Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending February 9, 2024.

Economist Views

Click to expand the below image.

The market will contend with a crowded economic release calendar this upcoming week. While the FOMC’s focus on reining in inflation suggests that the January update on consumer prices will be the marquee report, last month’s soundings on retail sales, industrial production, and residential construction activity could have material impacts on current-quarter real GDP growth projections. While the range of tracking estimates is wide, those from the Atlanta and New York Fed suggest no slowdown from Q4’s above-trend 3.3% annualized pace. A quintet of Federal Reserve officials – including three FOMC voters – will give their thoughts on the outlook.

NFIB Small Business Optimism Index: The National Federation of Independent Business’ sentiment gauge probably climbed to a 20-month high of 93 in January from 91.9 in the preceding month.

Consumer Prices Index: Capped by an anticipated decline in retail energy costs, the CPI likely edged just .1% higher in January, following a larger-than-expected .3% increase in December. Lower motor vehicle costs during the reference period may have limited the rise in the so-called core CPI excluding volatile food and energy components to .2%, after a pair of .3% gains in November and December. Those projections, if realized, would place the overall and core CPIs 2.9% and 3.7% above their respective year-ago levels – both still well above the Federal Reserve’s desired 2% target.

Empire State Manufacturing Survey: Manufacturing activity in New York State probably contracted for a third straight month in February, albeit at a slower pace than in January. The net percentage of respondents reporting an increase in general business activity is expected to clock in at -10%, after the abysmal -43.7% reading posted in the prior month.

Retail & Food Services Sales: Retail and food services sales likely edged .1% higher in January, following a better-than-expected .6% prior-month gain. Excluding an anticipated .7% decline in auto-dealer revenues, retail purchases are expected to have climbed .3% higher during the reference period after a .4% increase in December. As always, market participants will be paying attention to so-called “control” sales, excluding auto, building materials, and gasoline purchases in this week’s report for clues to the pace of current-quarter consumer spending. Barring any prior-month revisions, a .3% increase would leave core purchases in January 3.9% annualized above their October-December average, slightly slower than Q4’s 4.4% annualized gain.

Industrial Production & Capacity Utilization: Output at factories, mines, and utilities probably climbed by .7% in January, following a modest .1% gain in December. With output gains expected to eclipse additions to productive capacity during the reference period, the overall operating rate likely moved four ticks higher to a four-month high of 79%.

NAHB Housing Market Index: The confidence gauge probably moved four points higher to 48 in February – just two points shy of the 50-point mark associated with neutral conditions.

Housing Starts & Building Permits: Buoyed by generally favorable weather conditions, the number of new housing units started, and building permits issued likely rose by .7% and 1.8%, respectively, to seasonally adjusted annual rates of 1.47mn and 1.52mn in January.

Michigan Sentiment Index: Upbeat appraisals of overall economic conditions likely pushed the gauge 3.5 points higher to 82.5 in February – the rosiest reading since the 85.5 recorded in June 2021.

Federal Reserve Appearances:

- Feb. 14 Chicago Fed President Goolsbee to participate in a Q&A event at the Council on Foreign Relations in New York.

- Feb. 14 Federal Reserve Vice Chair for Supervision Barr to speak at the NABE conference in Washington.

- Feb. 15 Atlanta Fed President Bostic to speak on the economic outlook to the Money Marketeers of New York University.

