Member Services Desk

Weekly Market Update

This MSD Weekly Market Update reflects information for the week of August 17, 2020.

Economist Views

Click to expand the below image.

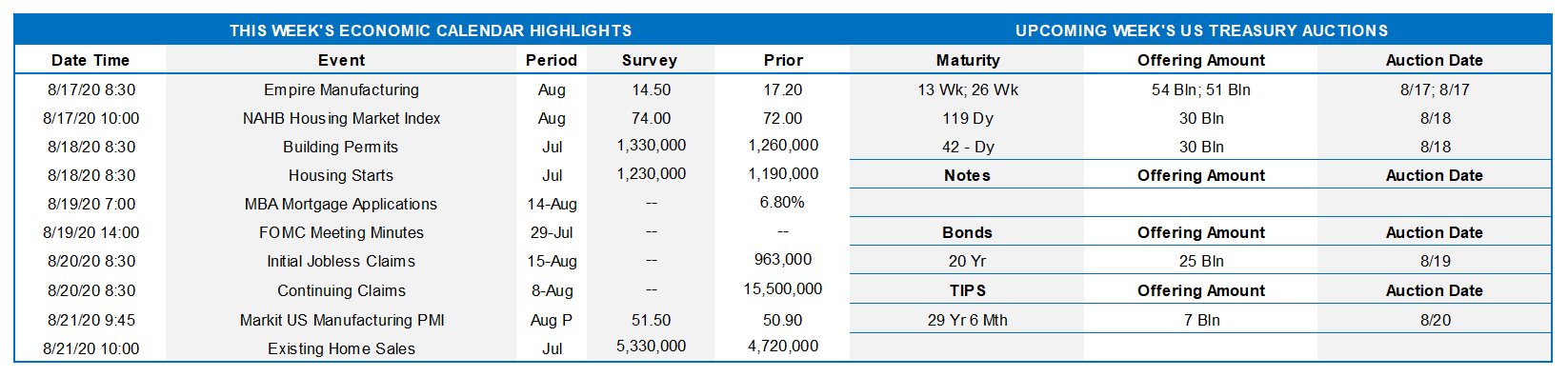

The release of minutes from the late-July Federal Open Market Committee (FOMC) meeting likely will be the key event of the week. In particular, market participants will look for clues to potential changes in the forward guidance to be provided in future post-meeting communiqués and any discussion of the comprehensive review of the strategy, tools, and communication practices the central bank uses to pursue the monetary policy goals established by Congress, namely maximum employment and price stability. At his press conference in late July, Federal Reserve Chairman Powell said that, as a result of the review, the Fed “in the near future” will revise its Statement on Longer-Run Goals and Monetary Policy Strategy. Board Vice Chair Richard C. Clarida, who is leading the review, stated in an early August interview that the Fed is looking at “some important evolutions.” On the data front, a trio of housing reports are expected to portray that activity in this important segment of the economy continues to improve.

Empire State Manufacturing Survey: The recovery in local factory activity likely continued in August, with the headline general business conditions diffusion index improving upon the 17.2% reading recorded in July.

NAHB Housing Market Index: Rosier appraisals of current and future sales, combined with a pickup in prospective buyer traffic, probably propelled home-builder sentiment to a level last seen before the Coronavirus outbreak.

Housing Starts & Building Permits: Supporting the view that housing will contribute meaningfully to the upcoming revival in real economic growth, new starts and building permits both likely climbed for a third straight month.

Weekly Jobless Claims: While the past week’s move back below the 1mn mark was encouraging, a sharp pickup in online inquiries about how to file for unemployment insurance benefits over the August 8-15 span points to a potentially large increase in new filings in the upcoming report. The total number of persons receiving regular state benefits, meanwhile, probably will be little changed from the 15.7mn tally posted during the week ended August 1.

Markit Manufacturing PMI: Factory activity probably expanded further in August, thereby pushing the closely followed gauge further above the critical 50-point mark.

Existing Home Sales: The surge in home-purchase contract signings over the May-June span points to a leap in closings to levels experienced before the Coronavirus outbreak.

Federal Reserve Appearances:

Aug. 14: Dallas Fed President Robert Kaplan to speak in a moderated virtual Q&A session.

Aug. 17: Atlanta Fed President Raphael Bostic to discuss inclusive innovation at a virtual event hosted by the Rotary Club of Atlanta. No text; audience Q&A.

Aug. 19: Minutes from the July 28-29 FOMC meeting to be released.

