Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending March 31, 2023.

Economist Views

Click to expand the below image.

Please note that the Weekly Update will return on Friday, April 14th.

Ripping another page off the calendar, market participants will face a hectic economic release calendar this week. Labor market updates are expected to show that the hiring environment remains exceptionally strong, despite recent press reports of layoffs. Manufacturing probably ebbed further as the winter quarter ended while the nationwide service-producing expansion continued apace. The median projection for Q1 real GDP growth currently stands at 1% annualized, but the range of projections remains quite wide, following the 2.6% gain posted during the quarter of 2022. A duo of non-voting district Federal Reserve Bank presidents are scheduled to provide their thoughts on the economic outlook and monetary policy.

Construction Spending: The nominal value of new construction put-in-place probably was unchanged in February, after a modest .1% dip in January.

ISM Manufacturing Activity Index: The nationwide slump in manufacturing activity likely marked its fifth month in March. District Federal Reserve Bank canvasses and other surveys suggest that the Purchasing Managers Index improved marginally to 48.3% from 47.7% in the previous month.

JOLTS Job Openings: A bounce back in online help-wanted postings suggests that nationwide job openings rebounded by 185K to 11mn in February, reversing almost half of the 410K drop witnessed in January. At an estimated 5.07mn, the excess of vacant positions nationwide would represent 1.85 jobs per unemployed person.

International Trade Balance: April 5th – A larger shortfall on merchandise trade probably widened the international trade deficit to $68.5bn in February from $68.3bn in the preceding month.

ISM Services Activity Index: Available surveys suggest that service-producing activity expanded for a third straight month in March, with the Institute for Supply Management’s barometer clocking in at 55%, little changed from February’s 55.1% reading.

Jobless Claims: Initial claims for unemployment benefits probably remained below 200K during the filing period ended April 1. Keep an eye on continuing claims for any signs that recently furloughed employees may be having a tougher time finding work.

Employment Situation Report: Labor market conditions probably remained exceptionally tight in March. Indeed, nonagricultural establishments likely added 300K net new workers, almost matching the 311K jump witnessed in February. The civilian unemployment rate is expected to hold steady at 3.6% during the reference period, just slightly above the half-century low of 3.4% plumbed in January. Average hourly earnings are expected to have quickened last month, rising by .3% after February’s .2% gain. If realized, that result would place nominal compensation 4.3% above the $31.33 per hour recorded a year ago.

Federal Reserve Appearances:

- Apr. 4 Cleveland Fed President Loretta Mester to speak to the Money Marketeers of New York University.

- Apr. 6 St. Louis Fed President James Bullard to discuss the economic outlook and monetary policy in Little Rock, AR.

