Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week ending January 6, 2023.

Economist Views

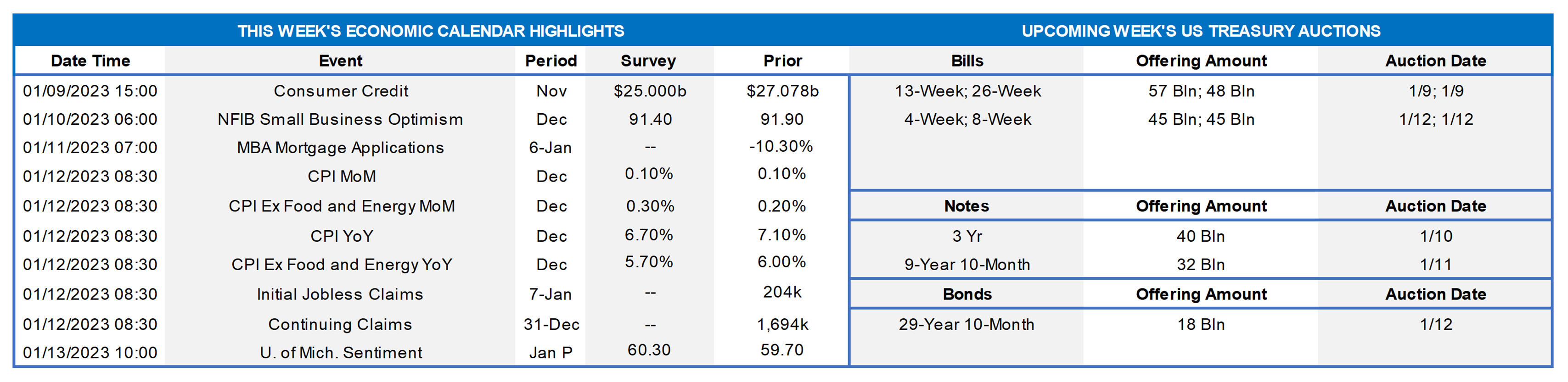

Click to expand the below image.

Having weathered the Bureau of Labor Statistics’ update on labor market conditions at year-end, the attention of market participants will turn to the inflation side of the Federal Reserve’s dual mandate. The Street is anticipating yet another 0.1% uptick in the Consumer Price Index (CPI) in December and a 0.3% rise in the core inflation gauge excluding volatile food and energy components, but more benign readings may once again be in store, especially if recent declines in apartment rental rates and home prices filter into the reported results. Traders and investors are almost equally divided as to whether another half-percentage-point hike in the federal funds target range or a more modest 25-basis-point increase will be delivered at the next Federal Open Market Committee meeting. This week, a quartet of Federal Reserve officials will also provide their views on the economic outlook and monetary policy.

Consumer Credit: Consumer installment credit probably expanded by $25 billion in November, almost matching the $27.1 billion takedown posted in the previous month.

NFIB Small Business Optimism Index: Echoing the improvement in consumer confidence at yearend, the National Federation of Independent Business’ sentiment gauge likely jumped to a ten-month of 95.0 in December from 91.9 in November.

Jobless Claims: Initial claims for jobless benefits probably returned to the 225-245K range during the period ended January 7, after the holiday capped 204K filings posted in the previous week. Continuing claims likely moved back above the 1.7 million mark during the week ended December 30 suggesting that recently furloughed employees may be having a more difficult time finding work.

Consumer Prices: Pared by a projected falloff in retail gasoline costs, the CPI likely dipped by 0.2% in December – the first decline in the headline inflation gauge since May 2020. Smaller hikes in shelter costs, combined with anticipated reductions in used motor vehicle prices and airline passenger fares, probably capped the advance of the core CPI at 0.2% during the reference period, following a similar uptick in November. Those projections, if realized, would place the overall and core CPI inflation gauges 6.3% and 5.6% above their respective December 2021 levels, both still well above the Federal Reserve’s desired 2% target.

University of Michigan Sentiment Index: Buoyed by healthy labor market conditions and signs of receding inflation, the University of Michigan’s consumer confidence barometer likely climbed to 61 in early January –the rosiest reading since the 65.2 posted in April.

Federal Reserve Appearances:

- Jan. 9 Atlanta Fed President Raphael Bostic to take part in a moderated discussion hosted by the Rotary Club of Atlanta.

- Jan. 10 Fed Chair Powell to take part in a panel discussion on central bank independence at an international symposium.

- Jan. 12 Philadelphia Fed President Harker to discuss the economic outlook with the Main Line Chamber of Commerce.

- Jan. 12 St. Louis Fed President James Bullard to discuss the economy and monetary policy with the Wisconsin Bankers Assn.