Aug. 20: San Francisco Fed President Mary Daly to discuss the new future of work at an event hosted by the bank. Text, Q&A to be determined.

Click to expand the below image.

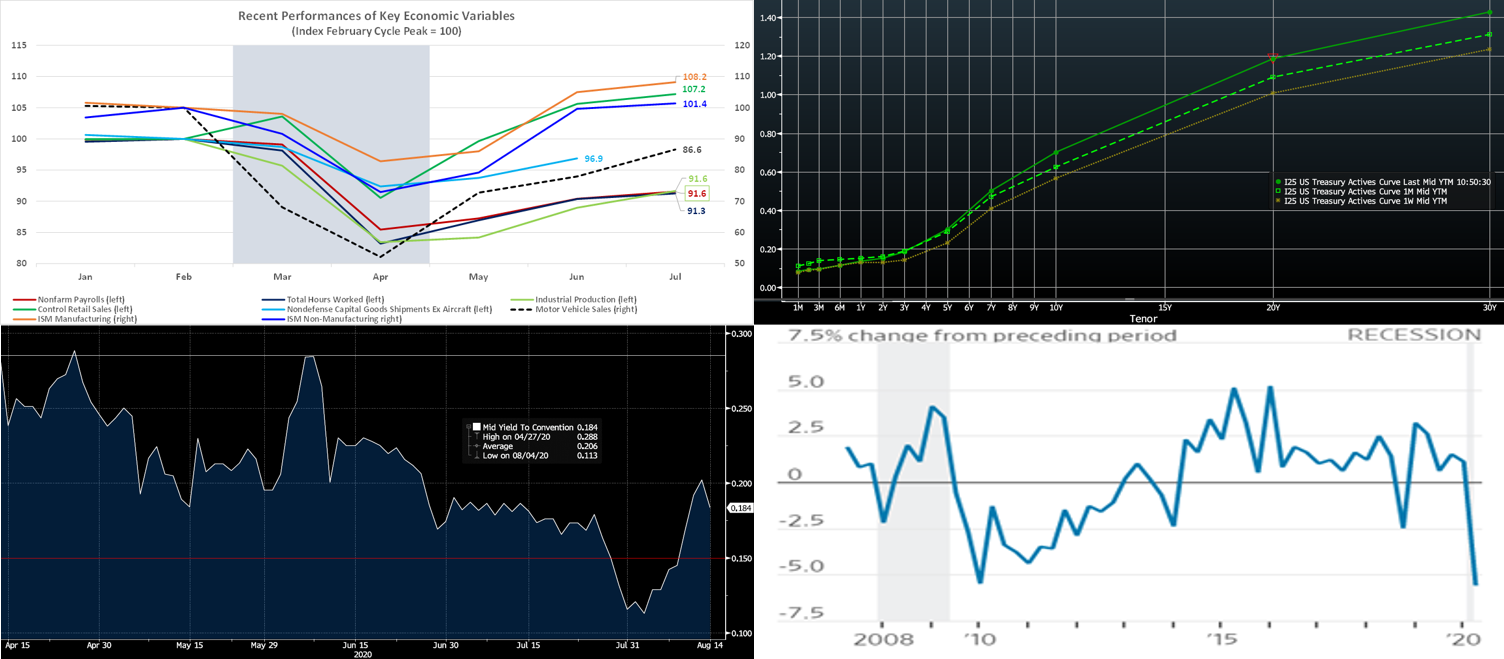

Source: BLS; Census Bureau; FRB; ISM; FHLBNY. Major economic gauges continue to recover from their Coronavirus-induced lows, with several now well above their pre-pandemic levels. The sharp snapback in retail control purchases excluding auto, building materials, and gasoline sales points to a sharp summer snapback in consumer goods outlays. Recent economic data has mostly been announced higher than Street forecasts. Fed actions and legislative relief packages, along with the expected return of activity post-lockdowns, have served to generate a rebound in economic trends.

CHART 2 – UPPER RIGHT

Source: Bloomberg. After recording all-time low levels the prior week, the UST yield curve notably “bear-steepened” this past week. The record-size supply of 3/10/30-year UST auctions of the past week demonstrably weighed on demand. Corporate issuance also accelerated the past week and remains strong for a usually slow August period. For instance, Apple issued $5.5bn of 5/10/30/40-year debt on Thursday. Meanwhile, the release of higher than expected inflation data also pressured yields upward. Added to the mix of market influences was the news of a Russian COVID-19 vaccine; the efficacy of this potential vaccine is very much in doubt, however.