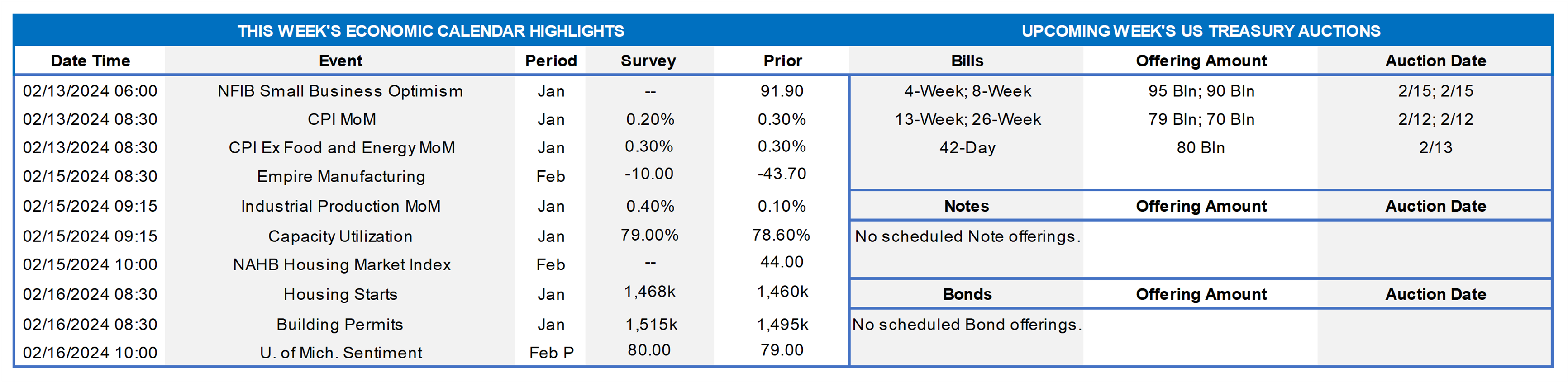

CHART 1 UPPER LEFT and CHART 2 UPPER RIGHT

Source: Federal Reserve Board; National Bureau of Economic Research; FHLB-NY. Note: Shaded areas denote recessions. Released this past week, the Federal Reserve Board’s January 2024 Senior Loan Officer Opinion Survey on Bank Lending Practices, or SLOOS, revealed a general tightening of standards across all loan categories continued in Q4 2023. For loans to households, as seen in these charts, banks reported tighter standards for all categories of residential real estate loans over the final three months of 2023 amid an accelerated weakening in demand. In addition, banks reported tighter standards and weaker interest in home equity lines of credit. Regarding loans to businesses, survey respondents, on balance, reported tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes. Furthermore, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories. A bit of a “silver lining” was that while banks, on balance, reported having tightened lending standards further for most loan categories in Q4, lower net shares of banks reported tightening lending standards than in the prior quarter.

