Member Services Desk

Weekly Market Update

Economist Views

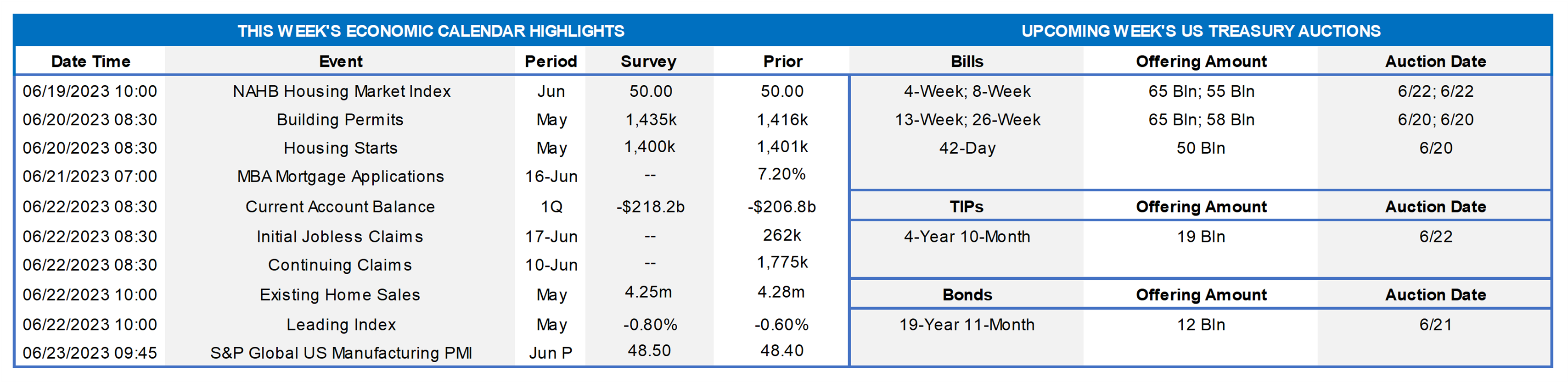

Click to expand the below image.

NAHB Housing Market Index: Home-builder sentiment probably improved marginally in early June, leaving the National Association of Home Builders’ confidence barometer at slightly above the neutral 50-point mark.

Housing Starts & Building Permits: Buoyed by unusually dry and warm weather conditions, the number of building permits issued and housing units started likely rose from their respective seasonally adjusted annual rates of 1.42mn and 1.4mn in April.

Current Account Balance: Driven by the reported narrowing of the gap on international trade in goods and services, the current account deficit likely narrowed by $12.7bn to $194.2bn during Q1 – the smallest shortfall since the winter of 2021.

Jobless Claims: Initial claims for unemployment benefits likely remained in a 250-275K range during the filing period ended June 16. Keep an eye on continuing claims for signs that furloughed employees may be having a tougher time finding work.

Existing Home Sales: Home-purchase contract signings over the March-April span suggest that closings on existing dwellings slipped by 1.5% to a four-month low SAAR of 4.22mn in May. With the number of homes on the market expected to jump by 11.5% to 1.16mn on a not seasonally adjusted basis during the reference period, the months’ supply at the estimated sales pace probably edged four ticks higher to 3.3 months.

Index of Leading Economic Indicators (LEI): The Conference Board’s augur of prospective economic activity is expected to have fallen by 0.8% in May, after a 0.6% drop in April. That projection, if realized, would mark the LEI’s 14 consecutive monthly decline.

Federal Reserve Appearances:

- June 20 St. Louis Fed President Bullard to speak at the Barcelona School of Economics Summer Forum.

- June 20 NY Fed President Williams to speak at the banks Governance and Culture Reform Conference.

- June 21 Fed Chair Powell to deliver semi-annual Monetary Policy Report to the House Financial Services Committee.

- June 21 Chicago Fed President Austin Goolsbee to speak at the Wall Street Journal Global Food Forum in Chicago.

- June 22 Federal Reserve Chair Powell to deliver semi-annual Monetary Policy Report to the Senate Banking Committee.

- June 22 Cleveland Fed President Mester to speak about the outlook at the bank’s annual Policy Summit.

