Member Services Desk

Weekly Market Update

Economist Views

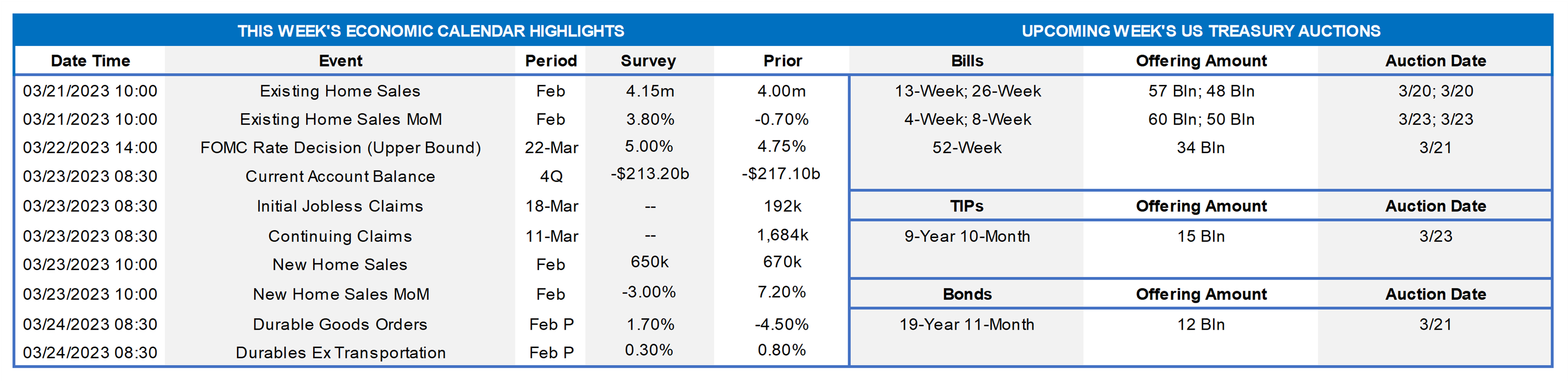

Click to expand the below image.

Existing Home Sales: Home-purchase contract signings over the December-January span suggest that closings on existing dwellings jumped by 4.8% to a four-month high seasonally adjusted annual rate of 4.19mn in February, stemming the 36.9% dive witnessed over the prior 12 months. While the number of homes on the market is expected to hold steady at 980K during the reference period, the months’ supply at the estimated sales pace would move one tick lower to 2.8 months.

Current Account Balance: Reflecting the reported narrowing of the gap on international trade in goods and services, the current account deficit is expected to have close to $213.2bn in Q4 from the $217.1bn shortfall posted last summer.

Jobless Claims: Initial claims for unemployment benefits probably clocked in nearly 200K during the filing period ended March 18. Keep an eye on continuing claims for early signs that recently furloughed employees may be having a tougher time finding work.

New Home Sales: Reported increases in single-family building permits and housing starts suggest that contracts to purchase a newly constructed dwelling climbed by 4.5% to an 11-month high seasonally adjusted annual rate of 700K in February.

Durable Goods Orders: Durable goods orders are expected to have rebounded by 1.7% in February, reversing a portion of January’s aircraft-led 4.5% decline. Excluding ever-volatile transportation equipment requisitions, “hard goods” bookings likely climbed by .4% during the reference period, building on the prior month’s .8% gain. Pay particular attention to core nondefense capital goods shipments for clues to the pace of business equipment spending during the current quarter.

Federal Reserve Appearances:

- Mar. 21-22 Federal Open Market Committee meeting.

- Mar. 22 FOMC to issue monetary policy statement.

- Mar. 22 Fed Chair Powell to hold post-FOMC meeting press conference.