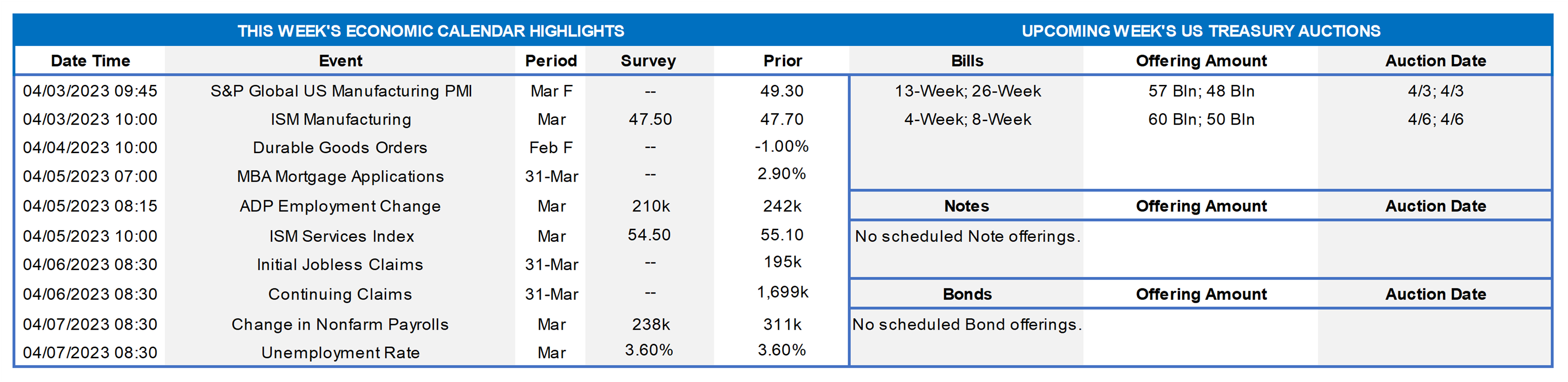

CHART 1 UPPER LEFT

Source: Bureau of Labor Statistics; NBER; FHLBNY. Notes: Blue-shaded areas denote recessions; orange-shaded highlights current economic expansion. Heading into the BLS’ update on the employment situation in March, it is instructive to assess hiring conditions in the FHLB-NY coverage area. Almost two years since the economy bottomed in April 2020, the District has finally recouped all but a fraction of the 2.83mn lost to the pandemic. Hiring has varied widely across segments, however. Owing to the relatively higher concentration of service-producing positions, nonfarm payrolls in New York State last month remained almost 157K below their February 2020 peak. At almost 822K, headcounts in the Garden State now stand 92K above their pre-pandemic high. Puerto Rico has experienced a surge in job growth since the pandemic recession ended in April 2020. Indeed, the island’s headcount has swelled by a whopping 60K positions or by ~53% since that time, with 83% of employers reporting difficulties finding talent. Labor market conditions remain most challenging in the U.S. Virgin Islands which have failed to recover any of the positions lost to the COVID-19 crisis.

