Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending September 22, 2023.

Economist Views

Click to expand the below image.

Having weathered the latest FOMC and digested its updated interest rate projections, the market will likely next focus on scheduled public appearances by Fed officials for additional color on their current thinking. On the data calendar, the most important report will be the Bureau of Economic Analysis’ comprehensive revision to the National Income and Product Accounts data, which could recast the real GDP and real GDI growth pictures over extended periods of time.

S&P CoreLogic Case-Shiller (SPCLCS) 20-City Home Price Index: Home prices probably edged .5% higher in July across the twenty major metropolitan areas canvassed by SPCLCS, boosting the cumulative rise over the latest five months to 3.9%. Despite the anticipated increase, the average selling price nationwide would remain .3% below that recorded 12 months earlier.

New Home Sales: Mixed data on single-family building permits and housing starts suggest that contracts to purchase newly constructed dwellings retreated by 2.3% to 697K yet remained 9.3% above the 638K posted a year earlier.

Conference Board Consumer Confidence: Available soundings suggest that the consumer sentiment gauge retreated to a 14-month low of 101 in September from the 106.1 level posted in August.

Durable Goods Orders: An anticipated modest decline in commercial jetliner bookings probably left durable goods orders .4% lower last month after the larger-than-expected 5.2% drop suffered in July. Net of the expected weakness in transportation equipment requisitions, hard goods booking likely edged just .1% higher in August, after a .4% prior-month gain. As always, pay particular attention to core nondefense capital goods shipments, excluding jetliner deliveries, for clues to the strength of business equipment spending as the summer quarter progressed.

Comprehensive Revision of National Income & Product Accounts: The Bureau of Economic Analysis will release the initial results of a comprehensive update of the National Income and Product Accounts. GDP and related components will be revised from Q1 2013 forward, while GDI estimates going back to Q1 1979 will be subject to alteration.

Pending Home Sales: Capped by the ongoing dearth of dwellings on the market, contracts to purchase a home probably were little changed in August, following a .9% uptick in July.

Merchandise Trade Deficit: The merchandise trade deficit was likely little changed in August from the $90.9bn shortfall recorded in the previous month.

Personal Income & Consumer Spending: Personal income growth probably quickened in August, climbing by .5% after a modest .2% gain in July. By contrast, consumer spending likely rose by .4% during the reference period following a .8% prior-month increase, implying a slight uptick in the personal saving rate from the 3.5% set in July.

Michigan Sentiment Index: Confidence probably deteriorated in the latter half of September, prompting a downward adjustment to the 67.7 reading recorded in the U of M’s early month canvass.

Federal Reserve Appearances:

- Sept. 25: Minneapolis Fed President Neel Kaskari to participate in a Q&A at University of Pennsylvania’s Wharton School.

- Sept. 28: Chicago Fed President Goolsbee to deliver a speech at the Peterson Institute for International Economics.

- Sept. 28: Federal Reserve Board Chair Powell to host a town hall with educators in-person and from across the country.

- Sept. 28: Richmond Fed President Barkin to give a talk on monetary policy to the Money Marketeers of New York University.

- Sept. 29: Federal Reserve Bank of New York President Williams to speak to the Long Island Association.