- June 22 Richmond Fed President Barkin to speak to Richmond chapter of the Risk Management Association.

- June 23 St. Louis Fed President Bullard to speak at the Central Bank of Ireland on optimal macroeconomic policies.

- June 23 Cleveland Fed President Mester to deliver closing remarks at the bank’s annual Policy Summit.

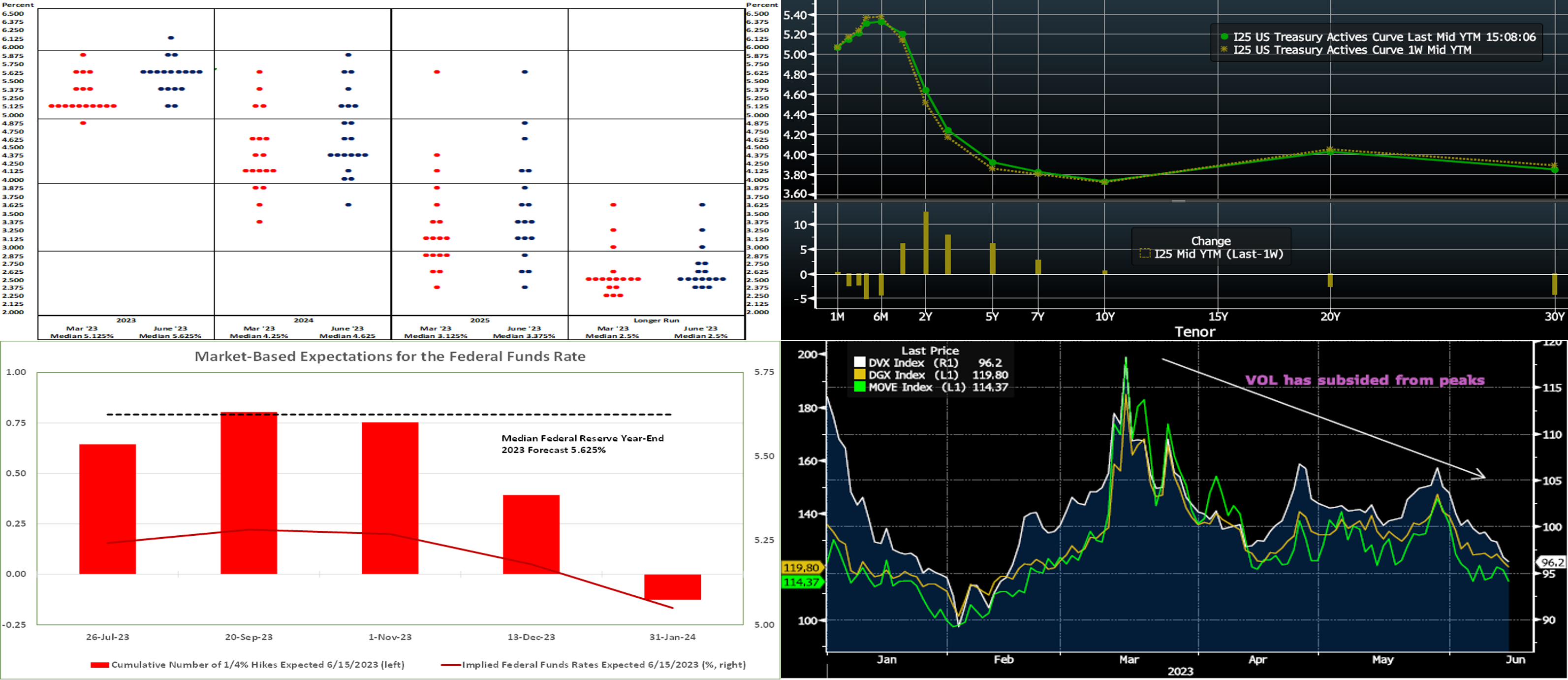

Source: As per FOMC convention, the Fed released its updated Summary of Economic Projections, or SEP. The so-called “dot plot”, in line with the “hawkish pause” theme, contained significant changes to policymakers’ expectations for the federal funds rate target range through the end of 2025. Officials now anticipate a resumption of rate hikes that will raise the target range by an additional 50 bps to 5½% to 5¾% by the end of 2023 (see/enlarge chart). The median projection for year-end 2024 now anticipates a percentage-point reduction from that level to 4½% to 4¾%. The median call for 2025 entertains the possibility of a further 125 bps reduction to 3¼% to 3½%. While the dots have drifted upward from the March SEP, Fed officials’ median expectation for the nominal federal funds rate over the longer term remains at 2½%.