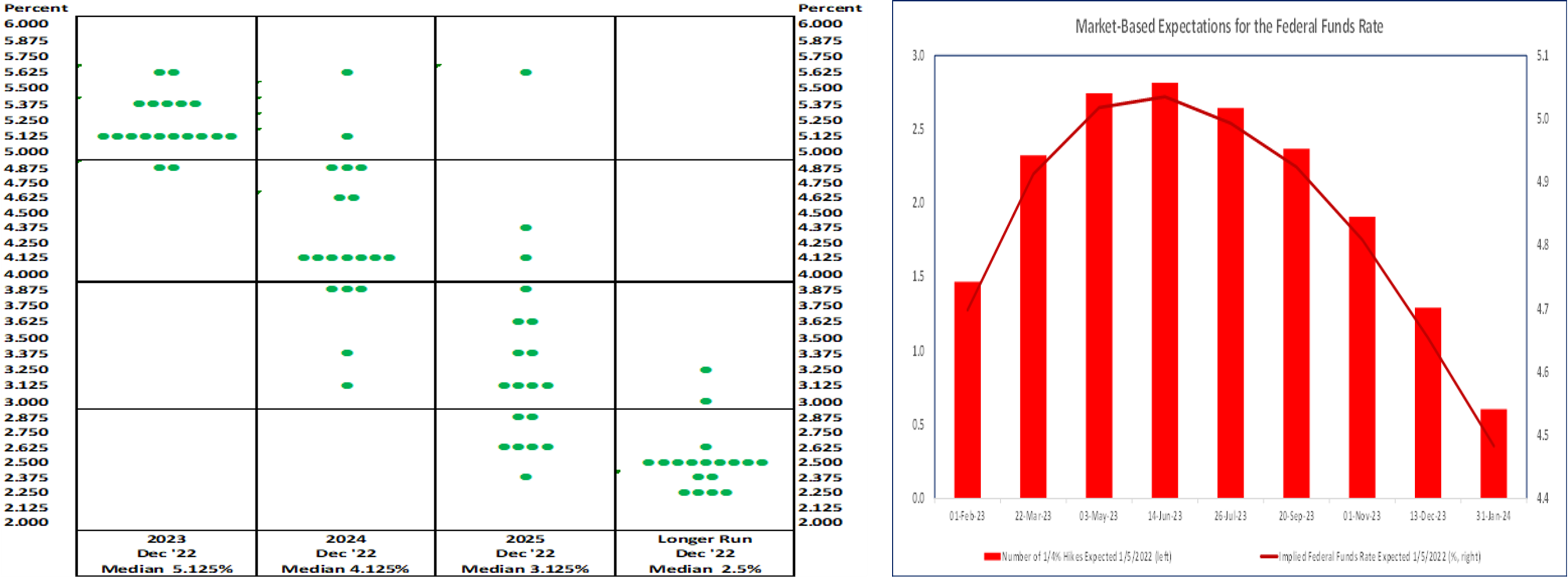

CHART 1 Left and CHART 2 Right

Sources: Bloomberg, Board of Governors of the Federal Reserve System and FHLB-NY

Federal Reserve officials and market participants have decidedly different views on the prospective path of monetary policy over the course of this year. In the effort to slow aggregate demand and rein in stubbornly high inflation, the median forecast of the Nation’s central bankers calls for a further 75 basis points of tightening, resulting in a year-end federal funds rate target range of 5-5.25% (see chart above, left). Traders and investors also believe that additional increases probably are in store over the first six months of 2023 – but feel that the onset of an economic recession will prompt the Federal Open Market Committee to reverse course, resulting in a federal funds rate of approximately 4.5% at the end of December (see chart above, right).

FHLBNY Advance Rates Observations

Front-End Rates

- Short-end rates have been relatively flat over the past few weeks, please see the prior slide for more Fed-pricing color. Rates in the 4 to 6-month zone were minimally changed, as the Fed-pricing out the curve remained roughly the same as last week, and typical year-end “safety inflows” to short-end investments have occurred.

- Given the Fed’s tightening and data-dependent posture, rates will remain responsive to economic data the upcoming weeks.

Term Rates

- The longer-term curve finished flat to lower from a week ago. Kindly refer to the previous section for relevant market color. The advance curve remains inverted out to 5-year, thereby offering opportunities to extend in advance duration for minimal or lower coupon cost. The flat curve and still relatively high implied volatility environment also can serve to make putable advances more compelling.

- On the UST term supply front, this upcoming week serves a 3 & 10y notes and 30y bonds. Kindly call the Member Service Desk for information on market dynamics, rate levels, or products.

Product Alert: FHLBNY is pleased to announce the reintroduction, after a temporary suspension owing to Libor-cessation, of the Putable Advance, Fixed-Rate with SOFR Cap Advance, and ARC with SOFR Cap/Floor Advance. The Callable Advance continues to be offered. This expansion of the product menu will provide members with more options and flexibility for the management of funding and/or hedging needs.

Forward Start Advance (FSA): For members with upcoming borrowing or refunding plans, consider the FSA as a method to opportunistically “lock in” rates before advance settlement date. Please contact the Member Services Desk at (212) 441-6600 for more information.

The Symmetrical Prepayment Advance Feature

For those anticipating term funding needs, and with rates on an uptrend, it can be an appropriate juncture to consider our SPA feature. This feature allows the member to capture, at prepayment, changes in the fair value of the advance which are favorable to the member. Contact Member Service Desk to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the MSD Team.