CHART 1 UPPER LEFT

Source: Bloomberg, Federal Reserve; FHLBNY. Market expectations for the outcome of this week’s upcoming FOMC meeting have changed markedly over the past two weeks. Following the hawkish interpretation of Federal Reserve Chair Powell’s semi-annual report on monetary policy to Congress, market participants were pricing in yet another 25 bps hike in the federal funds rate target range with complete certainty, with odds of a larger 50bps move at ~70%. Since then, turmoil in the commercial banking sector has led the market, via futures/swaps pricing, to pare the probability of just the 25 bps hike to ~80%. Moreover, as of this writing, market participants believe that policymakers may begin cutting the federal funds rate target range as early as the June 14th meeting.

CHART 2 UPPER RIGHT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (bps). From last Thursday afternoon to this, it has been a week to remember! As of this writing and still constantly moving, UST yields were notably lower than the week prior. The 2-year was the clear leader, down ~75 bps, while 5-year was ~45 and 10-year ~33 bps lower. The Fed was in blackout mode, and data took a backseat to the main market-mover of the week, namely the banking sector news and turmoil. Rates markets, to put it simply, were “all over the place” (see following charts/color). For the March 22nd FOMC, the market as of now prices ~77% probability of a 25 bps hike, much lower pricing than a week prior. The market’s pricing for end-2023 is now ~4.16%, down 128 bps from last week’s 5.44%! The market, moreover, has priced the peak rate at ~4.93% for this spring, to be followed by cuts in the subsequent months; this pricing is a massive change from a week prior. The volatility and lower rates spurred good demand from the membership in term space, and we encourage members to engage with us on levels and market intelligence.

CHART 3 LOWER LEFT

Source: Bloomberg. Here is a snapshot of the massive volatility witnessed over the past week. Shown is the 2-year SOFR swap rate (RHS, %), in 15-minute increments, since the morning of March 10. With an early morning March 10th high of ~4.92% to an early morning March 15th low of ~3.62% and a level of ~4.15%, as of this writing, coining the week “volatile” would be an understatement. Naturally, the volatility proved challenging and impacted our advance levels, but, as always, FHLB-NY stands as your strong partner for ready liquidity in both calm and tumultuous times.

CHART 4 LOWER RIGHT

Source: Bloomberg. The large market moves, in turn, pushed implied volatility in options pricing dramatically higher, thereby markedly increasing the cost of interest rate option products. Shown here is the ICE BofA MOVE index, a yield curve weighted index of the normalized implied volatility (RHS) on 1-month expiry UST options. The spike higher over the past week is clear within the red rectangle area. As of Thursday afternoon, the index was retreating a bit from the lofty level of this chart, as a few “calming” banking sector news reports hit the wires.

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates were higher by ~6 to 30 bps, week-over-week, from last Thursday afternoon. Tenors 1-month-and-in led the move, as the FOMC meeting looms close and market liquidity demand increased during the tumultuous week. The 2-month-and-out tenors were ~8 to 12 bps higher. Please see the previous section for more specific Fed-pricing color.

- Given the recent banking and financial market developments, rates may remain volatile, especially with this week’s looming Fed decision outcome more uncertain.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, was lower by ~21 to 75 bps, Thursday-to-Thursday afternoon. The 2-year led the move, down by ~75 bps, while 5-year was ~40 and 10-year ~21 bps lower. Kindly refer to the previous section for relevant market color. The advance curve remains inverted out to 5-year, thereby offering opportunities to extend in advance duration at lower coupon cost.

- On the UST term supply front, this upcoming week serves a 20-year nominal and a 10-year TIPS auction. Banking and Fed headlines will likely rule the week. Kindly call the Member Services Desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce the reintroduction, after a temporary suspension owing to Libor-cessation, of the Putable Advance, Fixed-Rate with SOFR Cap Advance, and ARC with SOFR Cap/Floor Advance. The Callable Advance continues to be offered. This expansion of the product menu will provide members with more options and flexibility for the management of funding and/or hedging needs.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please contact the Member Services Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.