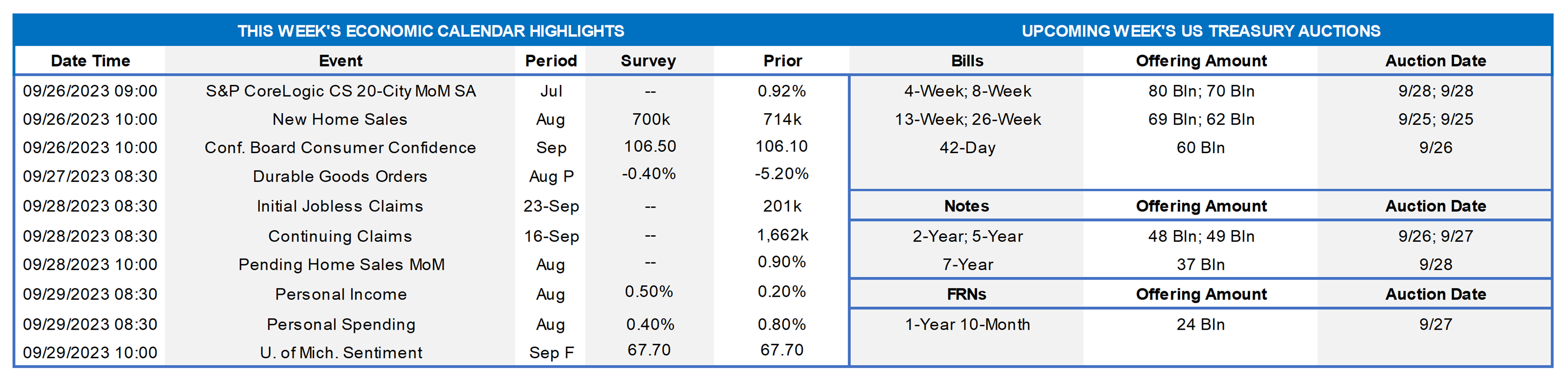

CHART 1 LEFT

Source: Board of Governors of the Federal Reserve System; FHLB-NY. While the Federal Open Market Committee decided unanimously to leave the federal funds rate target range unchanged at 5¼% to 5½% at this week’s meeting, policymakers’ updated projections revealed they believe administered rates will remain higher for longer. As per convention, the Federal Reserve Board released an updated Summary of Economic Projections. The so-called “dot plot” contained significant changes to policymakers’ expectations for the rate target over the next two years. Fed officials continue to believe that one more 25 bps increase in the target range to 5½% to 5¾% may be appropriate in 2023 but boosted their median projections for year-end 2024 and 2025. The median projection year-end 2024 now anticipates a 50 bps reduction from that level to 5% to 5¼%. The median call for year-end 2025 entertains the possibility of a further 125 bps reduction to 3¾% to 4%. The initial median forecast for year-end 2026 calls for an additional 100 bps of cuts to 2¾% to 3%, just slightly above the 2½% expected to prevail over the longer term.