CHART 2 UPPER RIGHT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (bps). From last Thursday afternoon to this one, UST term yields finished higher and flatter again, with 2 to 5-year yields up by ~7 to 14 bps. The Fed’s “hawkish pause” partly spurred the move, as the market backtracked further on its pricing of rate cuts in 2023. As of this writing, the market prices the odds of a 25 bps hike at the July 27th FOMC at ~70%. The year-end Fed Funds forward is ~5.19%, ~19 bps higher than a week ago. Economic data has been mixed, with signs of slowing inflationary forces and a loosening of labor markets. Such conditions would please the Fed if a “soft landing” can be achieved, but it clearly remains on guard for inflationary embers. The market’s repricing of the Fed has served to push the Fed’s BTFP rate higher, thereby now making our 2-month-and-in advance tenors a better alternative. Please call the desk for further information on market dynamics and/or products.

CHART 3 LOWER LEFT

Source: Bloomberg; FHLB-NY. Shown here, and illuminating the above color, is the latest (Thursday afternoon) market-implied Fed Funds rate expectations (LHS is number of cumulative 25 bps moves shown in bars, RHS is rate shown via red line, both derived from Fed Funds futures and swaps curves). The market’s pricing of the Fed path has shifted notably upwards in the past month. Indeed, after the May FOMC, there had been a slight chance of an ease priced for this past Wednesday’s FOMC! Yet the market currently still “underprices” the Fed’s dot plot. While the Fed’s year-end 2023 median forecast is 5.625%, the market’s pricing is ~5.18%. Looking further, not shown here, the dot plot has 4.625% for year-end 2024, whereas the market prices at ~3.65%.

CHART 4 LOWER RIGHT

Source: Bloomberg. Shown here are three indices of implied volatility (“vol”), a main component of options pricing, year-to-date. The DGX (LHS, tan) and MOVE (LHS, green) measure the implied vol of short-dated options on swaps and USTs, respectively. The DVX index (RHS, white) tracks vol on longer-dated options on swaps. As seen here, while not back at the lows of 2023, implied vol has declined markedly since the peaks of March. This decline in vol, all else equal, reduces the cost of options. For those considering caps for hedging or regulatory purposes, this move is beneficial. Kindly contact the desk for more information and/or pricing of products with embedded caps.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates are mostly lower by 3 to 5 bps from a week ago. In prior weeks, the debt ceiling issue pressured T-bill yields higher which, in turn, dragged ours and other short-end rates higher too. But the debt ceiling agreement brought relief and has allowed short-tenor yields to decline in the past two weeks. Additionally, FHLB supply has subsided from previous peak levels of spring. Net T-bill supply remains robust, as Treasury rebuilds its account post-debt ceiling agreement; thus far, it has been absorbed well, as Money Market Funds switch from the Fed’s RRP to the Treasury’s new short tenor offerings with slightly higher yields.

- With the FOMC having come and gone, economic data and Chair Powell’s Congressional appearance will be the prime drivers of rates this upcoming week.

Term Rates

- The longer-term curve bear flattened from last week, generally mirroring moves in USTs and swaps. The 1 to 4-year zone was up by ~7 to 8 bps, 5-year up ~ 3 bps, and longer tenors were unchanged to down a few bps. Kindly refer to the previous section for relevant market color. The advance curve remains inverted out to 5-year, thereby offering opportunities to extend in advance duration at lower coupon cost.

- On the UST term supply front, the upcoming holiday-shortened week serves a 20-year nominal and a 10-year TIPS auction. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce the reintroduction, after a temporary suspension owing to Libor-cessation, of the Putable Advance, Fixed-Rate with SOFR Cap Advance, and ARC with SOFR Cap/Floor Advance. The Callable Advance continues to be offered. This expansion of the product menu will provide members with more options and flexibility for the management of funding and/or hedging needs.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please contact the Member Services Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.