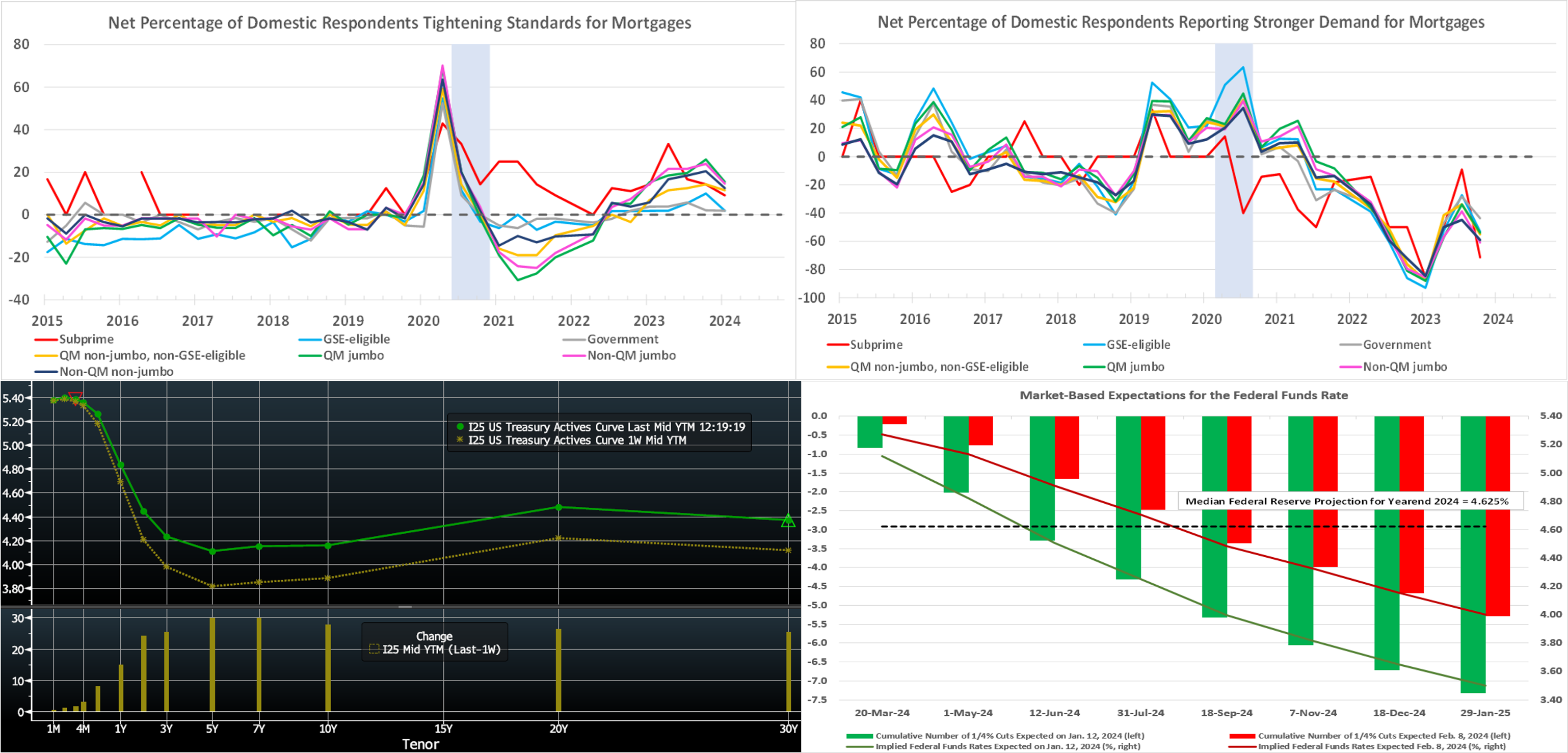

CHART 3 LOWER LEFT

Source: Bloomberg. Top pane is yield (LHS, %), bottom pane is change (LHS, bps). From last Thursday afternoon to this one, the UST curve notably rose, led by the belly of the curve. The 2- to 10-year sector moved 25 to 30 bps higher, with the 5-year rising the most. Much of the upward move occurred last Friday in the immediate aftermath of the strong jobs report release. This week’s record slate of new UST supply also added upward pressure but was absorbed relatively well. Meanwhile, various Fed members this past week offered comments on the economy and policy. Fedspeak has consistently indicated that, while rate cuts are likely on the horizon, the Fed is in no rush to lower rates and wants to see sustained and broad disinflation before doing so. In terms of market-implied pricing of the Fed, the chance of a 25 bps cut in March is ~17%, down from ~39% a week ago. The year-end 2024 forward is ~4.15%, roughly 30 bps higher than last Thursday. The market prices for a cumulative total of ~118 bps of cuts by the end of 2024, compared to ~148 bps a week ago.

CHART 4 LOWER RIGHT

Source: Bloomberg. Further on the above dynamics, here can be seen the recent recalibration of the market’s pricing of Fed policy. Shown here is current pricing (Red, LHS is number of cuts, RHS %) vs. that of January 12th (Green) when the market was at its most exuberant in pricing near-term rate cuts. Stronger-than-expected data, a moderately toned FOMC outcome on January 31st, and “we’re in no rush to ease” Fedspeak have all led the market to back off its previous pricing of ~80% chance of a 25 bps cut in March and push out the timeline and extent of potential subsequent cuts. The probability of a March cut is now ~17%. For the year 2024, moreover, the market has pared back its pricing to the equivalent of ~4.7 cuts of 25 bps from the January 12th pricing of ~6.5 cuts!

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates were modestly higher week-over-week. The shortest tenors were a bp or two higher, but the 5 and 6-month tenors were up by 3 and 5 bps, respectively. The market’s repricing of the timing of rate cuts contributed to the changes. Net T-bill supply remains positive, given announcements from the Treasury regarding upsized auctions and issuance needs. But the supply continues to be absorbed well as Money Market Funds (MMFs) switch from the Fed’s RRP to T-bills with competitive yields. Moreover, MMFs currently stand at or near all-time high AUM levels.

- The markets will continue to monitor Fedspeak and data, with the CPI report likely of most consequence.

Term Rates

- The longer-term curve, generally mirroring moves in USTs and swaps, moved notably higher week-on-week. The 2- to 10-year sector is 25 to 31 bps higher than last Thursday, with the longer tenors leading the way. Please refer to the previous section for color.

- On the UST term supply front, the upcoming week serves as a reprieve from auctions. Note that UST auctions usually occur at 1pm and can occasionally cause volatility around that time. Please contact the Member Services Desk for further information on market dynamics, rate levels, or products.

Grant funding under the FHLBNY 2023 Small Business Recovery Grant (SBRG) Program has begun and some funds are still available. The SBRG Program provides grant funds to benefit FHLB-NY members’ small business and non-profit customers. Please visit the SBRG webpage.

Price Incentives for Advances Executed Before Noon: In effect as of Tuesday, September 5, 2023, the FHLBNY is pleased to now offer price incentives for advances executed before Noon each business day. These pricing incentives offer an opportunity to provide economic value to our members, while improving cash and liquidity management for the FHLBNY. For further details, kindly refer to the Bulletin.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Services Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.