here (in $bn). This trend is pertinent, because Libor fixings are based on index contributors’ estimation of their borrowing rates on a mix of interbank borrowing, CP, and Certificates of Deposit (CD’s). Given very large deposits on their books, banks have had little need or incentive to issue CP. Meanwhile, instead of CP, corporates have been issuing bonds out the curve, in order to secure stable funding at historically low rates.

CHART 4 – LOWER RIGHT

Source: Bloomberg. FRB. Emblematic of the massive Fed asset purchase programs initiated to combat the pandemic downturn, this week the Fed reached another historic milestone when its UST holdings, portrayed here (in $trn), surpassed the combined UST holdings of all other global central banks. This past week the Fed bought $21bn of UST’s; these purchases equated to ~$14.4bn in 10-year maturity duration, the most in over a month. Indeed, the Fed is “driving the bus” on the direction of rates and the curve.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates finished unchanged to 2bps lower week-over-week. Heavy T-bill issuance was a feature, as usual, but net supply has been slowing and thereby allowing for easier market absorption. Reversing the trend of recent weeks, Government-only (G.O.) funds experienced ~$8.7bn inflow on the week, although Prime funds lost ~$9bn AUM on the week. Overall supply of short paper has moderated (see color on the previous section), thereby blunting the impact of any outflows.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs, and so this scenario could prove a small challenge. However, with short UST rates at rock-bottom levels, and the Fed likely on hold for a long period, rates may trade in a sideways pattern. Net T-bill issuance has been lower since mid-summer, and Treasury has announced plans to shift issuance out the curve, but a new fiscal relief package may complicate/alter this forecast.

Term Rates

Medium and longer-term advance rates were 1-4bps lower on the week, in a “bull flattener” move. Rates 5-year and shorter remain pinned in a very tight range, and so again it was the portion of the curve past 5-year that led the slight decline in rates. Rates moved lower on a mild “risk-off” tone in the markets, with stocks and credit spread experiencing some struggles.

Next week features a respite from UST auctions. Given the current market climate and Fed guidance, this past week’s 2/5/7-year UST auctions were absorbed without any impact. Corporate issuance should add to its record pace and typical strong September pattern. Attention will remain on the prospects of further relief legislation and certainly also on COVID-19 developments.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.