CHART 3 – LOWER LEFT

Source: Bloomberg. Here is a revisit of a chart from two weeks ago, namely the UST 3-year yield over the past four months. At the time, it was noted that the yield (and the yield curve in general) had broken below the lower boundary of its range and potentially represented an opportune zone for term funding and/or use of Community Lending/Disaster Relief Funding program capacity. The yield has now pushed higher into the previously prevailing range, but a move down to the lower boundary of ~.15% could certainly represent another possible opportunity.

CHART 4 – LOWER RIGHT

Source: FRB St. Louis; Commerce Dept.; WSJ. While economic data has portrayed an ongoing recovery and snapback in many areas, serious risks nonetheless remain to a lasting and broadly shared recovery. The Fed has stressed that downside risks remain to the economy; it also continues to advocate for fiscal relief, including for states. This chart (state & local government consumption and investment, % change seasonally adjusted annual rate, from preceding period) reflects why the Fed has stressed these concerns. Cities and states are in a budget crunch and struggling with the costly impacts of the pandemic; in turn, they have pulled back on spending. Vital to note is that virtually all states by requirement must run a balanced budget, very much unlike the federal government. Talks continue among legislators on a potential new relief package.

FHLBNY Advance Rates Observations

Front-End Rates

Short-end advance rates finished 2 to 3 bps higher week-over-week. Heavy T-bill issuance was a feature, as usual, but net supply has been slowing and thereby allowing for easier market absorption. However, Government-only and Prime MMF AUM experienced outflows on the week, thereby sapping demand somewhat for short paper. Government-only funds lost ~$20bn on the week.

Heavy T-Bill issuance will remain a theme; UST issuance overall is now net positive supply in that more is being issued than what the Fed is buying in its programs, and so this scenario could prove a small challenge. However, with short UST rates at rock-bottom levels, and the Fed likely on hold for a long period, rates may trade in a sideways pattern. Net T-bill issuance is forecast by Street dealers to notably slow in the months ahead, and Treasury has announced plans to shift issuance out the curve, but a new fiscal relief package may complicate/alter this forecast.

Term Rates

Medium and longer-term advance rates were 1-14 bps higher, week-over-week, in a notable “bear-steepener” shift. While the 1 to 5-year sector was 1 to 7 bps higher in yield, the 6 to 10-year sector was 9 to 14 bps higher. See the previous section for color on the move.

The upcoming week brings much more modest UST term supply than the past week, with a regular 20-year and then a 30-year TIPS auction. Attention will remain on further relief legislation and certainly also on COVID-19 and the question of whether or not it is being managed effectively enough to avoid further pauses in reopening. A key data highlight will be the FOMC Minutes and its information about the Fed’s intentions on its programs/actions/guidance.

The Symmetrical Prepayment Advance Feature

With rates at or near multi-year lows, it is a compelling juncture to use the SPA feature on term advances. This feature allows member to capture, at prepayment, changes in the Fair Value of the advance which are favorable to the member. Contact us to discuss.

Looking for more information on the above topics? We’d love to speak with you!

Questions?

If you wish to receive the MSD Weekly Market Update in .pdf format (includes FHLBNY rate charts) or to discuss this content further, please email the

MSD Team.

Special Member Alert

The FHLBNY recently announced a newly expanded and flexible Disaster Relief Funding (DRF) advance program which offers discounted rate advances with maturities 1-mo and greater. Additionally, we have announced that PPP loans will be accepted as eligible collateral. Please contact us with any questions.

The content provided in these disclosures is presented as a courtesy to be used only for informational purposes and is not represented to be error free. The FHLBNY makes no representations or warranties of any kind with respect to the content contained herein, such representations and warranties being expressly disclaimed. The FHLBNY is not a financial or investment advisor.

Moreover, the FHLBNY does not represent or warrant that the content of these disclosures is accurate, complete or current for any specific or particular purpose or application. It is not intended to provide nor should anyone consider that it provides legal, accounting, tax or other advice. Such advice should only be rendered in reference to the particular facts and circumstances appropriate to each situation. The FHLBNY encourages you to contact appropriate professional(s) and consultant(s) to assess your specific needs and circumstances and to render such advice accordingly. In addition, the FHLBNY is not endorsing or recommending the use of the means or methods contained in or through these disclosures for any special or particular purpose.

It is solely your responsibility to evaluate the risks or merits of any funding or investment strategy. In no event will FHLBNY or any of its officers, directors or employees be liable for any damages — whether direct, indirect, special, general, consequential, for alleged lost profits, or otherwise – that might result from any use of or reliance on these materials.