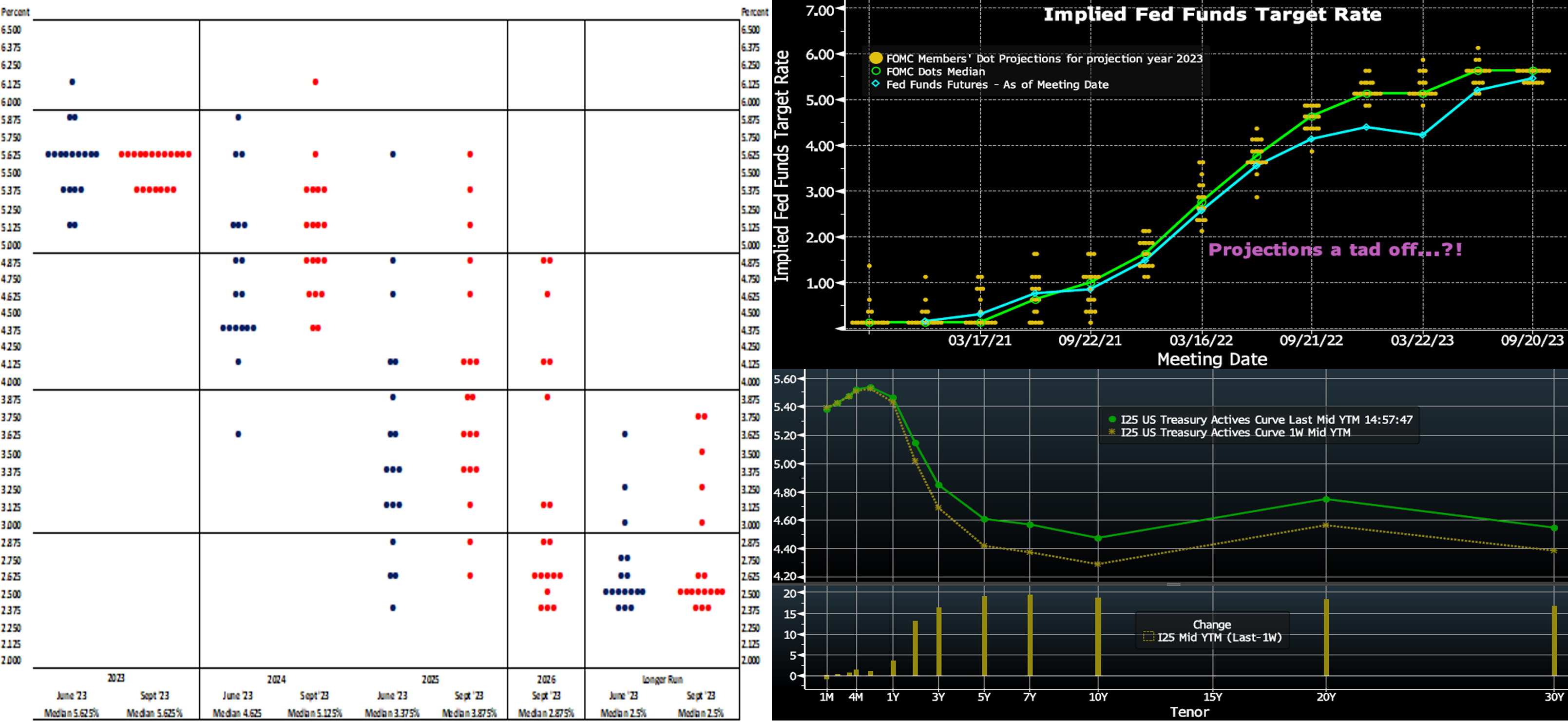

CHART 2 UPPER RIGHT

Source: Bloomberg. Usage of the Fed’s dot plot is a bit akin to driving a car on a mountain range; proceed with caution, as you never know what might be around the bend! There is a reason why risk management and hedging are vital, and that is because no one can accurately predict the future, especially beyond the short-term. Essentially, the dot plot provides context on the Fed but not a clear-cut portrait of what will actually occur, especially in the outer timeframes. Shown here are the Fed’s rate projections (LHS, %) from past FOMC meetings, for year-end 2023. Clearly, the projections of 18-months to a year ago were much lower than what has actually unfolded. Meanwhile, past market pricing (LHS, %, Fed Funds futures) for year-end 2023 consistently traded below the Fed’s projections and so was even further below actual outcomes. At the moment, the market still prices below some of the Fed’s projections; for instance, market pricing for year-end 2024 Fed Funds is ~4.67%, while the Fed’s projection is 5.125%.

CHART 3 LOWER RIGHT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). From last Thursday afternoon to this one, the UST curve marched higher, with corporate bond issuance continuing to add supply pressure but the bulk of the move spurred by the FOMC outcome. Yields were up to 18 bps higher, led by the belly 5 to 7-year sector, and breached and surpassed the multi-year highs previously reached last month. Essentially, the “higher-for-longer hawkish pause” FOMC outcome led the market to reprice higher than its expectations on future rates. In terms of market-implied pricing of the Fed, the 2023 peak Fed Funds rate in December now stands at ~5.47%; essentially, the market is pricing a bit below the Fed’s dot plot with only ~55% chance of another 25 bp hike this year. The years 2024 and 2025 moved higher from a week ago, with the year-end 2024 forward ~21 bps higher, at 4.67%. Please call the desk for further information on market dynamics and/or products.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates were modestly higher by a bp or two from a week ago. The 6-month tenor rose by two bps, as the market edged higher its pricing of another potential Fed hike. Net T-bill supply remains positive, given announcements from the Treasury regarding upsized auctions and issuance needs. But the supply continues to be absorbed well, as Money Market Funds (MMFs) switch from the Fed’s RRP to T-bills with competitive yields. Moreover, FHLB supply has subsided from peak levels of spring, further assisting T-bill interest from investors and thereby containing any severe upward pressure on rates from T-bill supply. MMFs currently stand at or near all-time high AUM levels.

- The upcoming week’s data and Fedspeak should drive direction near-term.

Term Rates

- The longer-term curve, generally mirroring the moves in USTs and swaps, was higher on the week, led by the 3 to 10-year sector’s rise of 16 to 20 bps. The advance curve remains inverted out to 5-year, thereby offering opportunities to extend in duration at lower coupon cost. Kindly refer to the previous section for relevant market color. We continue to experience keen demand for putable advances; call the Member Services Desk to learn more.

- On the UST term supply front, the upcoming week serves 2/5/7-year auctions. Note that UST auctions usually occur at 1 p.m. and can cause volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products.

Price Incentives for Advances Executed Before Noon – In effect as of Tuesday, September 5, 2023 – The FHLB-NY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our Members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the bulletin.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please contact the Member Services Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.