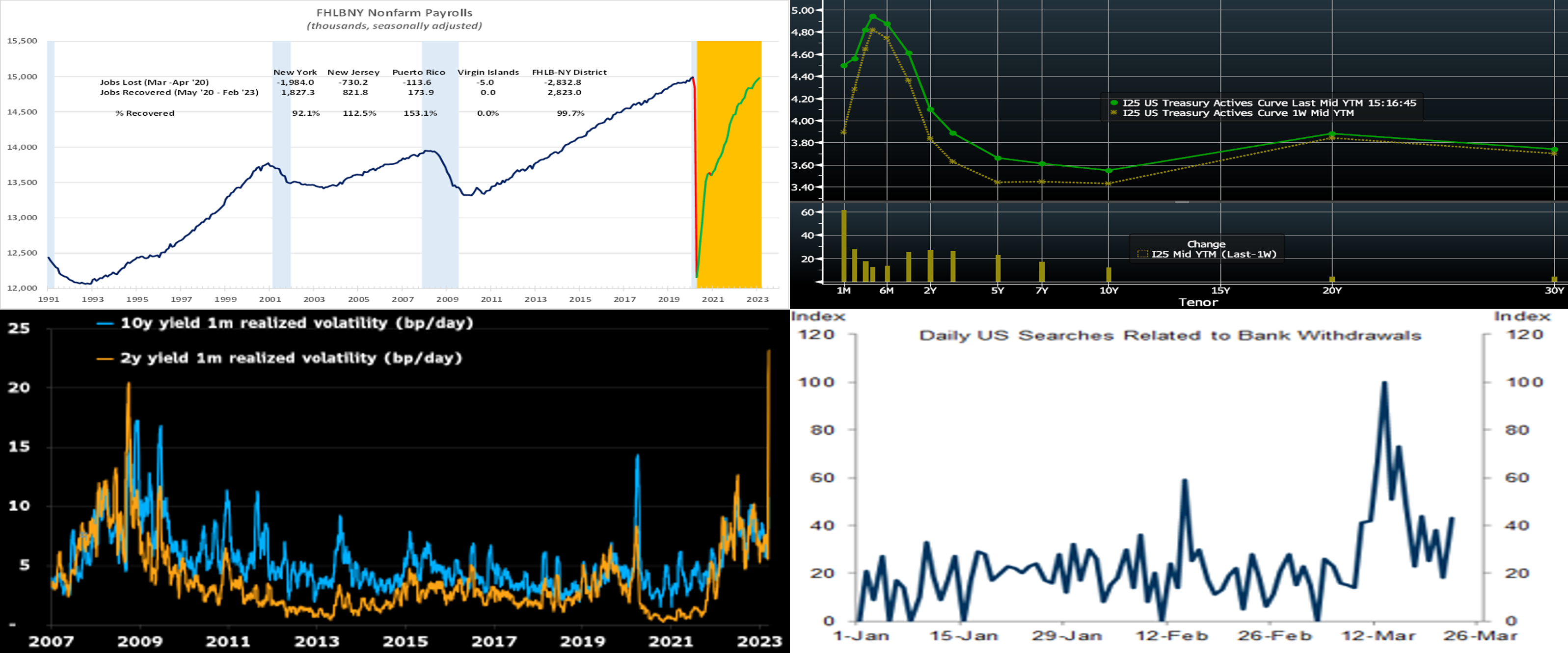

CHART 2 UPPER RIGHT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (bps). From last Thursday afternoon to this, UST yields were higher, with the 2 to 3-year zone up by ~27 bps to lead the move. The market backtracked further on pricing of potential Fed easing later this year, and hence the notable rise in yields out to 5-year. Economic data during the week was fair, and banking-related market turmoil largely ebbed, thereby adding further impetus to the repricing of the Fed’s prospective path. As of this Thursday afternoon’s writing, the odds of a 25 bps hike at the May 3rd FOMC are ~55%, and May, at ~4.95%, is the peak rate on the short-end forward curve. The year-end forward is ~4.37%, so Fed easing is still priced in but less so than in prior weeks. We continue to see good demand from the membership in term space, with a notable increase in Symmetrical-feature advances. Please call the desk to learn more about products, rate levels, and market dynamics.

CHART 3 LOWER LEFT

Source: Bloomberg. Here is some historical perspective on the whipsaw rate moves of the past month. Shown here is the trailing 1-month realized volatility (LHS, bps/day, essentially a measure of the volatility actually incurred) of the UST 2 and 10-year yields. The former clearly stands out as historically high, even relative to the Great Financial Crisis and pandemic periods. A main reason for the recent wild ride of the 2-year yield is that it incorporates and is most impacted by changes in the market’s pricing of the prospective Fed policy path. Although volatility has notably tempered over the past week, it would be wise to stay alert for ongoing moves in this sector.

CHART 4 LOWER RIGHT

Source: Bloomberg. Federal Reserve, GS Data Works, Google Trends, Goldman Sachs Research. Here is a somewhat different data-point on the recent banking industry turmoil. Google Trends search data compiled by the GS Data Works team show that the large initial increase in the public focus on banks and search trends related to bank withdrawals initially spiked but have receded in the past ten days or so. Nonetheless, a takeaway might be that this episode has increased public awareness and knowledge of bank accounts, deposit rates, and alternatives which may, in turn, heighten the risk of increased outflows, higher betas, and higher overall borrowing costs for banks.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates were mixed week-over-week from last Thursday afternoon. While the very shortest tenors declined 4 to 7 bps, 2-month-and-out were unchanged to up a bp or two. The severe market turbulence of a few weeks ago has abated and thereby allowed for much better FHLB issuance levels, and in turn, lower advance level, in the shorter tenors. Indeed, Money Market Fund AUM levels continue to rise, and these vehicles invest in the Fed’s RRP as well as T-bills and agency paper. Please see the previous section for information on market pricing of the Fed’s policy path.

- Economic data should dictate direction this week. Although quieter the past week, given the recent banking and financial market turmoil, rates could resume a volatile nature on any sudden news.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was 13 to 32 bps higher, Thursday-to-Thursday afternoon. The 2 to 3-year led the move, with longer tenors higher by progressively less out the curve. Kindly refer to the previous section for relevant market color. The advance curve remains inverted out to 5-year, thereby offering opportunities to extend in advance duration at lower coupon cost.

- On the UST term supply front, this upcoming week serves as a reprieve from auctions. Corporate bond issuance should continue to ratchet higher, as market turmoil has ebbed from prior weeks. The key data release will likely be Friday’s jobs report. Please contact the Member Service Desk for further information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce the reintroduction, after a temporary suspension owing to Libor-cessation, of the Putable Advance, Fixed-Rate with SOFR Cap Advance, and ARC with SOFR Cap/Floor Advance. The Callable Advance continues to be offered. This expansion of the product menu will provide members with more options and flexibility for the management of funding and/or hedging needs.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please contact the Member Services Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.