Financial Intelligence

Interest Rate Swaps: Consider All the Options in Managing Interest Rate Risk

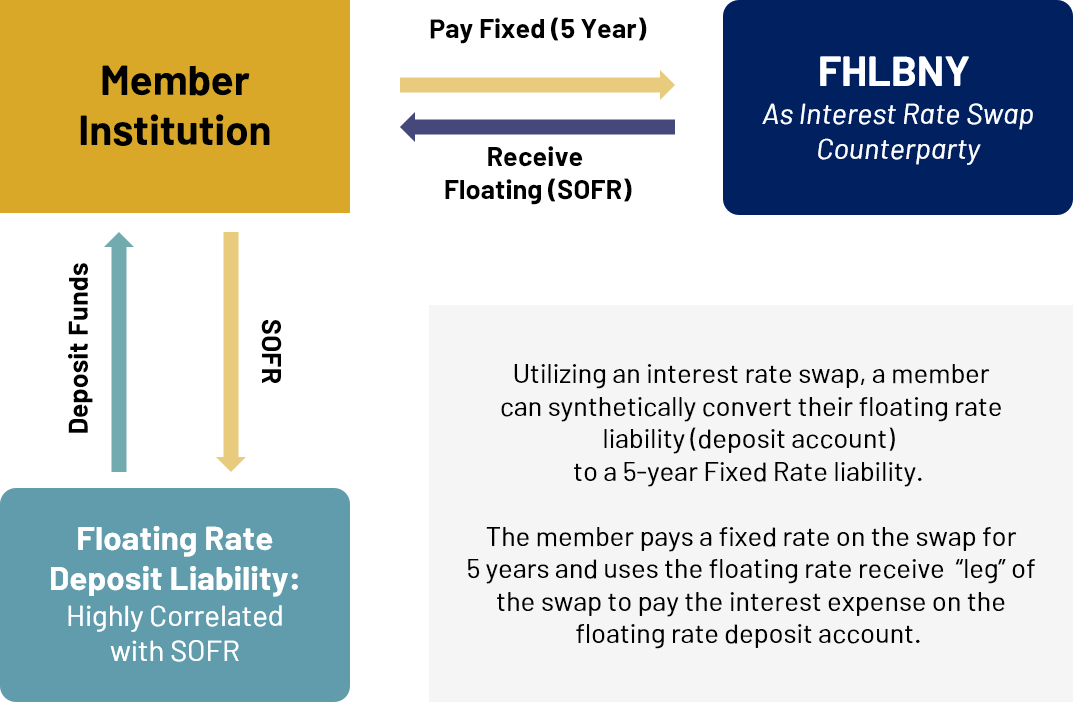

Interest Rate Swaps can be an effective tool in managing asset/liability mismatches present in many of our member’s balance sheets. Mismatches occur when a member funds long-term assets using short-term liabilities, or vice versa. Interest Rate Swaps involve an exchange of a fixed-rate payment for a floating payment, which is generally tied to the Secured Overnight Financing Rate (SOFR), Prime, or a Treasury index, based on a specified notional amount and an agreed upon day count convention.

Pay Fixed/Receive Floating

Interest Rate Swap

Liability-sensitive members may lock in spread and guard against a rise in rates by utilizing a “Pay Fixed/Receive Floating” Interest Rate Swap, where the floating rate received would increase in a rising rate environment, offsetting the associated increase in a member’s cost of funds relating to their short-term or floating-rate liabilities. Asset-sensitive members are vulnerable in declining rate environments, and conversely may opt to pay floating and receive a fixed payment when executing Interest Rate Swaps.

For example, if a segment of a deposit base demonstrates a high correlation to SOFR, a member may elect to “lock in” the rate of that floating rate deposit category for a period of time by engaging in a Pay Fixed/Receive Floating Interest Rate Swap (see the diagram above for an example). This would effectively transform the floating rate liability to a fixed rate equal to the term of the Interest Rate Swap. You can potentially receive favorable “hedge” accounting treatment provided that certain criteria are met at the inception and throughout the life of the Interest Rate Swap. Please consult with your accountant as a first step in deciding whether Interest Rate Swaps are appropriate for your institution.

Program Features and Benefits:

|

Considerations:

|

Please consult with your accountant regarding the accounting treatment and ongoing requirements associated with an Interest Rate Swap transaction. For more information on how FHLBNY Interest Rate Swaps are issued and how this product can be used to help meet your institution’s needs, contact a Relationship Manager at (212) 441-6700.

Disclaimer: Notwithstanding any language to the contrary, nothing contained in these disclosures is intended to constitute an offer, inducement, promise, or contract of any kind. Any product descriptions and pricing may be subject to change without notice.

The content provided in these disclosures is presented as a courtesy to be used only for informational purposes and is not represented to be error free. The FHLBNY makes no representations or warranties of any kind with respect to the content contained herein, such representations and warranties being expressly disclaimed. The FHLBNY is not a financial or investment advisor.

Moreover, the FHLBNY does not represent or warrant that the content of these disclosures is accurate, complete or current for any specific or particular purpose or application. It is not intended to provide nor should anyone consider that it provides legal, accounting, tax or other advice. Such advice should only be rendered in reference to the particular facts and circumstances appropriate to each situation. The FHLBNY encourages you to contact appropriate professional(s) and consultant(s) to assess your specific needs and circumstances and to render such advice accordingly. In addition, the FHLBNY is not endorsing or recommending the use of the means or methods contained in or through these disclosures for any special or particular purpose.

It is solely your responsibility to evaluate the risks or merits of any funding or investment strategy. In no event will FHLBNY or any of its officers, directors or employees be liable for any damages — whether direct, indirect, special, general, consequential, for alleged lost profits, or otherwise – that might result from any use of or reliance on these materials.

Key Contacts

Relationship Managers:

(212) 441-6700

Member Services Desk:

(212) 441-6600 or

(800) 546-5101, option 1